“A small spark can start a great fire” – Emmet Fox

A bank many of us had never heard of this time last week now has the entire financial spectrum on the brink of disaster. Or does it? Here are some things you need to know about Silicon Valley Bank.

The second-largest bank failure ever

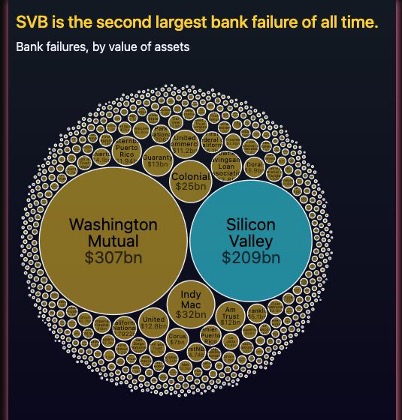

Things were just fine this time a week ago, but it all came crumbling down in less than 48 hours for Silicon Valley Bank (SVB) and parent company SVB Financial (ticker symbol SIVB). After losing 60% on Thursday, in the end, the 16th largest bank as of the end of 2022 had vanished by the end of the week, with only the failure of Washington Mutual in 2008 larger.

This chart from Pranshu Maheshwari puts things in perspective.

What happened?

Founded in 1983, SVB announced on Wednesday they had sold $21 billion in assets to raise cash and were taking a $1.8 billion loss as a result, while also trying to raise capital as well. Due to dwindling deposits and losses in their holdings, they were forced to sell to shore up their books.

As a result, there was a classic run on the bank, as customers demanded their money back and in less than 48 hours, the 16th largest bank with $209 billion in total assets as of the end of 2022 was gone. In fact, it is estimated customers tried to withdraw $42 billion on Thursday alone, about a quarter of their overall deposits.

As a result of the flood of withdrawals, they had a negative cash balance of close to $1 billion and couldn’t cover their payments, so the FDIC took over on Friday morning.

Why did this happen to SVB?

This bank was quite unique in that they focused on technology and healthcare companies, along with venture capital and startups. Heck, their name says it all. They were heavily invested in Silicon Valley and vice versa.

In fact, they provided almost half of the financing to US venture-backed technology and healthcare companies. So, whereas traditional banks had various type of customers, SVB was quite lopsided in their type of customers. This worked great when tech and startups soared from 2015 until 2021, but that all changed in 2022.

The big issue was technology had been one of the harder hit areas due to the Fed increasing interest rates by historical amounts. So instead of depositing money in the bank, they were taking out more and more to cover the bills. Couple that with the fact SVB had enormous unrealized losses in their portfolios of mortgage bonds and treasury bonds, it was the perfect cocktail for potential disaster.

The Fed finally broke something

After increasing rates nearly 500 basis points, many think the Fed was simply hiking until something broke. Well, housing broke and now the big worry is the huge drop in bond prices could be breaking things for banks.

SVB for example took many of the deposits and bought long-term treasuries, with many purchased when the 10-year yield was at 1.5%. Given the huge drops in bond values, their portfolios have significant unrealized losses as a result, thus pressuring the whole house of cards. What is worrisome here is many banks are in similar situations, with huge unrealized bond portfolio losses.

The FDIC reported that at the end of 2022, the total unrealized losses in the industry was $620 billion, versus only $15 billion the year before. Should other banks be forced to liquidate those portfolios, this would lead to huge drops in book value.

Let’s get one thing clear though, this only becomes a problem should said bank need to sell assets at depressed prices. It is well known that banks have losses on their bond holdings, but the problem comes when they need to raise capital and sell like SVB had to do. That is when the sharks circle.

Don’t forget, the last time the Fed hiked rates aggressively like this was in 1994 and this led to Orange County going under in December 1994. Is this another Orange County moment?

