“The waiting is the hardest part. Every day you see one more card.” -Tom Petty

Note: Individual equities discussed within are examples to show earning season trends and sector performance; They should not be viewed as buy/sell/hold recommendations.

“The Waiting” was the lead single from Tom Petty and the Heartbreakers’ Hard Promises album in 1981 and one of their many classics. Petty said that it was an optimistic song about waiting for your dreams and not knowing if they’ll come true. In a sense, equity investors are feeling the same way, which is why we’ve made it our theme song for this earnings season. We’re waiting to see one of two things – signs if we’re entering a slowdown and/or recession, or if the Fed has won its inflation battle and is near the end of its rate hike cycle, permitting a “soft landing.”

Meanwhile, equities have been in financial purgatory. Since last May, the S&P 500 has been rangebound, which has frustrated both bulls and bears that have gotten used to quick resolutions in either direction. A whipsaw climate has been great for traders but frustrating for longer-term investors who seem to be bracing for a highly-anticipated downturn only to find out that things remain mostly healthy – for now. Then we repeat this cycle all over again three months later.

The waiting is the hardest part.

Will we finally get a resolution in this earnings season? Tech and consumer discretionary, two major beneficiaries of pandemic lockdowns that account for a third of the S&P 500, have been spoiling the party. However, these are expected to recover in 2023. Industrials, energy, and consumer staples have remained strong but are also beginning to slow.

Fourth-quarter earnings reports are notable because many firms give full-year outlooks for the first time, which always matters more than reported results. Maybe this could put this directionless market back on some path, but this is a tall task, as forecasts from corporate management teams aren’t immune to changing economic and financial conditions. Either way, we’re anxious to get another peek into the current state of corporate fundaments.

Every day you see one more card.

Corporate earnings are expected to decline in the fourth quarter of 2022

Currently, expectations call for about a 3.5% drop in S&P 500 earnings during Q4’22, according to FactSet. This would be the first earnings decline since 3Q 2020 during the pandemic. However, actual results will likely come in better as the long-term average of firms beating consensus estimates is around 66% due to corporate sandbagging.

Weak profits are expected to be broad-based. In fact, 7 out of the 11 S&P sectors are anticipated to post lower EPS. Only Energy, Industrials, Real Estate, and Utilities are expected to show gains, but collectively these sectors account for less than 20% of the S&P 500. Some of this weakness is from a strong US dollar, which Wall Street tends to ignore since currency fluctuations aren’t typically long-lasting. The same is true when currency becomes a tailwind, which is expected to occur during the 2nd half of 2023.

Nevertheless, it’s hard to win over finicky equity investors without a solid forecast…

Growth is expected to decelerate into 2023, but the path matters

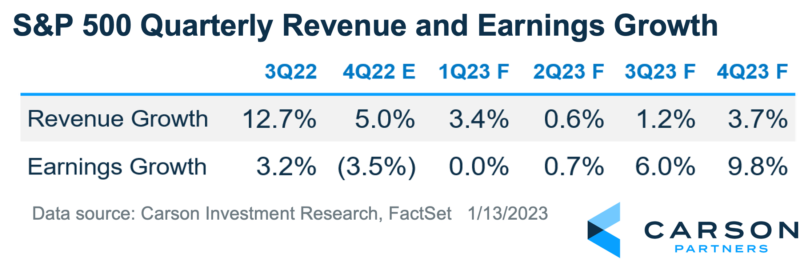

Revenue and profit growth are expected to slow further in 2023. According to FactSet, S&P 500 members are expected to increase sales by 2.7% and lift EPS by roughly 5%, which is a notable slowdown from 2022. While this is a bit of a wet blanket for fundamental investors, not all is lost when looking at the quarterly cadence expected in 2023. Earnings are expected to bottom in Q4’22, while sales growth is expected to trough in Q2’23. Then we’re expected to see a meaningful re-acceleration into the 2nd half of the year, including nearly a double-digit gain in EPS growth by the 4Q23 led by technology, consumer discretionary, and financials.

It’s the back-half ramp that may prove concerning. When a company’s outlook calls for such a meaningful 2H rebound, analysts get nervous about management being able to stick the landing. It is worth noting that Taiwan Semiconductor, the world’s largest manufacturer of semiconductor chips, gave a similar outlook last week, calling for a weak 1H but improving into the 2H. In fact, when the CEO was questioned about his forecast for a 2H ramp, he said that he didn’t know if it will be a very strong “V shape” recovery, but noted that it’s not a “U shape” either. This helped push the stock 6% higher.

We’re not saying it can’t be achieved, but a stronger-than-expected 1H would ease our nerves.

Investor expectations are higher going into earnings this time

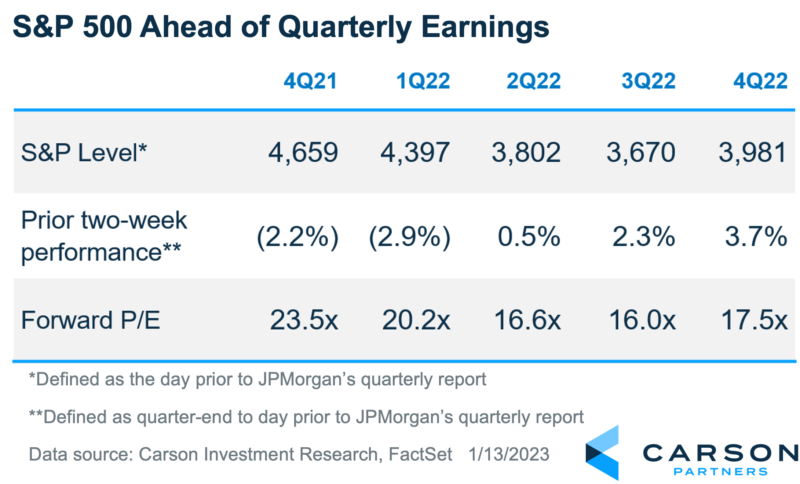

Unfortunately, there’s no single indicator that fully captures investor sentiment. However, it’s hard to beat price. On this basis, expectations coming into this earnings period are elevated versus recent quarters. While traditionalists will say Alcoa’s earnings marks the official start of earnings season, we feel a more modern launch point is JPMorgan, which typically reports earnings alongside several other major U.S. banks a couple of weeks after quarter end. Not only is the S&P 500 at a higher absolute level compared to recent periods, but it has also posted a notable rally and trades at a higher P/E multiple.

While prices are higher, EPS estimates have moved lower. Analysts have been reducing 2023 EPS estimates. Since September 2022, profit forecasts for 2023 have fallen by 4.4%, which is more than the 5-year average of 0.2% and the 15-year average of 2.7%.

Initial earnings have not been as bad as feared

We’ve already mentioned Taiwan Semiconductor’s 2023 outlook, which directionally aligns with Micron Technology’s last December. Also, initial results from several large U.S. banks (JPMorgan, Bank of America, and Wells Fargo) were not fantastic but not terrible either, which sent their stocks higher after initial weakness. Most of these CEOs are seeing business slow and expect a recession but a mild one.

However, the largest components of the S&P 500 don’t report earnings for a few more weeks, which will likely dictate investor sentiment more than these large U.S. banks. Apple is the headliner, and not just because it’s the largest index component. The stock has been down since its last report on concerns about slowing end demand and supply chain bottlenecks from China’s lockdowns. If Apple gives a 2023 outlook that calls for a moderate slowing in the 1st half of the year but improving demand in the 2nd half, that might be enough to get stocks out of this funk.