Apple (AAPL) Edition

A necessary part of any thorough research process is considering both the upside and downside investment case. The “bull” case is optimistic, characterized by the upward thrust of a bull’s lowered horns during battle. Meanwhile, bears fight by standing high and swiping down their sharp claws, exemplifying the potential risk of an investment.

What a vivid metaphor.

Who would win an actual bull vs. bear fight? It’s not just an allegory. Such fights were a form of entertainment during the 19th-century gold rush in California. It was considered a happy occasion. After Sunday church, families would gather towards the town square to watch the bloody battle. Without getting into the gory details, the California bears usually emerged victorious over the Spanish bulls.

Thankfully, the odds have historically favored the bulls when it comes to investing, as stocks remain the undisputed champ of long-term returns (1st Principle). Nevertheless, we believe it’s extremely helpful to consider both sides. Valuation is a reflection of investor expectations. Until you try to understand these embedded assumptions, it’s hard to know whether it’s a good investment and, more importantly, when it’s gone bad.

In this Bull vs. Bear edition, we present a battle on Apple. Here, we identify the three most important points on either side that long-term investors with at least a 3-to-5-year time horizon should consider. The conclusion is up to you.

Bull Case

- Healthy revenue growth and margins may continue to prove durable

- Apple can build off its dominance of mobile computing

- Current valuation underestimates future growth potential

Healthy revenue growth and margins may continue to prove durable

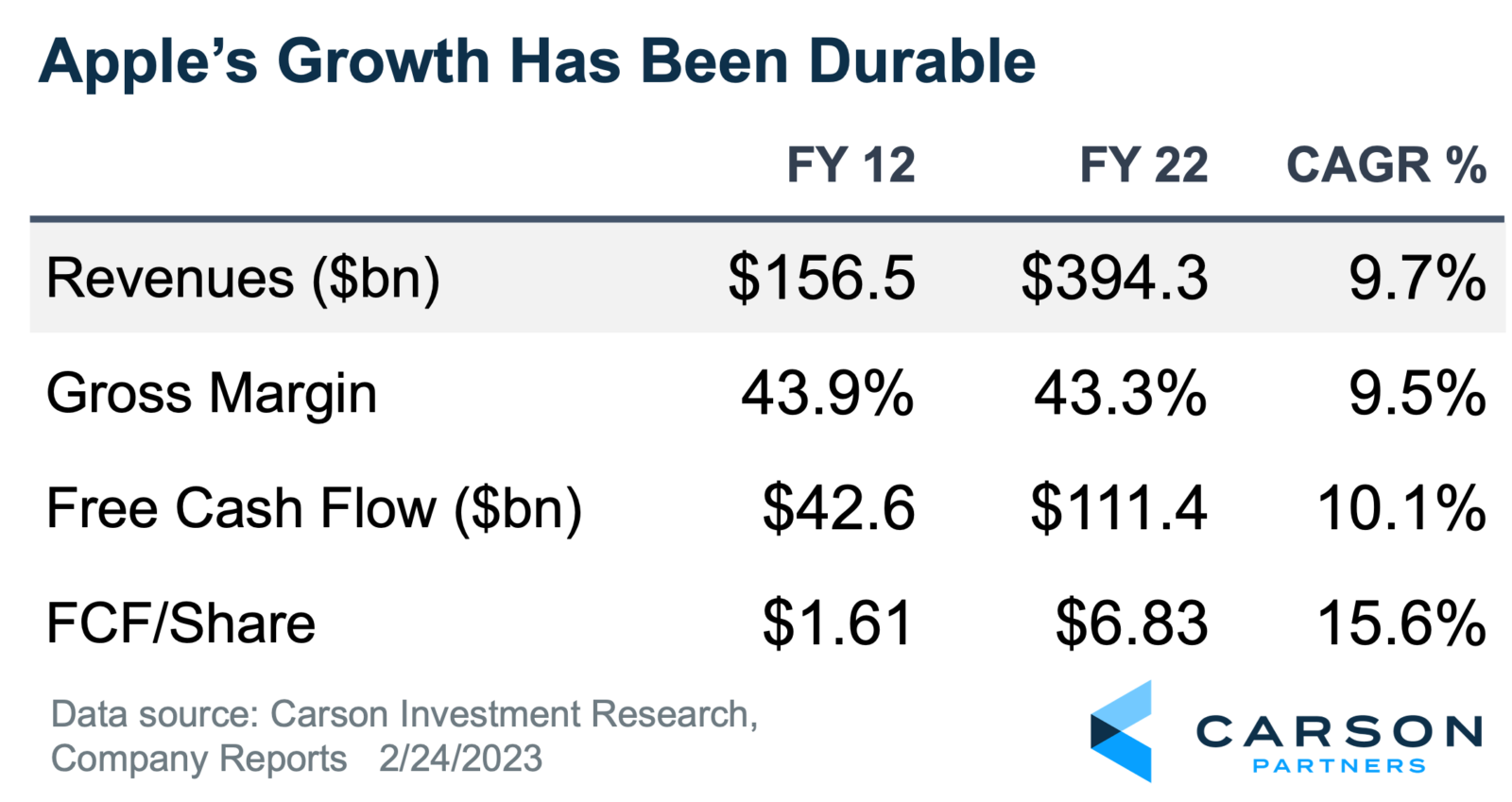

While short-term stock moves and quarterly results get all the press, we believe the primary driver of long-term equity value is how fast revenue, profits, and ultimately cash flow increase and for how long before reaching maturity.

Past results aren’t predictive of the future, but it’s constructive to highlight how Apple has continually defied the skeptics.

For the past ten years, the company’s sales have more than doubled, rising nearly 10% annually. iPhone, its flagship product that accounts for more than 50% of sales, has grown slightly faster. Yet, despite endless concerns over commoditization, Apple’s gross margins remain stable. This is arguably even more impressive considering how competitive the smartphone market has become and how iPhone has maintained (and increased) its premium pricing. Certainly, the rising mix of Apple’s services (20% of total sales) has helped buoy corporate margins since these are twice as profitable vs products, but hardware profits also remain steady. This defies the history of consumer electronics, which speaks to the power of Apple’s brand, its software, the quality of its products, and its scale.