This wasn’t your normal bank

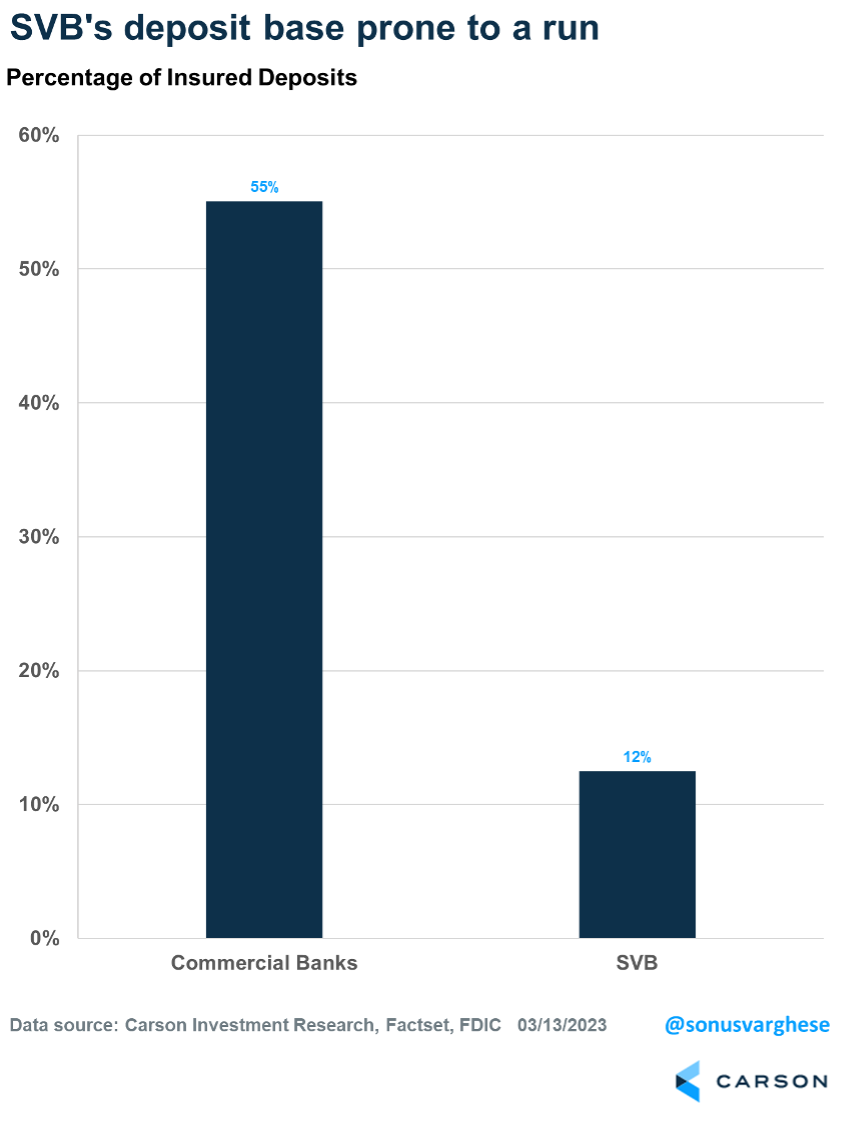

The FDIC insures bank accounts up to $250,000, but the issue was most accounts at SVB had well over this important threshold. Reports showed the bank had more than $151 billion worth of deposits over the FDIC limit as of the end of 2022. In fact, only 12% of deposits were insured, well beneath the 55% you’ll find from the average commercial bank. Again, this showed that customers were likely to pull out their money quickly at the first sight of trouble, which is what they did to the tune of $42 billion last Thursday.

Risks were extremely high

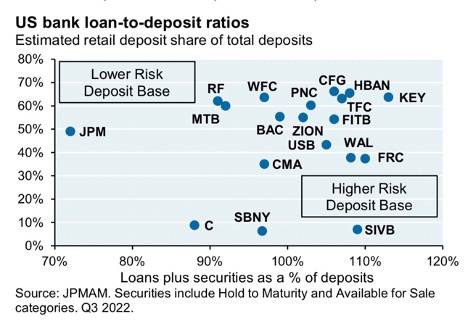

A great report by Michael Cembalest of JP Morgan found that SIVB was in a league of its own with a high level of loans plus securities as a percentage of deposits, and very low reliance on stickier retail deposits as a share of total deposits. Bottom line: SIVB carved out a distinct and riskier niche than other banks, setting itself up for large potential capital shortfalls in case of rising interest rates, deposit outflows and forced asset sales.

