O-O-O-Ozempic, you know the commercial. Weight loss drugs have enjoyed a stunning debut. Novo Nordisk, the Danish drugmaker, is now the largest company in Europe, thanks to the sensational success of Ozempic, also known as Wegovy. While the GLP-1 class of diabetes drugs has been around for years, it was recently proven to have potent weight loss effects. It enabled patients to shed a remarkable 15% or more of their body weight, accompanied by a noticeable reduction in appetite, leading many towards a healthier lifestyle.

Patients are rushing franticly to obtain these drugs as if they were Wonka bars housing coveted golden tickets. A global supply shortage has raised concerns about diabetics struggling to access this vital medication they depend on. The far reaching impact of the new therapies has generated worries for anything linked to the trend. From beer, fast food, and candy bars to Weight Watchers, heart valves, and insulin, everything remotely impacted is under close scrutiny.

It’s unclear if patients will remain on the drugs long term. Early data suggests half stop taking the medicine within a year, mostly due to side effects and cost. It is too early to gauge what percent of the population will ultimately take the medications. However, the excitement and short term impact they are having is incredible to witness.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Analysts project a surge in the obesity drug market, expecting it to eclipse $70 billion in annual sales by the end of this decade. Novo Nordisk and Eli Lilly are poised to dominate the field, although more than 40 other companies are scrambling to secure a piece of this lucrative pie. The global scale of the issue is staggering; nearly 1 billion people worldwide are classified as obese, with over 40% of US adults falling into this category. Additionally, more than 70% of the US population is overweight.

A landmark trial, concluded in late summer, showcased a significant breakthrough: obese patients with a history of heart problems reduced their risk of heart attacks and strokes by 20% while taking Wegovy. Lilly’s Mounjaro is also conducting a similar heart-related study. The results, anticipated before year end, and will likely further support these claims. While the adverse health effects of obesity have long been recognized, having these outcomes confirmed through rigorous trials means health insurers will likely be compelled to cover the cost, at least to some extent. Given the potential enormity of this cost, health insurance rates will likely increase. However, drug makers argue that the long-term health benefits for the insured population will outweigh these costs.

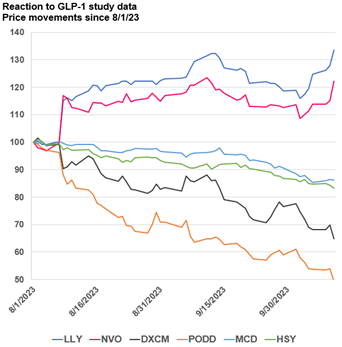

The knock-on effect to consumer companies can already be felt. Shares of fast-food restaurants have declined as Americans are expected to opt for healthier dining choices. Yum! Brands and McDonald’s stocks have both dropped about 15% since late summer. At Walmart, the head of US operations noted a “slight pullback” in spending due to the growing popularity of weight loss drugs. Customers are purchasing “slightly fewer calories,” indicating a potential shift in behavior. Meanwhile, the CEO of Pepsi said he hasn’t observed much impact on sales, but the company is “closely watching” how consumer habits evolve in this new weight loss paradigm. As usual, businesses will adapt to the trend. For instance, they might offer smaller portion sizes or healthier ingredient profiles.

Some observers have raised concerns about the concentrated consumption patterns among US consumers, suggesting that the impact of weight loss drugs could be more acute within certain demographics. For instance, Bernstein estimates that only 9% of US adults are responsible for over one-third of US candy consumption. Similarly, author Phillip Cook has highlighted that 10% of American adults consume about 70% of alcohol. The fear is that even if weight loss drugs are only prescribed to the most severe individuals, the impact on demand could be much larger given the concentration of consumption, or as the data may also be interpreted, addiction. There are emerging speculative claims that these drugs might find applications beyond obesity treatment, such as addressing other addictions and potentially reducing the risk of Alzheimer’s disease, and more.

The fallout in parts of the healthcare sector has been stunning. Surgical device companies such as Medtronic and Intuitive Surgical have experienced 20% declines in share price since late summer. Medtronic’s CEO acknowledged a “modest” dip in bariatric surgeries, likely linked to the growing adoption of weight loss drugs by patients. Players in the diabetes space have faced even harsher market reactions. Dexcom and Insulet, which manufacture continuous glucose monitoring systems and insulin pumps respectively, have seen their stocks cut in half. Investors fear that the popularity of weight loss drugs will reduce the number of type 2 diabetics, impacting these companies’ revenue streams. In stark contrast, Novo Nordisk and Eli Lilly have seen a significant boost. Both stocks have tripled in value since the FDA approved Wegovy for weight loss in 2021.

Indeed, the current landscape offers a myriad of investment opportunities with both the consequences and advantages of a skinnier America. Some investors might wager that the market’s reaction is overblown, anticipating that candy sales will remain resilient this Halloween despite the evolving health trends. Conversely, others may perceive this as merely the initial phase of a larger transformation. If these weight loss drugs demonstrate efficacy in reducing the burden of conditions like Alzheimer’s and obesity-linked cancers, as some experts have speculated, sales projections for the companies involved could surge much higher.

Even for the casual observer, with the catchy Ozempic jingle echoing in their mind, this unfolding experiment on a global scale is exciting to watch. The intersection of healthcare, consumer behavior, and market dynamics creates a captivating narrative. This space is ripe for both the curious and the investor. The disruption may create an opportunity for active management based on opportunities among “losers” where the knee-jerk reaction has been overdone, or winners where they aren’t expected. We can let our imagination run wild. (What happens to insurers if life expectancy tables see a meaningful shift? Will sporting goods sales increase? And could there be a backlash?) But untethered imagination is never a good way to invest and that seems to be some of what’s happening right now.

1937377-1023-A