Can this growth continue? On some measures, it is accelerating. In 2022, Apple’s installed base of devices reached 2 billion, which increased 11% from the prior year. Despite the law of large numbers, this is the highest growth rate in 4 years. How? New product launches that complement the iPhone (Watch, AirPods, AirTags) and share gains in the smartphone market. Apple Watch still holds a lot of promise as it becomes a health monitoring device. Despite accounting for 85% of industry profits, iPhone just recently eclipsed 50% share of US smartphone users, according to Counterpoint Research. Its share overseas is even lower, especially in faster-growing emerging markets. Both points underline that there’s still plenty of growth potential for the iPhone even as smartphones mature.

A lot has been made about the lack of Apple’s innovation. Sure, each year the iPhone gets faster chips, better cameras, richer displays, etc. But what happened to the big innovations: the touch screen, Siri voice assistant, or touch and face ID? We’d be on the lookout for foldable screens, which remain expensive and have issues but hold a lot of promise. The other big idea that Tim Cook is excited about is AR/VR (augmented reality/virtual reality). This could likely be first introduced as a separate headset but the technology should eventually make it into the iPhone, which could further revolutionize mobile computing. In short, there remain big innovations on the horizon that should fuel iPhone’s tank.

Apple might build off its dominance in mobile computing.

Apple is a master at controlling and monetizing its installed base. Services is a prime example, which consist of Apple subscriptions (Cloud storage, Apple Music, TV+, Fitness+, Arcade) along with a 30% cut of subscriptions to third-party apps and purchases on its App Store. Essentially, the company is a toll collector of the mobile economy. Services revenue continue to grow at a double-digit clip (ex FX) and the firm recently reported that it had 935,000 paid subscriptions, up 19% YoY. There remains a lot of opportunity to add additional services and monetize its ecosystem further, especially if it branches into other areas like autonomous cars, which could be worth $200 billion by 2030.

To further the point about how powerful Apple is, consider what it’s recently done to Facebook and the digital advertising market. By giving iOS users the option to opt-out of being tracked by apps, it meaningfully reduced the accuracy and ability to measure targeted ads, destroying hundreds of billions of digital advertising value. In fact, we would argue that Facebook’s enormous and controversial investment in the ”metaverse” is really about trying to win the next computing platform and evade Apple’s grip on mobile computing. Get your popcorn ready because it’s going to be a fascinating race to watch.