Deposits were another red flag

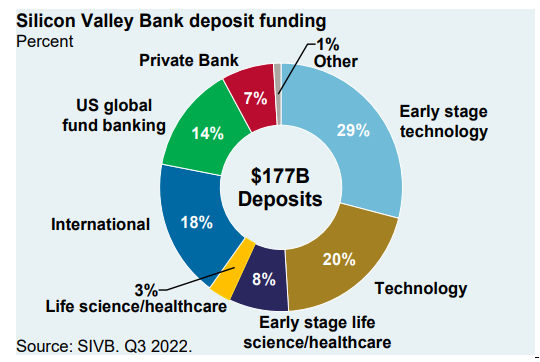

Additionally, looking at SVB’s deposits you’ll find it looked nothing like your traditional bank, with nearly half of the deposits coming from technology companies.

Only 7% coming from the private bank looked normal, i.e. the usual retail deposits. The bottom line was their concentration to companies specifically in Silicon Valley helped them on the way up, but greatly hurt them on the way down.

It was good till it wasn’t

Sure, being a bank to technology, startups, and private equity wasn’t the place to be lately, but from 2015 to 2021 it was a great place to be. In fact, deposits grew from $61.7 billion at the end of 2019 and soared to nearly $190 billion by the end of 2021. Speaking of 2021, deposits exploded 86% that year alone.

All in all, that is a tripling of deposits in three years. Not bad. What did they do with most of those deposits? Remember, most went into U.S. Treasuries and other government debt securities—not the best place to be when interest rates rose, as we explained above.

But what goes up must come down. Deposits sank from close to $200 billion at the end of March 2022 to $173 billion at the end of last year and to $165 billion by the end of February. This wasn’t just SVB though, as prior to 2022 only 10 quarters saw deposit outflows from US banks over the past five decades. Now there’s been four quarters of outflows in a row. Still, the factors that helped SVB succeed, also expedited its downfall.

What are others saying?

Mike Mayo of Wells Fargo is one of the most respected banking analysts and he said the issue wasn’t one of deposits, but of the diversity of deposits. Given the majority of their customers were primarily venture-capital firms and they had been under pressure lately, this forced them to slow down on their deposits and burn through cash. This shouldn’t be an issue for larger banks though.

“To us, the larger the bank, the more diversified the funding,” Mayo writes. “To us, this is part of the test that the largest banks, i.e., the ones that caused the Global Financial Crisis, are today the more resilient portion of both the banking and financial systems.”

Mark Zandi, Moody’s chief economist said, “The system is as well-capitalized and liquid as it has ever been. The banks that are now in trouble are much too small to be a meaningful threat to the broader system.”

Lastly, David Trainer, CEO at investment research firm New Constructs said other banks’ financial health and diverse portfolios should help protect them. Yes, all banks are dealing with the loss of value in their bond portfolios, but this only becomes and issue if they actually have to sell those securities. In fact, most banks’ securities holdings are more diversified, much like their customer bases, reducing the chances of trouble.

The first domino to fall?

