“The Waiting”

We made Tom Petty’s 1981 classic “The Waiting” our theme song for this earnings season as investors are seeking the direction of earnings and the economy amidst strong cross currents. When writing the song, Petty noted that he got the chorus right away, along with the song’s guitar riff. However, he said the verse took weeks, spending entire days to get it right.

We feel that the third week of this earnings season also provided more clarity for equity investors. The proverbial song isn’t complete, but it’s coming together. This was enough to help fuel a 1.6% rally for the week in the S&P 500. How? Equity investors have been searching for clues regarding a) how severe this slowdown will be and b) how long it will last. The first is being partly answered by corporate outlooks, which have mostly called for near-term weakness but second half-of-the-year improvements. In other words, we could be near a trough.

The Fed is helping answer the second; how long will this last? As Sonu Varghese wrote last week, Fed Chair Powell was given an easy opportunity to push back against loosening financial conditions. He didn’t. Rather, he seemed comfortable with where things stood, even pondering the possibility of the Fed beating inflation without meaningful damage to jobs. In other words, he was talking openly about a potential soft landing instead of pain.

Sure, things are far from ideal. However, the probability of a Fed policy mistake or something “breaking” fell considerably last week. This is a big change from a year ago.

Every day you get one more yard.

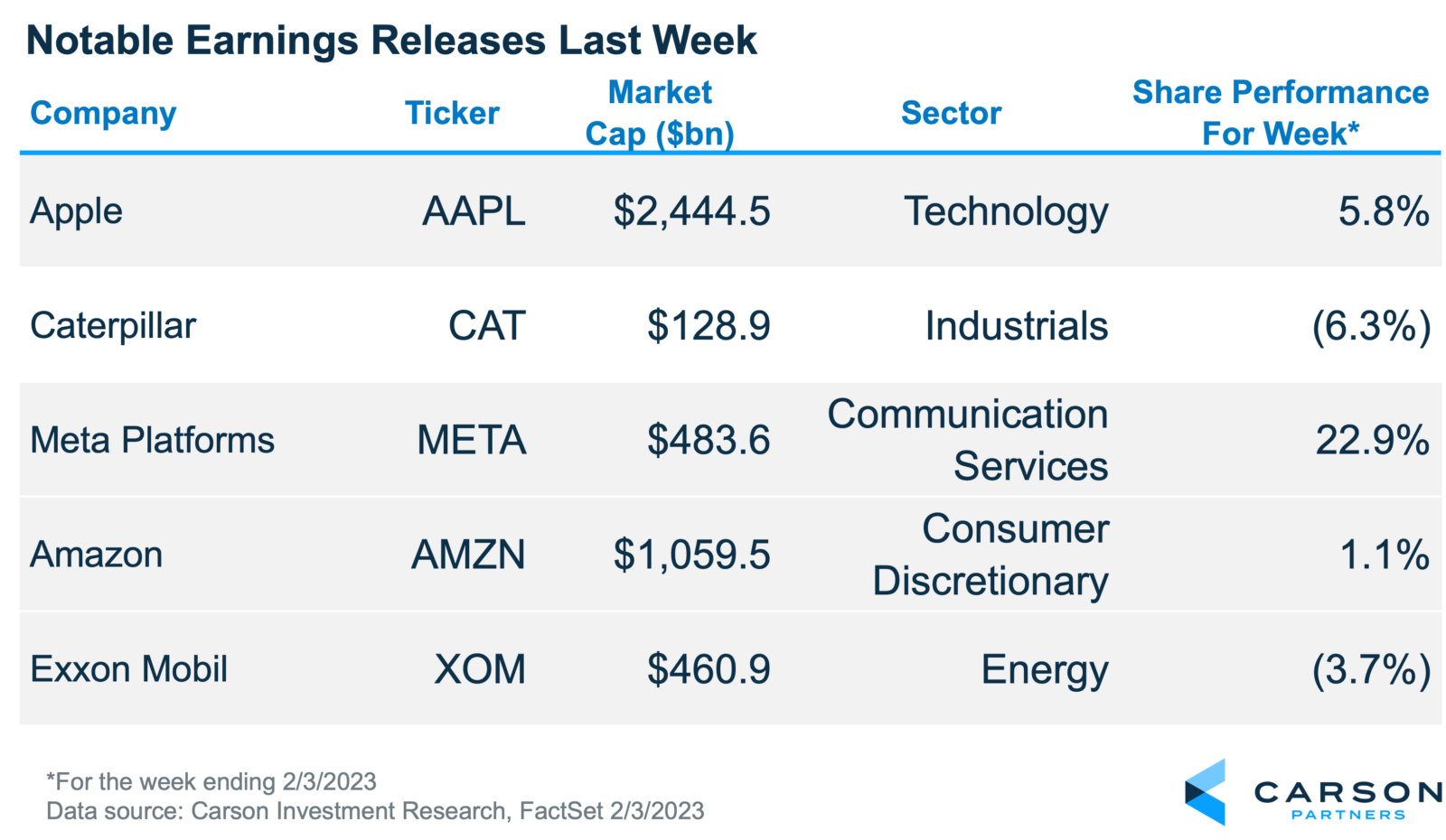

*For the week ending 2/3/2023

Data source: Carson Investment Research, FactSet 2/3/2023

Apple (AAPL) – Margins and underlying iPhone demand prove resilient yet again.

If earnings are the main event for equity investors, Apple is the keynote speaker. While its quarterly report wasn’t great, with sales and earnings declining and below estimates, “Tim Apple” brought some snacks to satiate the bulls. First, he saw improving demand as China re-opened. Management also forecasted revenue growth to accelerate next quarter, including iPhone sales, due to its improving supply chain and healthy demand. However, Apple’s forecast for gross margins to expand was the tastiest treat. Their forecast is flat-out impressive, considering the pressures from foreign currency, inflation, lower volume, etc. Apple bears have been calling for the commoditization of the iPhone for a decade. Unfortunately, it looks like they’ll have to keep waiting.

Initially, the stock dropped lower in early trading but posted a strong rebound. While this puzzled some, the demand for Apple’s high-end smartphones remains resilient and unlikely to tumble hard as some feared/hoped.

Caterpillar (CAT) – Moderating demand but growth expected to continue in 2023

