“We do the worst possible thing at the worst possible time because we are most certain that we are right just when we are most likely to be wrong.” -Jason Zweig, writer at the Wall Street Journal

As we look to finish up 2023 on a strong note, there are many reasons to be thankful as investors. Here are six reasons we would like to share.

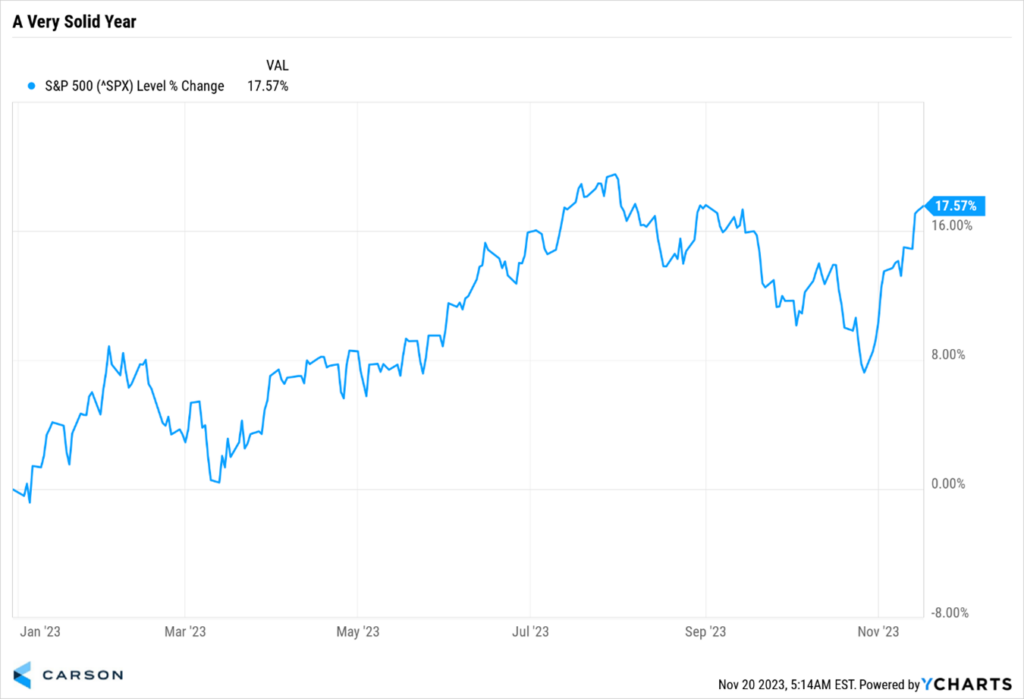

Stocks Are Having a Great Year

The S&P 500 is up 17.6% for the year, a very solid year in the face of many worries and concerns. We came into this year overweight equities and said there would be no recession. It wasn’t a popular view and we got many funny looks (and even some stern calls for not understanding how bad it was out there), but fortunately, things have played out very close to how we expected.

But what about all the worries you ask? Here’s the thing, all years have worries and concerns. One year ago, nearly every strategist and economist on TV was telling us the bear market wasn’t over and a recession was a near certainty. Go look at the quote from Jason at the top for a great way of understanding what happened. Fortunately they’ve all been wrong. It’s been a great year for stocks, which should have investors smiling and is a reason to be thankful.

The Path Remains Higher for Stocks

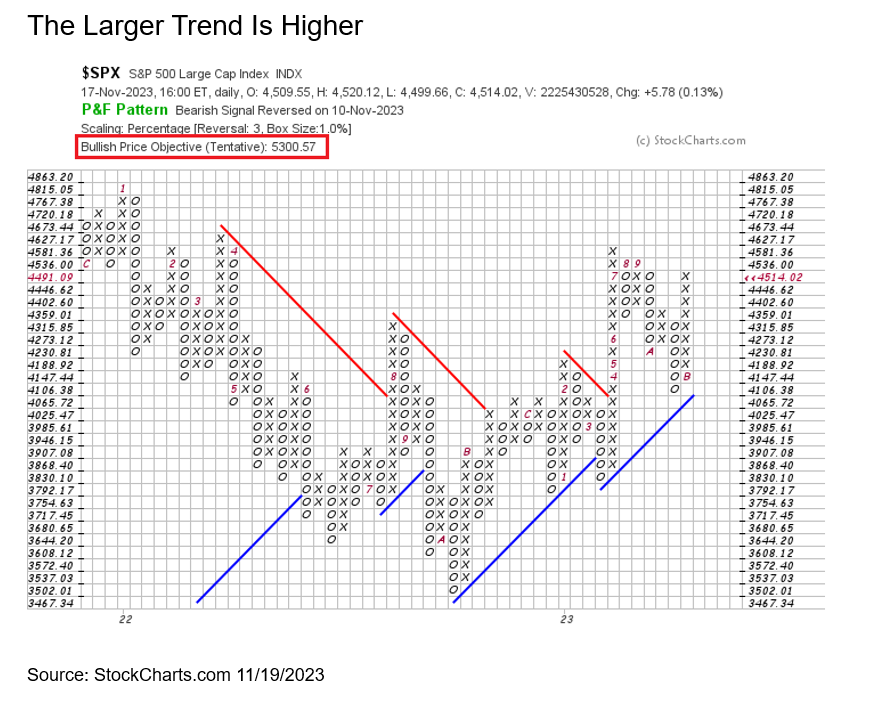

We remain overweight equities, as we continue to expect the economy to surprise to the upside next year and the bull market we’ve been in for 13 months now to continue.

