There are many reasons stocks and bonds have had a rough year so far in 2022, and right at the top is the huge spike in inflation this year. With the latest ‘most important economic event of our lifetime’, aka the latest CPI data coming out on Tuesday, today we’ll look at some continued better inflation trends we are seeing.

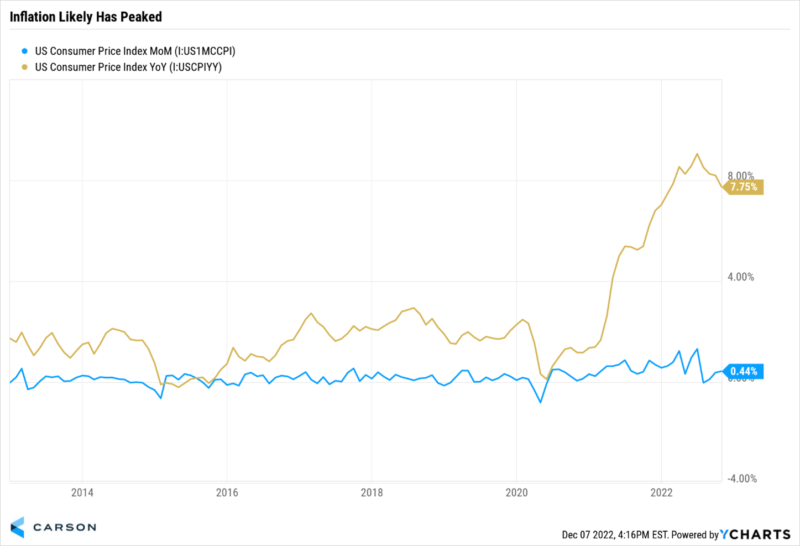

First up, the consumer price index was up more than 9% year-over-year in June but has since come back to 7.7%, and we expect the trend to continue lower.

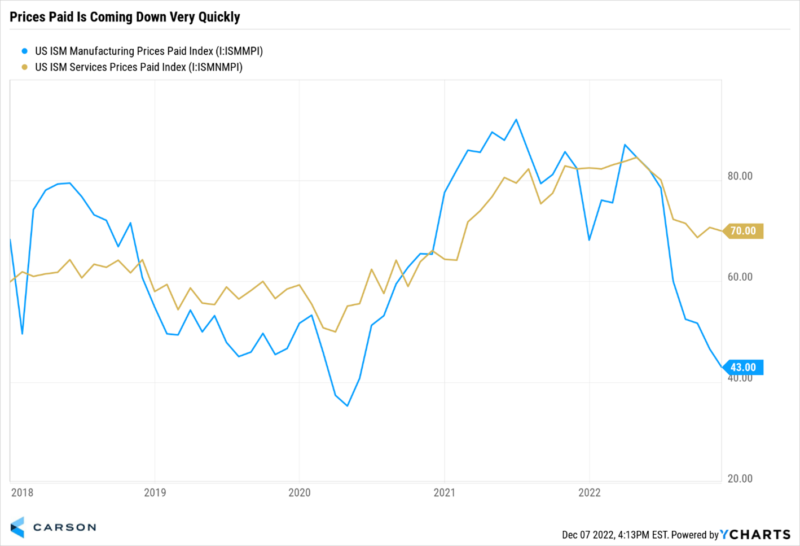

Prices paid for manufacturing have simply crashed lower. If people aren’t paying as much for stuff, there is a good chance they will be able to charge less. As the chart below shows, services prices have been more stubborn, but manufacturing is dropping at a record pace. It recently came in at 43, cut in half from March.

