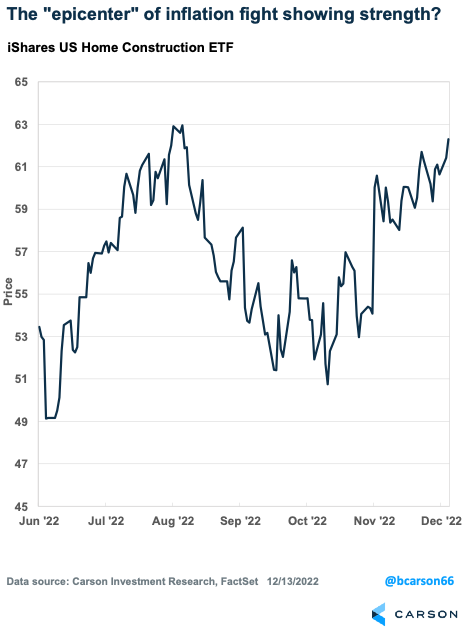

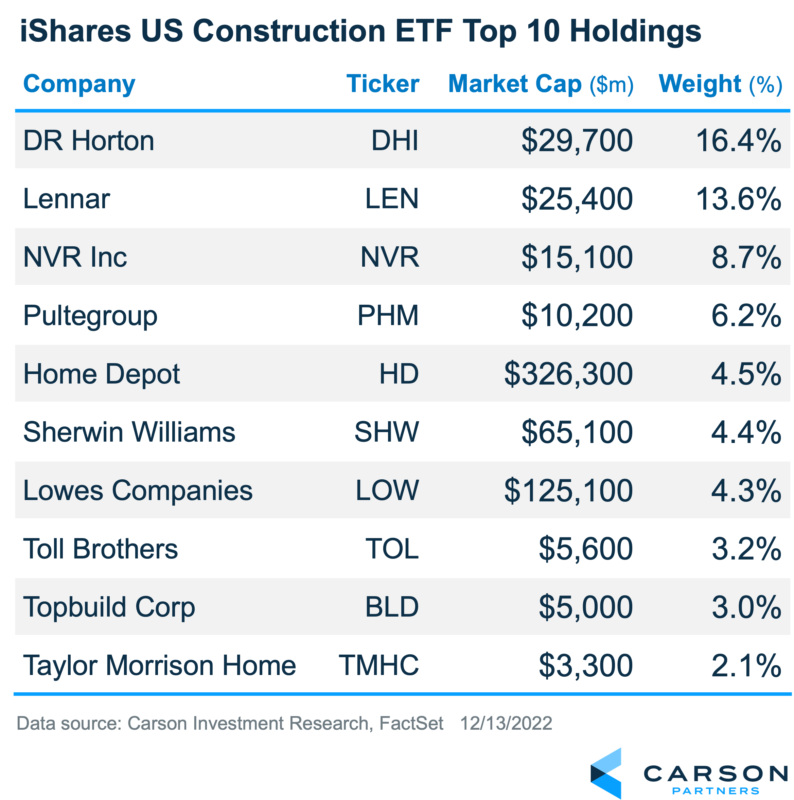

The recent headlines in the housing market are downright ugly. Mortgage rates have more than doubled in 2022 and sit near 20-year highs, existing home sales continue the longest streak of declines on record, and last week the CEO of a luxury home furnishings retailer compared this housing market to 2008/2009, even using the “C” word (crashed). However, the sector’s equities look nothing like they did during the Great Financial crisis when many shares dropped over 80%. In fact, performance as measured by the iShares US Construction ETF (ITB)* has bounced roughly 23% off the mid-June lows, meaningfully outpacing the S&P 500’s 4% rise over the same period. Are there signs of life at the epicenter of the Fed’s fight against inflation, and what could it mean for broader equities?

To be clear, all is not well in the land of housing equities. The ITB ETF* is still down 27% YTD from its peak. Recently, Toll Brothers (TOL)*, one of the largest builders of luxury homes, announced that its unit orders for new homes plunged 60% for the second quarter in a row. Yet, the stock still bounced some 8% on the report, which helped lift the broader sector. Why? The company’s margins are holding up, cancellations remain low, building costs are coming down, and discounting/incentives are controlled. Management even noted that its web and foot traffic was only down 15%, suggesting that buyers are on the sideline but still interested.

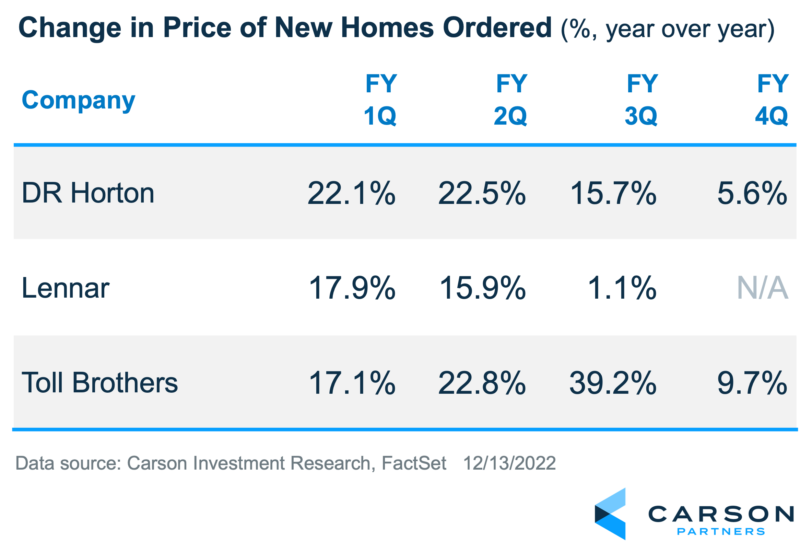

What is impressive about the major homebuilders is how resilient their margins have been despite rising input costs such as materials and labor. Thus far, pricing has remained disciplined in the face of plunging demand, and Toll’s recent earnings call suggests more of the same. This is interesting considering the meaningful moderation we have seen in the average price of new homes ordered, which is a key leading indicator shown in the chart below.

The bubble has burst in housing. However, recent developments from homebuilders says a couple of things that could bode well for broader equities. First, the Fed’s rate hikes are working, both in terms of prices for new home orders but also input costs as margins remain strong. However, despite being the poster child of the boom/bust cycle since 2020, housing stocks are proving resilient and have bounced back strongly over recent months. There has been a lot of bad news, but recent price action suggests that a lot of that has been priced in.

References to specific securities and/or ETFs are for illustrative purposes only and are not a recommendation to buy or sell the securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change with notice.