From a purely technical point of view, the trend is higher, potentially much higher. According to Point & Figure charting, the target on the S&P 500 is 5,300, which would be a gain of approximately 18% from here. Take note there is no time frame for hitting this, it is only a pure price target. Also realize that this isn’t the only reason we are bullish, but it is another nice building block supporting the bullish thesis.

You can read more about Point & Figure charting from our friends at Investopedia here, but the bottom line is the trend has been higher and likely will continue to be.

The Consumer Remains Healthy

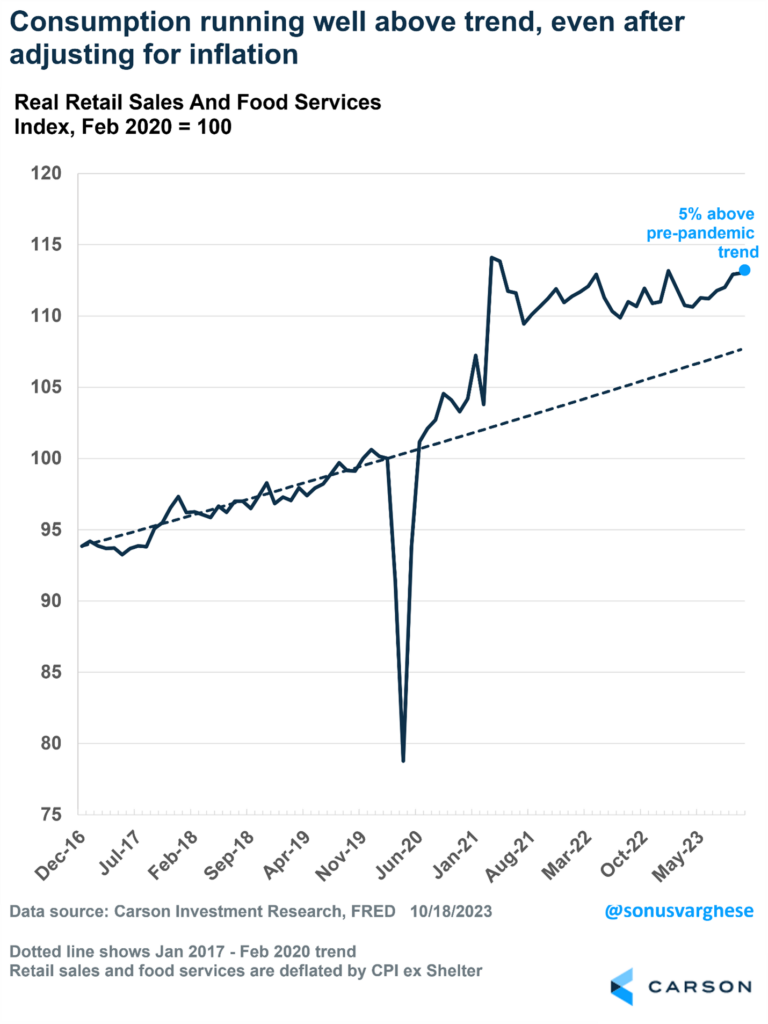

We’ve been hearing for two years now that the consumer was tapped out and the economy was headed for a recession. Many economists used things like yield curves, M2 money supply, Leading Economic Indicators (LEI), and credit markets to scare investors into thinking trouble was coming and the consumer was cracking. Well, the consumer has continued to surprise and we don’t think things will change anytime soon.

Our economy is still adding approximately 200,000 jobs a month and real wages are reaching new highs, both great signs of consumer health.