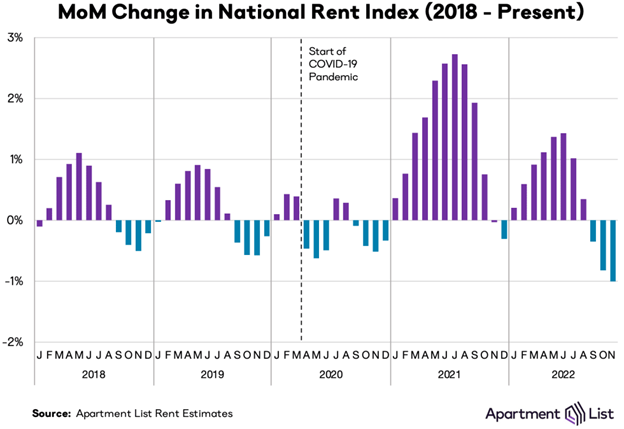

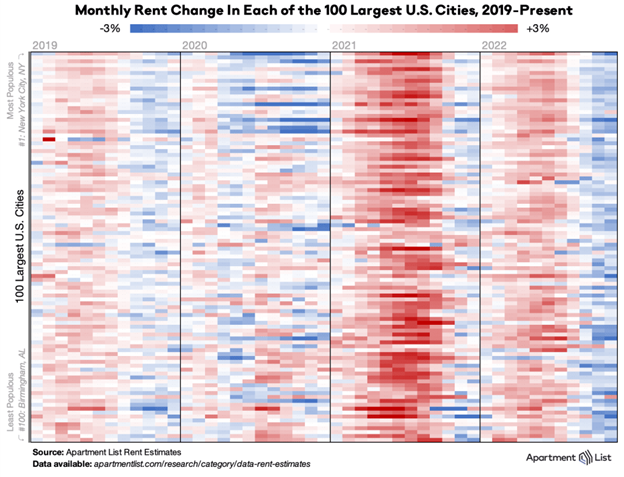

Shelter makes up about 40% of the core inflation basket, so this is a very big deal when it runs hot as it has for most of this year, but should it turn lower, it could be a nice tailwind. Although the government’s data showed that rental prices were recently up more than 7% over the past year, we are seeing private measures of rents slowing down considerably, with the Apartment List nation rent report down a record 1% last month, on the heels of the previous record of 0.8% set the month before.

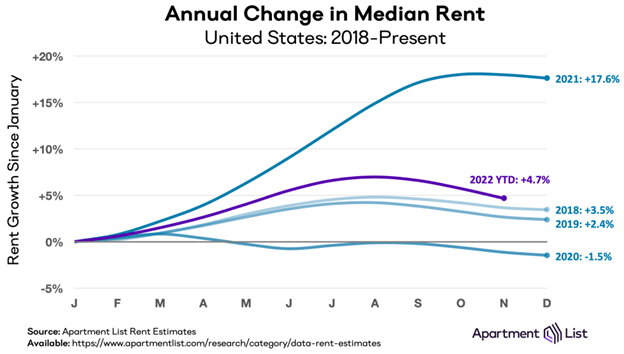

Apartment List found that rents were up 17.6% last year but are up only 4.7% this year, and the trend remains firmly lower.

Lastly, rents in 93 cities out of the 100 largest saw rents decline last month, so safe to say this is a widespread trend.

Once again, government data lags behind private data, and the truth is that the government looks at existing and new leases, while private indices consider just new ones. Also, for the official data, rental units are sampled only every six months (given that rents aren’t re-negotiated very often). For this reason, we expect CPI rental measurements to lag private indices by about 8-12 months.

Additionally, Case-Shiller U.S. National Home Price Index has dropped more than 1% back-to-back months for the first time in over a decade and has been lower three months in a row. Again, positive signs show that inflation is coming back to earth.

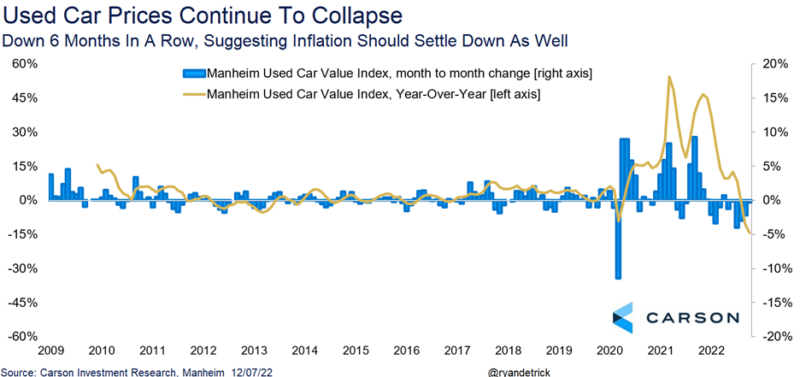

Lastly, used car prices continue to sink. According to their data, the Manheim Used Car Index showed that used car prices have dropped a record six months in a row and are down year-over-year 14.2%, the largest decline ever. Given that used cars make up about 5% of headline inflation, this is another potential tailwind as we head into 2023. And similar to rent prices, the government’s data tends to be slow to get with the picture, so we expect these lower used car prices to begin to get into the government’s data more over the coming months.

Why does all of this matter? As quickly as inflation soared, we think it could come back down in 2023, and things like rents, prices paid, and used cars are all suggesting that much lower prices could be coming soon. This, of course, would give the Fed room to take the foot off the pedal and likely end rate hikes early next year.

Be sure to listen to our latest Facts vs. Feelings podcast titled Every Rose Has Its Thorn, as Sonu and I discuss our latest market and economic views and our favorite ‘80s hairbands.