An interesting item recently hit my newsfeed describing how Apple CEO Tim Cook and Amazon CEO Jeff Bezos can be profoundly productive as they successfully guide two of the world’s largest companies.

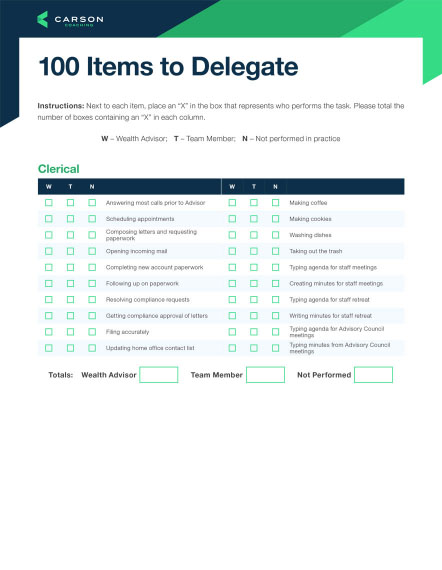

The juicy morsel at the center of the piece was the idea that these two company leaders – and by extension, all truly successful executives – share a common trait: They work exclusively on those activities that only they can perform. Anything that can be delegated is delegated – to a trusted team member who has the capability, capacity and desire to do that work.

This resonated with me because many of the senior advisors and firm leaders I work with are overwhelmed with tasks, some of which are high-value activities worthy of their experience, expertise and role in the firm – and many that are not.

However, you can’t hand off important tasks unless team members are prepared to take them over. This is especially crucial for what is arguably the most vital function of an advisory firm: meeting with and advising clients.

Let’s explore the reasons why building a crack team of advisors is a fundamental element of your future success.

Why This Is Important To You

In the desire to grow their business, senior advisors often continue adding to their personal client roster until they reach a point where they have insufficient time to service all their clients appropriately, let alone effectively execute the other key elements of their executive role.

Below are examples of important business leadership functions you might be ignoring if the demands of your client base are too pressing:

- Nurturing and replicating top-tier relationships

- Transforming contacts into advocates who proactively introduce friends, colleagues, and neighbors to the firm

- Building a client engagement model that inspires referrals

- Designing and deploying a staffing model that empowers the right people to work on the right activities and develops team members for future promotion

- Leveraging advancing technologies to enhance the client experience and firm effectiveness

- Developing the strategic vision that defines your future firm

How does inattention to management imperatives such as these impede the achievement of strategic initiatives and financial targets? Do you have time to work on the projects or tasks that are most important to you?

With the scalable foundation always top of mind, build advisor capacity that scales in alignment with firm growth. This requires a staffing roadmap, as well as organized, ongoing efforts to develop your client service bench: client service associates, relationship managers, paraplanners, senior financial planners, service advisors and senior advisors.

Perhaps the most logical place to start is a common-sense approach to client segments and the advisors who serve each segment.

In all likelihood, not all the clients you currently serve need your expertise and experience. A savvy business strategy, then, is to create two types of client-advisor alignment:

- Align the value received from clients – both fees and introductions to ideal prospects – with the expense incurred in serving them, including the “expensive” time of the senior advisor.

- Align the expertise and experience of the advisor with the complexity of clients’ circumstances.

Imagine a retired couple who live a simple life. They have $500K in liquid assets and are unlikely to inherit more. Thanks to your stewardship, their financial plan has been in place for years and things are pretty much in maintenance mode. Why do these clients need the moxie of a senior wealth strategist? Wouldn’t an associate advisor with the proper training and exposure to your “firm way” be capable of delivering the appropriate level of service and client engagement?

In large measure, this alignment is achieved by delegating mid- and lower-tier clients to more junior advisors. If you, like most advisors, have client attrition concerns when it comes to delegating relationships, reach out to your Carson coach for help. Experience has proven that with the right process and proper messaging, clients will not fly the coop when transitioned to another qualified advisor.

Employee retention is another substantial consideration. It doesn’t take much time in our industry to learn that it’s much easier to keep existing clients than acquire new ones. The same is true, perhaps more so, for team members. Replacing key personnel can absorb massive amounts of time and distract you from your primary focus. Team members who are disaffected through lack of career path, a disorganized, hair-on-fire workplace, or a narrow-minded leader may be inspired to explore other options, leaving you struggling to find appropriate replacements.