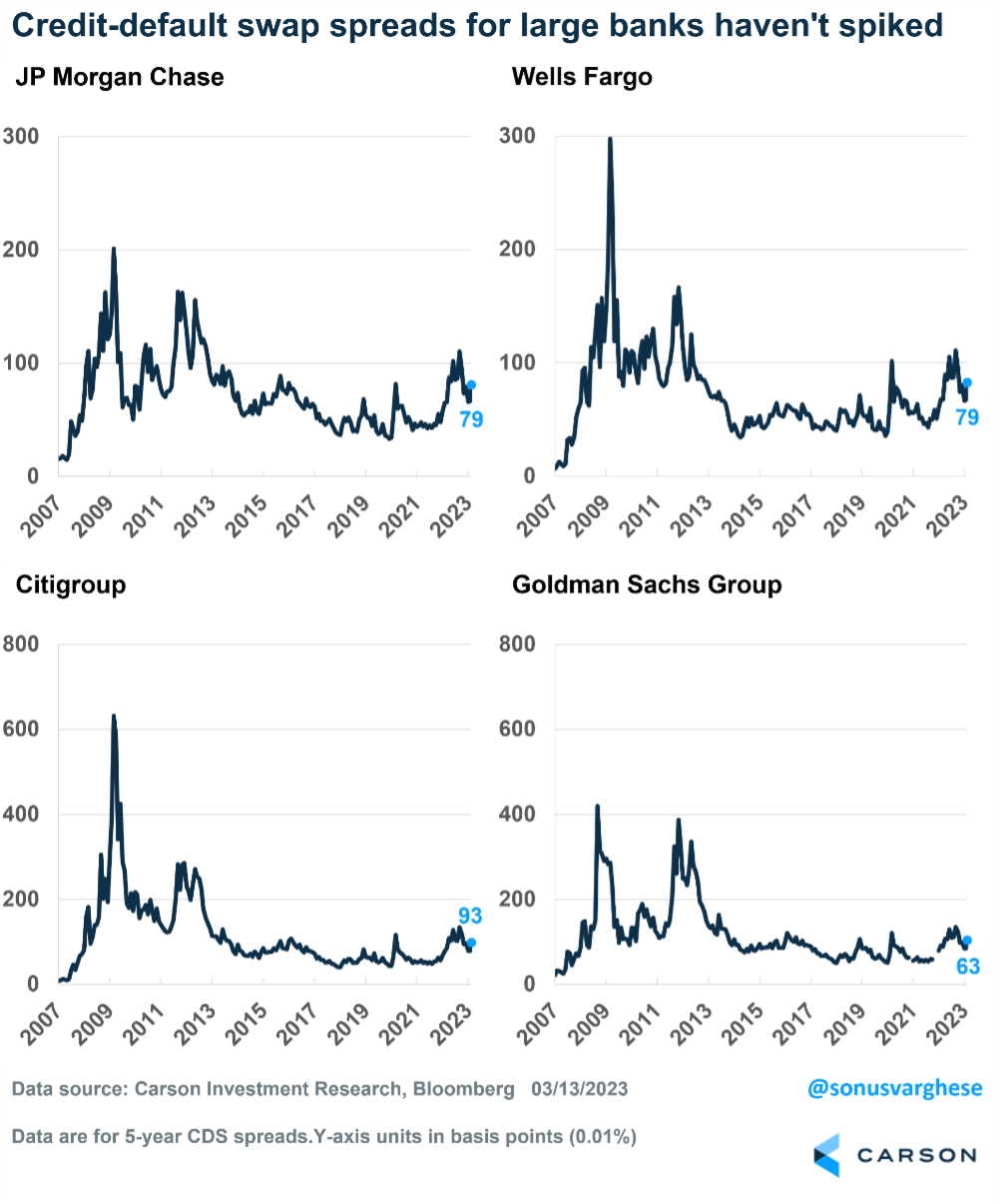

Although bank stocks and the financial industry in general had a historically bad week last week, it was worthwhile to note that credit markets remained calm last week. In fact, credit default swaps of large banks didn’t show any signs of stress, suggesting things are contained as of now. Additionally, the US Dollar weakened late in the week. Historically the US Dollar would find a bid under times of extreme stress. Junk bonds were also flat on Friday, quite the opposite of what you’d expect if things were spiraling out of control.

Who else is in trouble?

Earlier in the week, Silvergate Capital fell as they wound down operations and liquidated the bank. They were one of the largest lenders to crypto companies, an industry that has fallen on hard times lately.

Then on Sunday evening it was announced that Signature Bank was also taken over by the government as well. Similar to Silvergate Capital (but much larger), they had heavy exposure and loans to crypto companies.

So as of now, two banks went under due to exposure to crypto, while SVB isn’t a traditional bank as we already discussed. Regional banks in general have seen huge losses, but as of the time we are writing this, none of those have gone under.

Didn’t anyone see this coming?

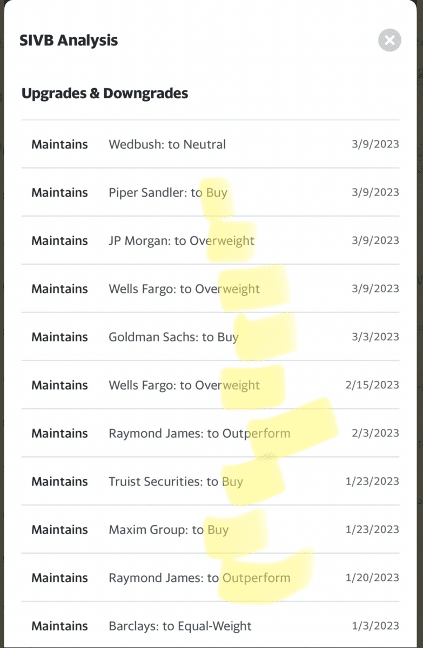

Some did, but most didn’t is the fact of the matter. Moody’s and S&P both rated SVB Financial at Investment-Grade credit ratings before last week and most analysts had it at a buy or overweight. (Thanks to Howard Lindzon for the table below).