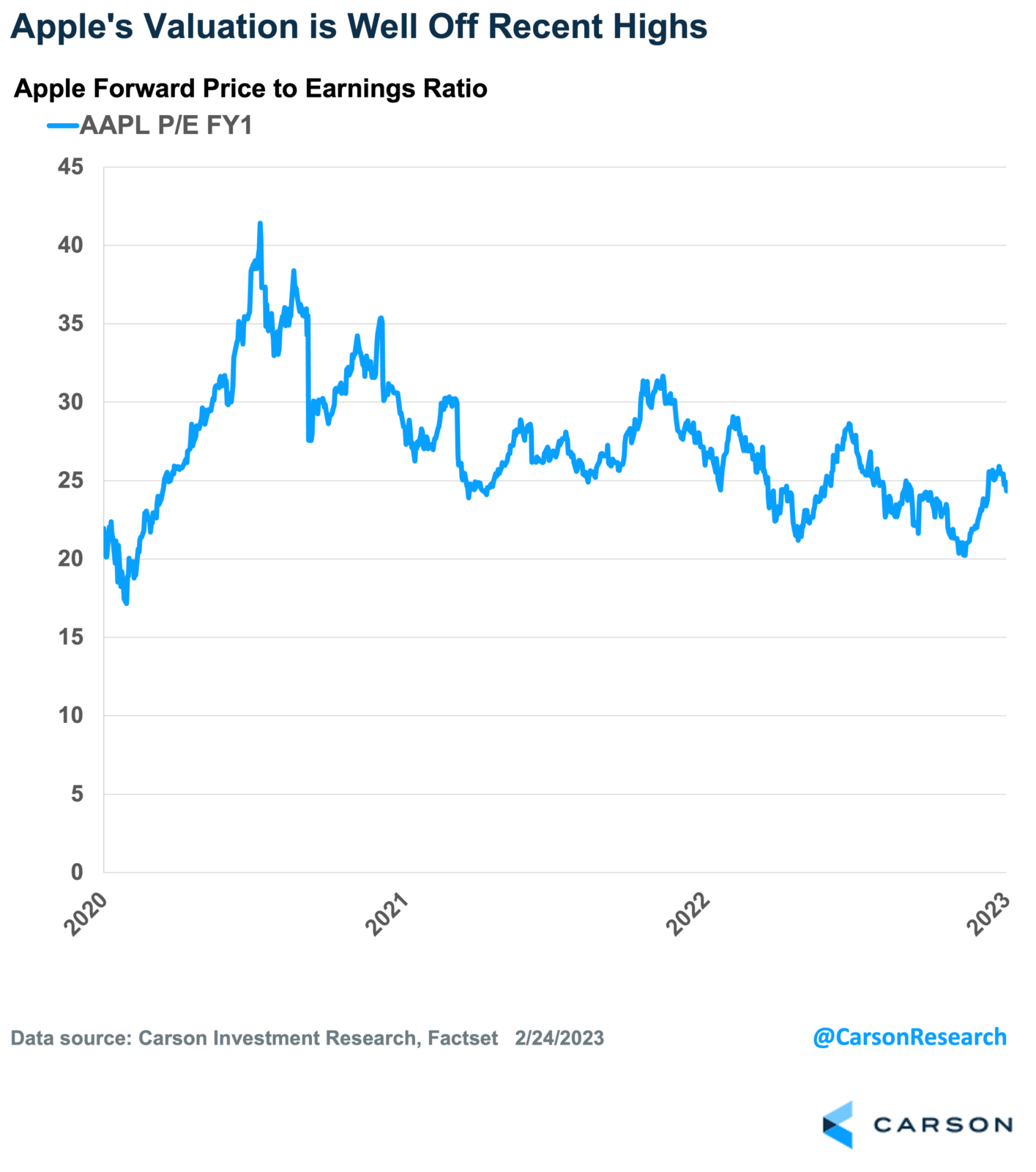

Current valuation underestimates future growth potential

Apple’s valuation has certainly elevated over the years after proving it wasn’t the next Nokia or Blackberry. That said, the company’s forward P/E ratio has fallen towards more reasonable, pre-pandemic levels and currently trades at a modest premium to the S&P 500. However, what investors are ultimately looking for is free cash flow, which is the amount leftover that can be returned to shareholders. On this measure, Apple trades at a 4.5% yield, which is just a slight premium to the S&P 500’s 5% yield, according to FactSet. This is despite having grown its free cash flow per share at nearly twice the rate of the S&P 500 over the past 10 years.

