“If everyone is thinking alike, somebody isn’t thinking.” -General Patton

Well, isn’t that interesting? After more than a 20% rally from the lows in stocks last October, we are finally seeing some bullishness out there. We didn’t notice this back in mid-December when many things lined up for a substantial rally and we moved to overweight stocks in our Carson House Views, or during the mid-March lows when we were in the middle of the regional bank crisis and we added equities to the Carson House View models that we run, or during the great worry over the always was going to be settled debt ceiling drama of May. But now that stocks have broken above 4,200 and all the previous worries are out of the way, now we see bulls showing up. Hmm.

From a contrarian point of view, we remain overweight stocks here, but we felt more comfortable being bullish when we’d get those weird looks for being bullish. For starters, check out Barron’s cover from over the weekend. I’ll be the first to admit though, Barron’s has been quite right over the years, and a bullish magazine cover in the usually pessimistic Economist would worry me more, still, this is a point worth noting.

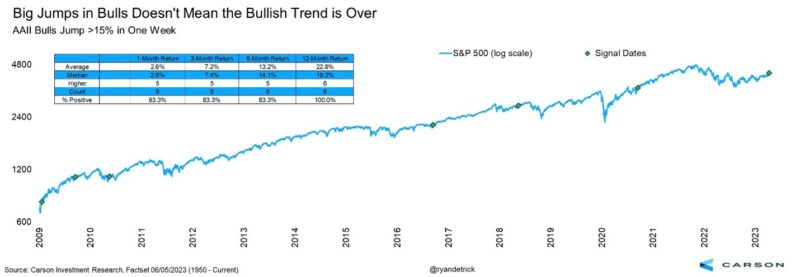

We also noticed a huge surge in the number of bulls in the American Association of Individual Investors (AAII) Sentiment Poll last week, as the bulls jumped up to 44.5%, the most since November 2021. Additionally, the number of bulls jumped more than 15%, from 29.1% last week, the largest weekly increase since November 2020.

Look at the General Patton quote above one more time, which is hands down one of my favorite quotes ever. Nearly every strategist in December was saying how bad the first half would be for stocks and the second half would be better. Isn’t it interesting how they all were wildly wrong? When the crowd all agrees, someone isn’t thinking.

The good news is looking at previous 15% weekly jumps in bulls hasn’t been bearish recently, as the last six times it happened since the March 2009 lows were greeted by more gains. In fact, a year later the S&P 500 was higher all six times and up nearly 23% on average.

Although I’ll be the first to admit that a well-deserved break near the 4,300 level makes a lot of sense. Remember, this was right where the summer rally peaked last August, as stock rolled right back over to new lows. Stocks broke above 4,200 only to get everyone all bulled up, to run into that logical area of resistance from last August. Wouldn’t that be an interesting trick played by Mr. Market?

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

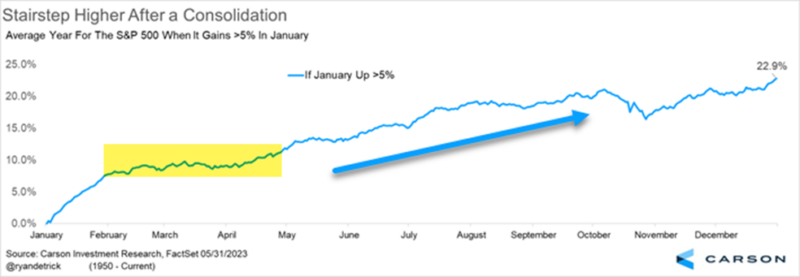

But one potential positive that could suggest some more is left in the tank is what typically happened during years that gained at least 5% in January. Usually, there was a consolidation in February, March, and April, before a surge higher in the summer. This year has played out somewhat to that template thanks to the overblown worries about the regional banking crisis in March and the never-in-doubt, but played up in the media for views and clicks, debt ceiling drama. Now that that’s all out of the way, the stage could still be set for a surprise summer rally.

The risks to a well-deserved break are adding up, but we’d be a buyer of any potential weakness. We remain overweight equities and underweight bonds, expecting both of those trends that have played out nicely so far this year to continue in the second half, as more investors realize that all those economists in bowties and three pieces suits that have been calling for the most talked about recession in history will be delayed yet again.