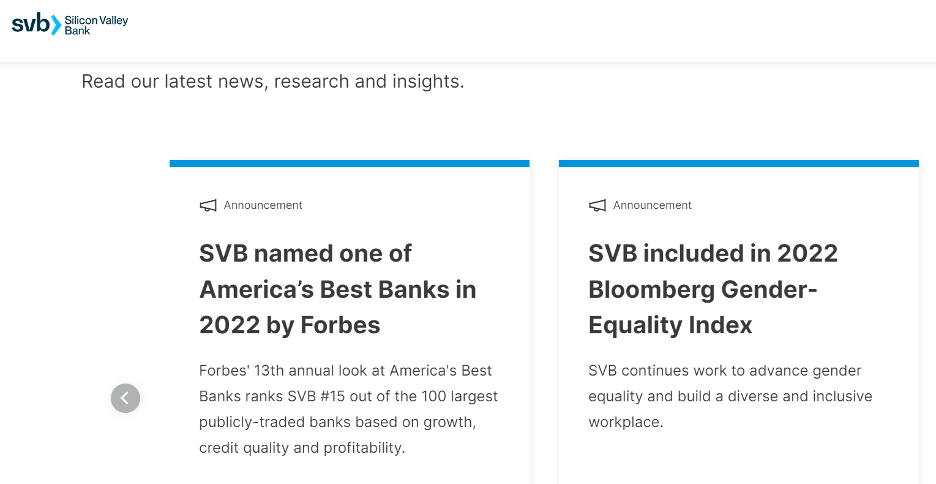

In fact, SVB was named one of the Best Banks in 2022 by Forbes, something they made five straight years. Below is straight from their website as of Sunday afternoon.

Lastly, SVB’s CEO sold a good amount of stock right before the collapse. Let’s be clear, this was likely a scheduled sell, still, it is interesting.

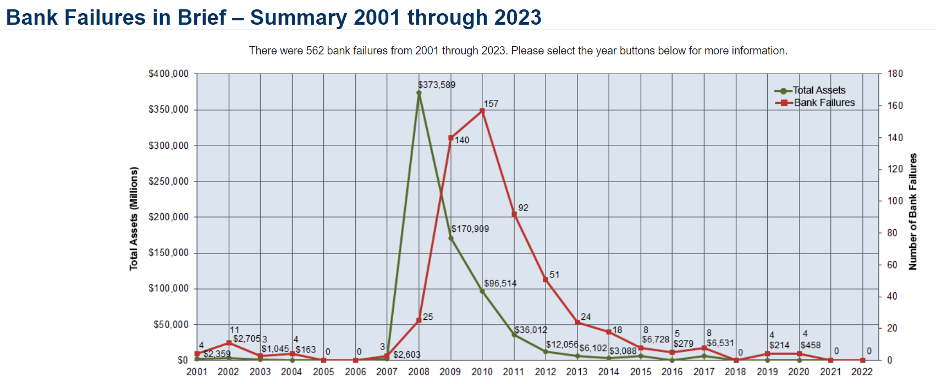

Banks do fail sometimes

Although it had been more than 850 days since a bank failed in the U.S., it is important to remember that this does happen from time to time. This nice chart from the FDIC shows how often it happens.

Now what?

Late Sunday evening, the Federal Reserve, Treasury and FDIC issued a joint statement that all deposits at SVB will be protected. At the same time, shareholders and some debtholders will not be protected.

The Federal Reserve is making available additional funding for banks across the U.S. to make sure they can meet all the needs of their depositors. This is a massive step and will help banks avoid the situation that happened at SVB. It will also bolster confidence in the banking system and prevent contagion.

This is a very fluid situation and news is coming out seemingly every hour. We will continue to monitor things, but to us things appear to be contained and a full-blown crisis isn’t the likely scenario. Should that be the case, this recent worry could very well be an opportunity for investors to use to before likely higher equity prices in 2023.