Out-year consensus forecasts appear modest, especially when compared to the results Apple has been producing over recent years. FactSet shows that Wall Street consensus is only expecting 7% revenue and 11% EPS growth in FY24. Things are expected to slow further in FY25 with ~5% sales growth and a 7% EPS rise. Considering the long runway Apple has for its existing products and potential entry into new areas like autonomous cars and AR/VR, future expectations look beatable.

Bear Case

- Apple sells consumer electronics, which eventually gets commoditized and/or displaced.

- The company has become too big.

- Valuation is rich considering Apple’s best days are behind it.

Apple sells consumer electronics, which eventually get commoditized and/or displaced

Consumer electronics is a brutal business that eventually becomes commoditized. This has happened to the PC, the television, gaming consoles, portable music players, and mobile phones. Apple has done a commendable job at delaying this inevitability by establishing a premium brand, cool marketing, gimmicky features, and making more iPhone components in-house vs. paying a premium to third parties. However, there’s only so much juice to squeeze. The bottom line is that the smartphone market matured years ago. In fact, IDC reported that smartphone shipments plunged 18% in the 4Q22, which was a record decline. Apple may be able to gain a little more share, but eventually, it may run out of room in a saturated end market.

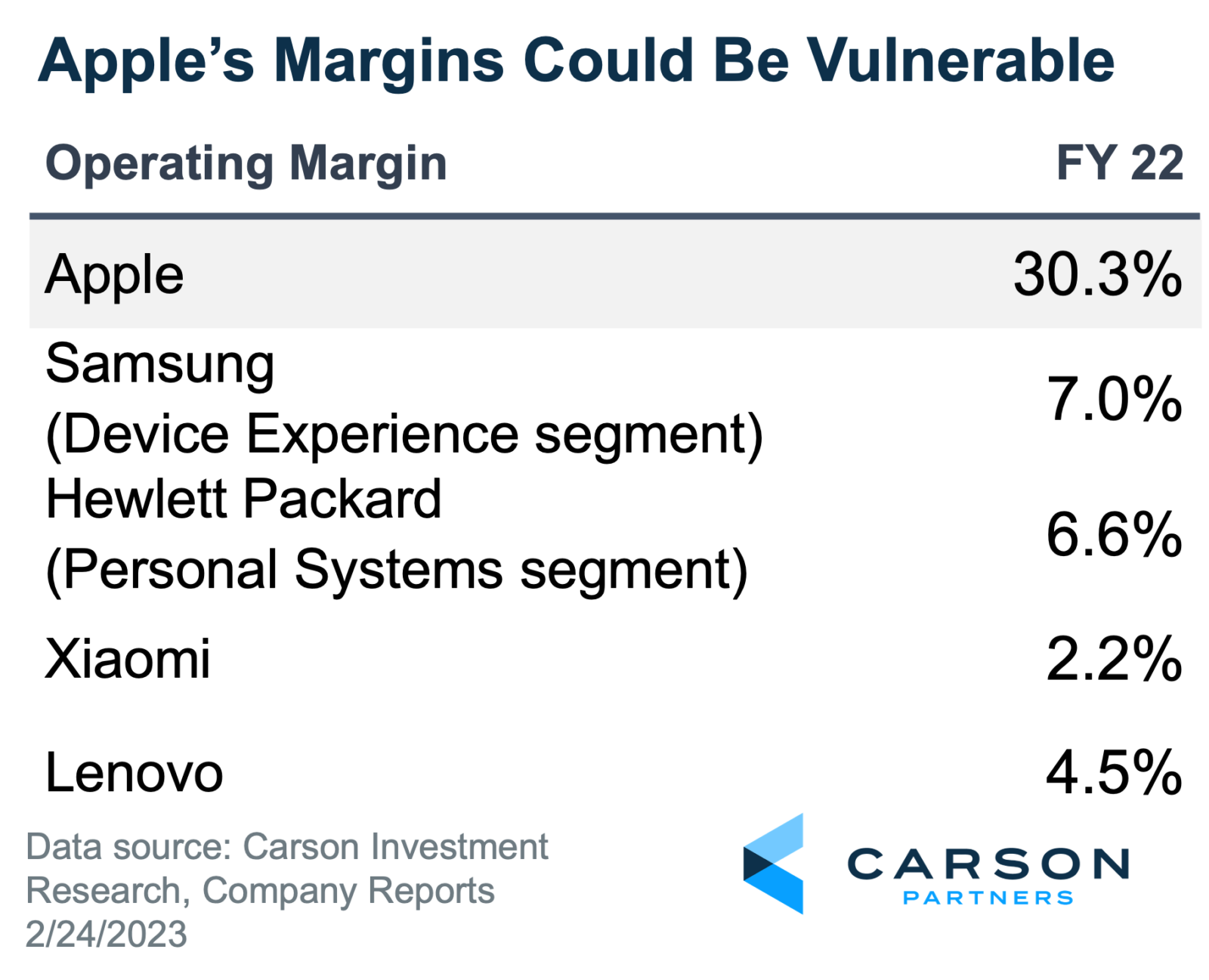

Apple’s margins look even more vulnerable. Sure, they have been stable, but they currently sit at 30% on an operating basis! If you want to know where these are likely going over time, just take a peek at Samsung’s consumer electronics division or Hewlett Packard’s PC business. Or how about the 2.2% operating margin reported from Xiaomi, one of China’s largest smartphone manufacturers? In fact, that firm now taking direct aim at Apple. Lenovo, the Chinese firm that purchased IBM’s ThinkPad and also makes smartphones, generated a 4.5% operating margin in 2022. Even if you assume that Apple can hang onto a 10% operating margin over time due to its brand, software, service, etc., that’s still only one-third of the profits per sales dollar it currently enjoys. This won’t happen immediately, but once margins start to fall, it will have an immediate and permanent impact on the stock’s valuation.

Too Big?

Apple could be considered the most successful company of all time. However, that comes with a host of challenges. Due to its size, can it keep growing at a healthy rate? Can it remain nimble enough to keep winning new innovations? Will it become hamstrung by regulatory scrutiny from US and foreign governments? Can it attract enough incremental investors to propel the stock higher? Has Apple become too big?

