It’s been a wild two weeks for equity markets. On the one hand, broader equities have been remarkably resilient. Despite three banks being shut down (Silvergate Capital, Signature Bank, and Silicon Valley Bank) and two others (Credit Suisse and First Republic) needing billions in assistance to stay afloat, the S&P 500 is down only 2.1% since March 3rd. However, its max peak-to-trough drawdown was 6.6% over just six trading days. Nevertheless, investors are concerned, and understandably so.

Carson Investment Research has given our opinion on what this means for financials – the epicenter of recent volatility. In short, we feel that large-cap banks are “too strong to fail” and are poised to take share from stressed regionals. This, coupled with a strong economic backdrop and a higher-for-longer interest rate outlook, underpins our overweight rating for this sector in our House Views models. However, what other industries could be impacted by the current stresses in regional banks? Predicting the future is a tricky business, but we’ll take a look at potential areas of vulnerability across other sectors.

Information Technology – 29% of S&P 500

Carson House View: Underweight

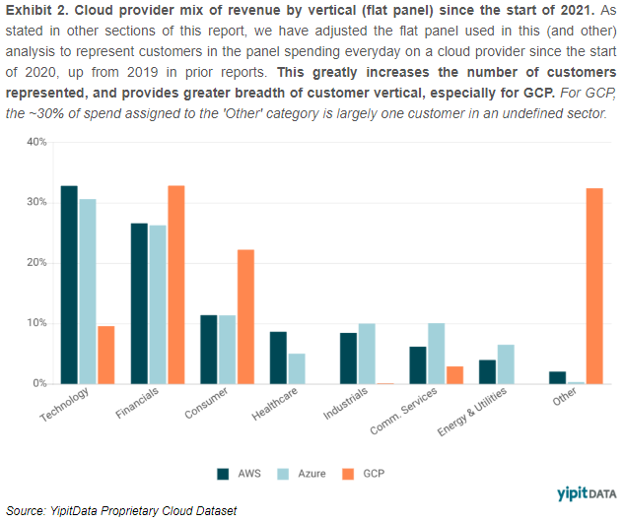

Surprisingly, tech stocks are up. The Technology Select SPDR ETF (XLK) has risen 2.5% since March 3rd. However, we’re skeptical. For now, it seems to be a “rate trade” as long-term bond yields have fallen, providing cheaper capital and lower discount rates for these longer-duration growth assets. However, this only works if demand isn’t impacted. The financial sector is a major consumer of technology as they race towards “digital transformation.” In fact, this industry accounted for over 30% of cloud spending over the past two years, as shown in the chart below. With cloud growth already slowing for the likes of Microsoft (MSFT), Alphabet (GOOGL), and others, will recent bank stress cause these customers to pull back further?

Health Care – 14% of S&P 500

Carson House View: Neutral

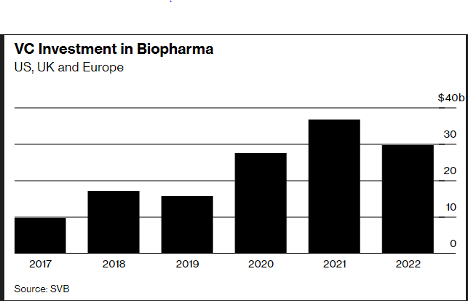

Health Care stocks have also been resilient. The Health Care Select SPDR ETF (XLV) has only fallen 1.3% since March 3rd. However, it’s been a different story for small-cap firms in this industry. The difference is cash flow. Large caps tend to be profitable, have healthy balance sheets, and generate strong cash flow, while their smaller colleagues are still in growth mode and are dependent upon raising capital. Following three years of record funding, higher interest rates, and the collapse of Silicon Valley Bank (worked with nearly half of all US venture-backed life science companies), these investments have been under pressure. Most growth firms are racing to turn profits and reduce their dependence on third-party funding.

REITs – ~3% of S&P 500

Carson House View: Underweight

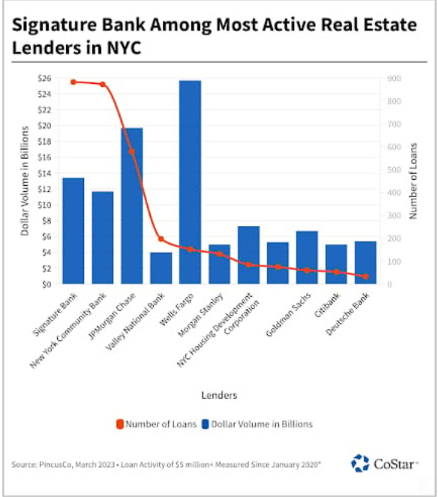

In terms of size, real estate investment trusts (REIT) are a rounding error for the S&P 500. However, Carson Investment Research believes investors here need to be cautious. A lot of the issues that are currently plaguing certain banks (duration mismatches, higher funding costs) exist here as well. Plus, many of these firms have become very levered over the past decade to boost their returns and dividend yields for income-starved investors. We note that Signature Bank was issuing the third-highest number of commercial real estate mortgages in New York City since January 2020. Only Wells Fargo (WFC) and JPMorgan (JPM) lent more.

Not all REITs are created equal. However, we’d be cautious about searching for unusually high dividend yields in this area because it may indicate financial stress and concern about dividend cuts.