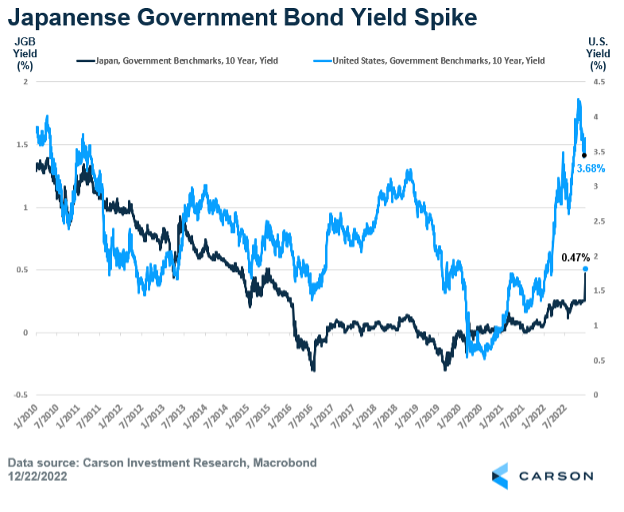

The Bank of Japan (BOJ) made a surprise decision on Tuesday to widen the allowed trading band for 10-year Japanese government bonds (JGBs) from ~25 to ~50 basis points. This move signals a shift in the BOJ’s approach to monetary policy and inflation and is likely to be sustained by the incoming governor of the BOJ.

For context, Japan has implemented a dovish monetary policy stance for years, with the BOJ’s rates remaining at 0% and large-scale quantitative easing being standard practice. The central bank has targeted a range around zero for the benchmark government bond yield since 2016 and has used this as a tool to keep overall market interest rates low. The policy change could alter the flow of capital from Japan, a major exporter of capital.

The decision to widen the trading band caused the yen to spike and bond yields to rise. This caught investors off guard, who had expected the BOJ to wait to make changes to its yield curve control until Governor Haruhiko Kuroda steps down in April. The 10-year Japanese government bond yield has spiked to 0.47%, close to the BOJ’s newly set implicit cap.

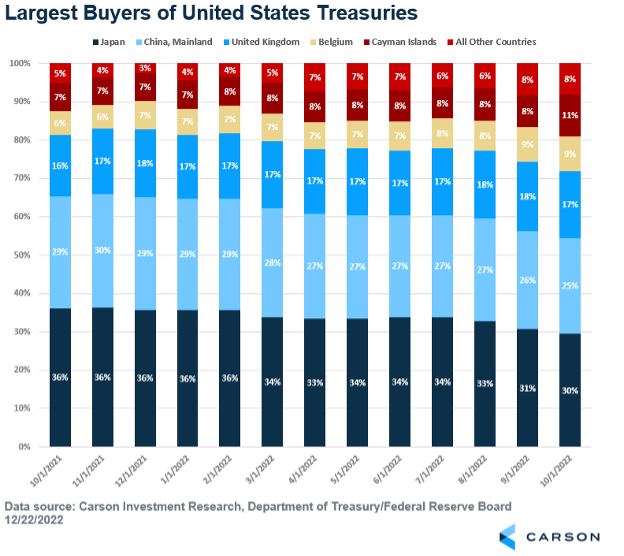

The Largest Buyers of U.S. Treasuries, But for How Long?

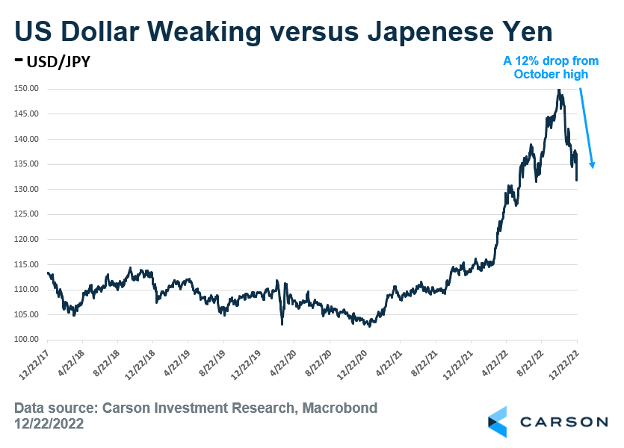

Japanese investors have historically sought investment opportunities outside of Japan, and as of October 2022, they were the largest holders of US Treasuries. The BOJ’s decision can significantly alter this flow of capital, causing Japanese investors to reconsider purchasing US Treasuries. The market is currently pricing in higher Japanese yields and a stronger yen. The rise in Japanese government bond (JGB) yield provides an increased incentive for Japanese investors to keep cash at home amid the global economic slowdown. This has the potential to negatively affect foreign risk assets, as well as strengthen the Yen versus the US Dollar.

A Preview of Things to Come?

The Bank of Japan’s (BOJ) low-interest rate policy and its consistent purchase of bonds to maintain its yield cap have been criticized for distorting the yield curve, reducing market liquidity, and contributing to the yen’s depreciation, which has increased the cost of importing raw materials. The main question is whether this is a one-time adjustment or if we are getting a preview of what Japan’s new monetary policy approach will be moving forward.

This unexpected move by the Bank of Japan has the potential to be a headwind to the US Dollar as the Japanese Yen strengthens. We’ll continue to monitor the implications of the hawkish move by the Bank of Japan and be sure to keep you updated along the way.

Thanks to Carson Research Analyst Lane Schopp for his contributions to this piece.