One month does not make a trend, but today’s consumer price index (CPI) report was very positive. Dare I say, it’s probably the best inflation report we’ve seen in about 15 months, especially because there were so many encouraging signs in it. This is a huge relief, and markets appear to be responding in kind. S&P 500 futures were up more than 3% after the CPI report was released and as of lunchtime, the rally continued.

Let’s walk through it.

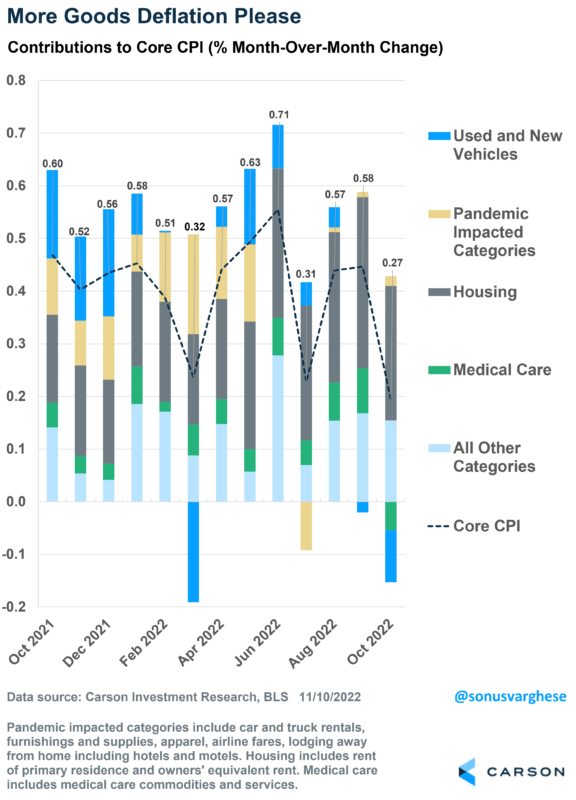

Headline inflation rose 0.4% in October, as expected. Core inflation, which strips out volatile food/energy prices, and is arguably more important for the Federal Reserve (Fed), surprised: rising 0.3% in October, below expectations for a 0.5% jump. This is the lowest monthly increase since September 2021.

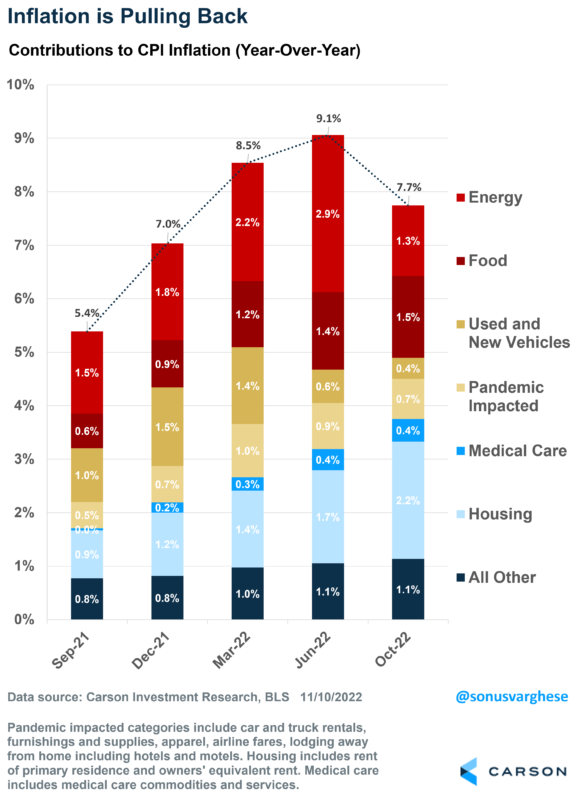

Looking back over the past year, headline inflation is up 7.8%. That’s high but that’s come down from 9.1% in June. A big part of the deceleration was falling energy prices – you can see how the lighter red bars have been making up a smaller portion of inflation over the past few months.

In the chart above, you can see that Food prices continue to make a big piece of inflation (dark red bars). But we got a break here as well. “Food at Home”, i.e. groceries (which make up close to 9% of the inflation basket), rose just 0.4% in October – the lowest in more than a year and well below the average 0.7% monthly increase we’ve seen over the first 9 months of the year.