Learn more: A Smoother Road to Growth: Carson’s Advisor Growth Planner

As with so many things, planning is key. The Carson coaches have a weekly confab in which we discuss what’s working well and some of the challenges advisors are facing. During these sessions, one of us will occasionally observe that we need to eat our own cooking. This means that, as a group, we have an opportunity to be more effective by implementing a technique or strategy we have been suggesting to coaching members.

As advisors, you expend a lot of energy promoting the value of a thorough financial plan and guiding clients in its development and implementation. An opportunity you have to eat your own cooking is to apply this same planning focus toward the evolution of your advisor team; that means preparing future advisors and advancing qualified associate or service advisors to the lead advisor role.

Think about the farm system in professional baseball. The affiliated minor league organizations are incubators for teams to “grow” talent, developing young players until they are ready to contribute in the big leagues. Wouldn’t that readily available pool of talent be a distinct advantage in the operation and expansion of your business? Do you want to be in the position of starting a talent search from scratch when advisor demand outpaces supply or an advisor unexpectedly leaves?

Based on my many conversations with advisors, it’s clear that a primary motivator for many of you is to make life simpler and more joyful for clients. Why not give yourself the same gift?

By nurturing, mentoring, and training worthy team members to help cover the ever-expanding client service load, by shaping the next generation of advisors into the next iteration of you, freedom and fulfillment unfolds.

And, when you escape the constraints of servicing too many clients, you create space to do the things you enjoy the most and that have the greatest impact on the firm’s success. For many advisors, that includes the joyful pursuit of new top-tier relationships. Hello, increased profitability and enterprise value!

Lastly, if the clock has started on the fourth quarter of your career and you want to start sitting out a few possessions – or even retire your jersey altogether – remember that you can’t leave until you replace yourself. When you head for the bench, you need seasoned advisors who can backfill your role – advisors who can service top-tier clients with confidence and competence.

Read more: How to How to Plan for a Smooth Exit From Your Business

Why This is Important for Your Team

We’ve explored the numerous benefits firm leaders receive when building out a team of advisors. This team, consisting of various skill and experience levels, can collectively deliver red carpet service to the current volume of existing clients in a segment-appropriate fashion. Junior staff – client service administrators and relationship managers – can explore the opportunity to advance to the service advisor role. And service or associate advisors with a desire for advancement can prepare for the senior wealth manager role. Thus, you ensure a constant supply of qualified team members you know and trust who can move into more senior roles as the firm grows and client needs become more complex.

How does this approach benefit your team members? They get training and experience that no college degree, certification program or wirehouse can come close to matching. No doubt learning from books is valuable, but real command of the job comes through applying classroom knowledge in real-world situations with clients, prospects, COIs, team members and the boss. Through this practice, they can enhance their skill set, experience and income in what may be the best possible way.

On-the-job training is powerful. Performing under the tutelage and watchful eye of an experienced mentor who is committed to your growth is an ideal learning environment. This approach empowers team members and sets them up for an outstanding career that sees their client impact and income rising.

Ron Carson has suggested that if you want to attract and retain A+ clients, you have to have A+ team members. Retaining these employees is far more likely if they know a definite plan is in place to rise up the ranks, increasing their proficiency and earning power. Motivated individuals will be driven to contribute more significantly to the firm’s success, and the career path you have documented and verbalized will give them confidence that they are in the right spot.

Team members will be more energized and engaged when they see themselves as a member of your team for the long-term. “I have a place here. My boss understands me, and my career journey is important to him/her.” Employees who think and feel these things will have greater confidence and more commitment to the firm and its success. They are more likely to innovate and think strategically about improving the firm’s methods.

In addition, they are more likely to dismiss offers from other employers. Given the expense and immense distraction of replacing your best performers, ensuring they are not poachable should be a top priority.

The most motivated, innovative, success-minded team members – those you are especially driven to retain – are not likely to stick around if there is no discernable plan to realize their desired career trajectory. Rather than a hope and a prayer, A-level players desire a formal plan that identifies next steps with specific timelines and success measurements that clearly identify their readiness for advancement.

It’s a risky situation to let your best team players think “Well, maybe if I stick around long enough, I’ll be able to become an advisor.” People in this mindset will be susceptible to offers from your competitors and probably are not giving their all to the success of the firm. Key employees will have many career options, and you want them to stick with you for the long haul.

For guidance on cultivating team members and building a scalable corps of current and future advisors, reach to Carson Coaching. We can help light the path.