In 2018, Apple was the first company to reach a $1 trillion market cap. It only took two years to reach $2 trillion and just 16 months and 15 days for another trillion. It currently sits at over $2 trillion. The company’s value exceeds most countries’ GDP, and it bests the total of most worldwide stock exchanges.

As companies become larger, it becomes harder to sustain growth rates. For example, in 2022, Apple posted $394 billion in revenue, which grew roughly 8%. However, it had to produce $28.5 billion of incremental sales to generate that rate. If bulls expect that to sustain for the next five years, Apple would need to add over $40 billion of additional sales in that fifth year. That could require a lot of product innovation and successful entry into new markets.

Many firms that begin to slow due to their size and maturity start making acquisitions in adjacent areas to sustain growth. However, that window has likely passed for Apple due to its enormous size. It is already catching the attention of lawmakers due to its App Store practices. That’s just in the US. China already represents just under 20% of Apple’s sales and is an important growth engine. With China/US tensions heating up, can Apple evade impact from either side?

Valuation is rich, considering that the company’s best days are likely behind it

Most bears will admit that Apple has been a wild success story and that the firm’s growth and innovation engine lasted much longer than they expected. However, capitalism is dynamic. Being wrong in the past doesn’t mean the bears will be wrong in the future. Instead, they would argue that only their timing was incorrect.

Now that the smartphone market is declining, the commoditization process shouldn’t be far behind. This likely means the company’s profit margins could start coming under pressure, impacting the stock’s premium multiple times. Under such a scenario, bulls would get hit with the double-whammy of declining earnings and shrinking P/E multiple, possibly in the single digits.

And no, a company that’s near peak earnings and generates over half of its sales and even more of its profits from a single product shouldn’t trade at a premium to the S&P 500.

Summary

There are many other notable points that Apple bulls and bears will debate. However, these are the primary issues. Our goal here is to encourage investors to think about the counterpoints to whatever side they sit on. It’s never as easy as saying a P/E ratio is “too high” or that “consumers won’t stop using iPhones.” Investing is hard. According to our 5th Principle, we must respect its complexity.