The Goods Deflation We’ve Been Waiting For

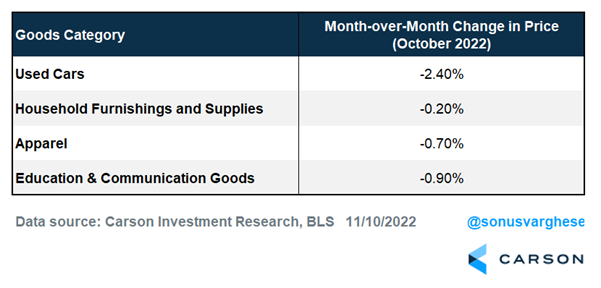

We’ve been talking about how private inflation data has been showing decelerating prices for goods outside energy and food. Just yesterday my colleague Ryan Detrick wrote about collapsing used car prices. Retailers have been telling us for a while that they’re discounting items as well. We’ve just been waiting for the official inflation data to catch up, and looks like it’s doing that, finally.

There’s a broad list of goods, including used cars, that saw prices fall in October, which is what makes it even more encouraging. The items below make up about 11% of the inflation basket (and 14% of the core basket). Falling household goods prices probably reflect the slowdown in residential activity, as home sales collapse amid higher mortgage rates.

Are Rents Breaking?

The best part about goods deflation is that it offsets high services inflation. As you can see below, the blue bars are now below the zero line for the second month in a row. We also got good news in the form of medical care services – which was a function of falling health insurance premiums.

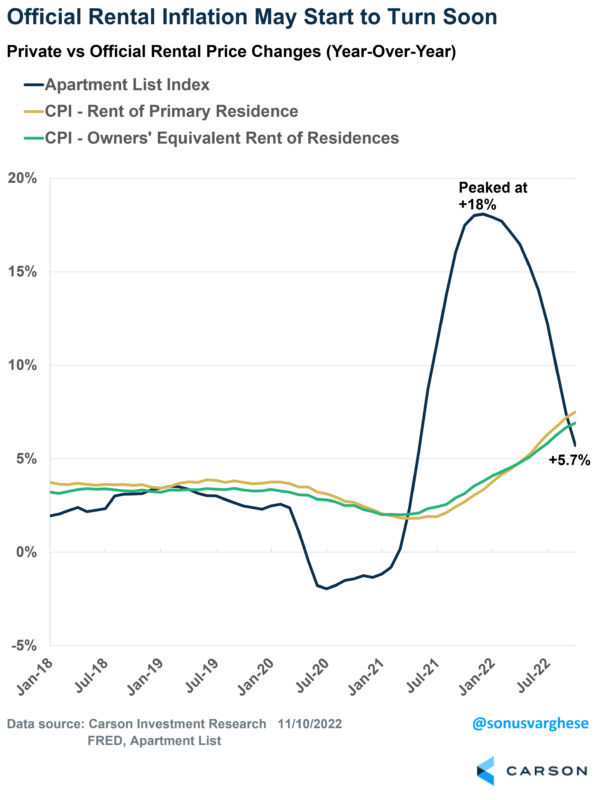

The biggest part of the inflation basket is Shelter, including rents on primary residences and something called “Owners’ Equivalent Rent” (OER), which is the “implied rent” that owner-occupants would have to pay if they were renting their homes. The latter is also determined using rents of equivalent homes as I wrote about a month ago. In other words, OER is effectively a measure of rents, and altogether rents make up a whopping 40% of the core inflation basket.

And rents have been rising, putting a lot of upward pressure on core inflation. You can see the gray bars in the previous chart growing larger and larger over the past year.

However, market rents have been decelerating quite rapidly over the last few months – Ryan discussed this just yesterday. The problem is it hasn’t shown up in the official inflation data because of methodological reasons (we wrote about this quite extensively).

But the official rental data may be beginning to turn. Rent of primary residence rose 0.7% month-over-month and OER rose 0.6% in October, which is lower than what we’ve seen over the previous couple of months. Make no mistake, a 0.7% rise is still a lot – that translates to an annualized pace of 9%, which is why the Fed is really worried about it. But hopefully, the October data is a sign that the official data is beginning to turn and follow the private data, lower.

What does this mean for Fed policy

Perhaps the most important question.

As I said at the top, one month is not a trend. But this is not random. It jives with all the other leading indicators of prices, which have been showing a deceleration in prices. And now it looks like the official data is catching up.

With respect to policy, Fed officials are unlikely to change their minds based on one report. They’ll probably need to see at least three of these before starting to view it as “convincing evidence” that inflation is on its way down.

But what today’s CPI does is that it buys time. Yet another hot inflation print would have put more pressure on the Fed to raise rates even further. By coming out on the soft side, the report increases the odds for a “soft landing” scenario. In other words, inflation and wage growth can (hopefully) come down without the Fed having to ratchet rates higher and higher, which would eventually break the labor market.