Caterpillar’s results last week gave us a view into construction activity. The good news is that demand remains strong. However, it is expected to slow. Non-residential construction is healthy, along with that mining, energy, and transportation. Yet, investors sold shares after the report. Management noted that a chunk of its 20% sales growth in 2022 was due to its dealer’s re-stocking inventory, which would not repeat this year. This will likely moderate volume gains, leaving price as the primary growth driver. Another disappointment was that CAT has not yet seen a rebound in China, which is expected to weaken further in 2023.

The stock has run nicely into the print, further heightened expectations.

Meta Platforms (META) – Shareholders cheer Zuck’s “Year of Efficiency.”

After a disastrous 2022, Meta (formerly Facebook) rose from the ashes, doubling from its lows last November. Investors found relief in the company’s moderated spend on its metaverse ambitions. As a result, it remains high but not the infinite black hole it appeared to be last quarter. Shareholders were also relieved to see progress towards overcoming the data privacy changes implemented by Apple.

Both Meta and Snap reported that conditions remain challenging but didn’t worsen regarding the ad market. This is another notable change from recent periods. Shares of Meta spiked 35% on its report, adding $100bn of market cap for the day and $12bn for Zuck. Reality > Metaverse

Amazon (AMZN) – Investors left searching for stabilization

Along with other growth stocks, shares of Amazon had ripped 34% higher YTD coming into its earnings report. It still managed to post a gain for the week after tumbling over 8% on Friday post-earnings. However, investors left the call with more questions than answers. Like Microsoft, the focus is on its cloud computing service, AWS, which continues to slow meaningfully. This once 30%+ perennial grower decelerated to just 20% in the period. Management added that this rate had fallen to the mid-teens in January and offered no predictions for when it would stabilize as customers continue to “optimize” their spending. However, Amazon reminded investors that the cloud only represents 5% to 10% of enterprise computing, leaving a long future runway.

The company’s forecast for the coming quarter calls for further slowing, and management didn’t have the visibility to offer commentary beyond.

Exxon Mobil (XOM) – Production discipline is emitting cash for shareholders

Exxon Mobil posted record-setting profits that pushed shares moderately higher. Cash flow reached a corporate high and a record for the US oil industry. Looking forward, oil supply remains tight, but the question remains how global demand fares this year in light of higher interest rates and the pace of China’s re-opening.

Oil supply is set to tighten further when the EU’s ban on Russian oil goes into effect this month.

Note that none of this commentary constitutes buy/sell/hold recommendations.