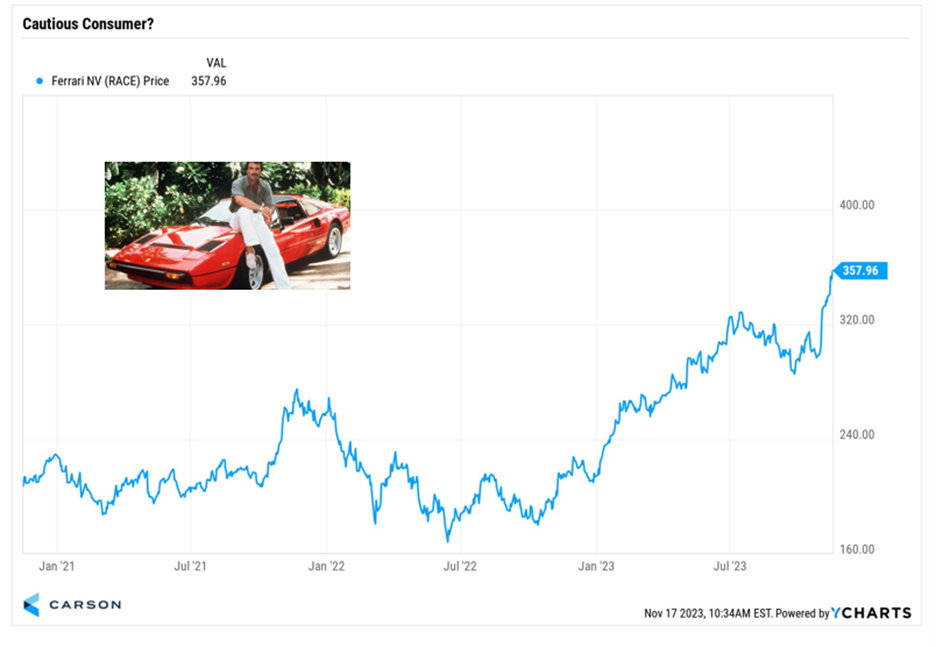

Yes, there are some small cracks potentially forming with delinquencies moving higher, but in many cases we are still well beneath pre-COVID levels. Think about it, how bad could things be when Ferrari is making an all-time high? Yes, clearly few people can afford one, but it is hard to see a global disaster coming when this stock is doing so well.

We did also see a big jump in consumption last quarter. Remember, this took place as student loans and higher rates took hold. In fact, retail sales and food services are still running at 5% above pre-COVID trends, with no signs of slowing down.

Fear Is Still Everywhere

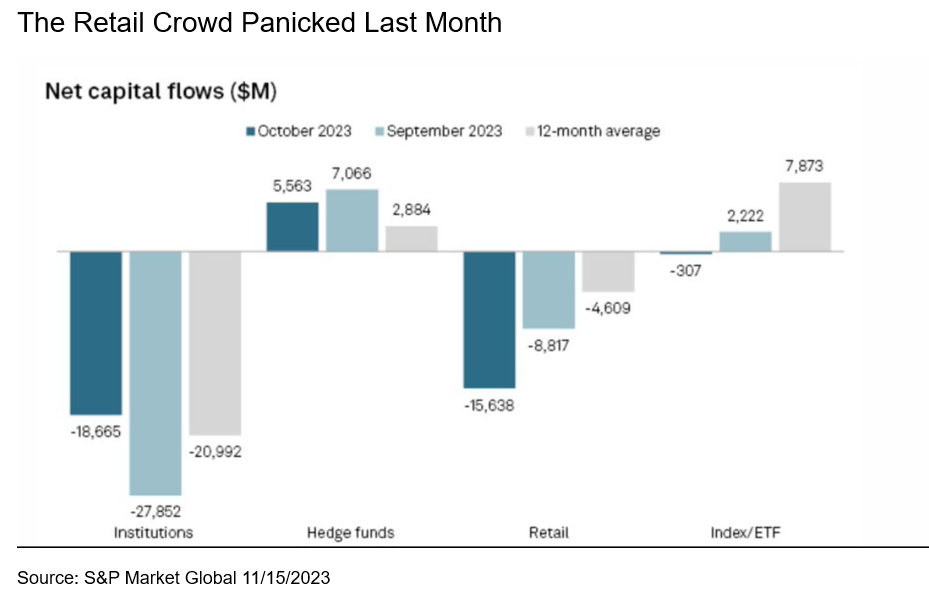

They say the stock market climbs a wall of worry, which is something it has undoubtedly done so far this year. We were on record in late October saying a major low was likely, as it was clear that overall sentiment had turned too bearish. Remember, once everyone who wants to sell has sold, it means that only buyers are left.

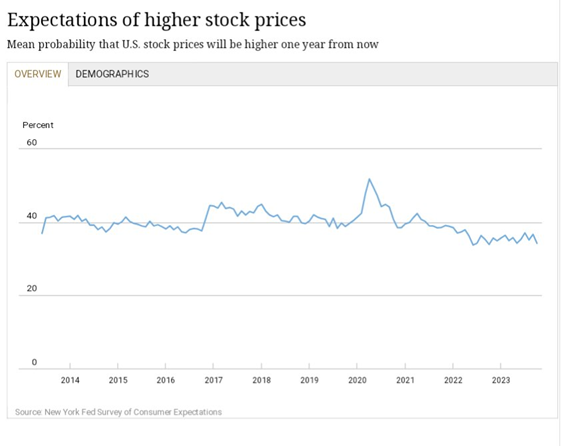

The New York Fed surveys consumers monthly and in the October survey the mean probability of higher U.S. stock prices in a year was the lowest it had been all year!

But that’s just a survey. Let’s look at the hard data of what investors really are doing. According to data from S&P Market Global, retail investors sold stocks last month like rarely before seen in history. Retail investors sold stocks to the tune of $15.6 billion in October, which was more than in October 2022 at the bottom of a vicious bear market. Unfortunately, this likely means many investors sold right as the market made another major low, but from a contrarian point of view, this is how lows form.

Manufacturing Is Stronger Than Many Think

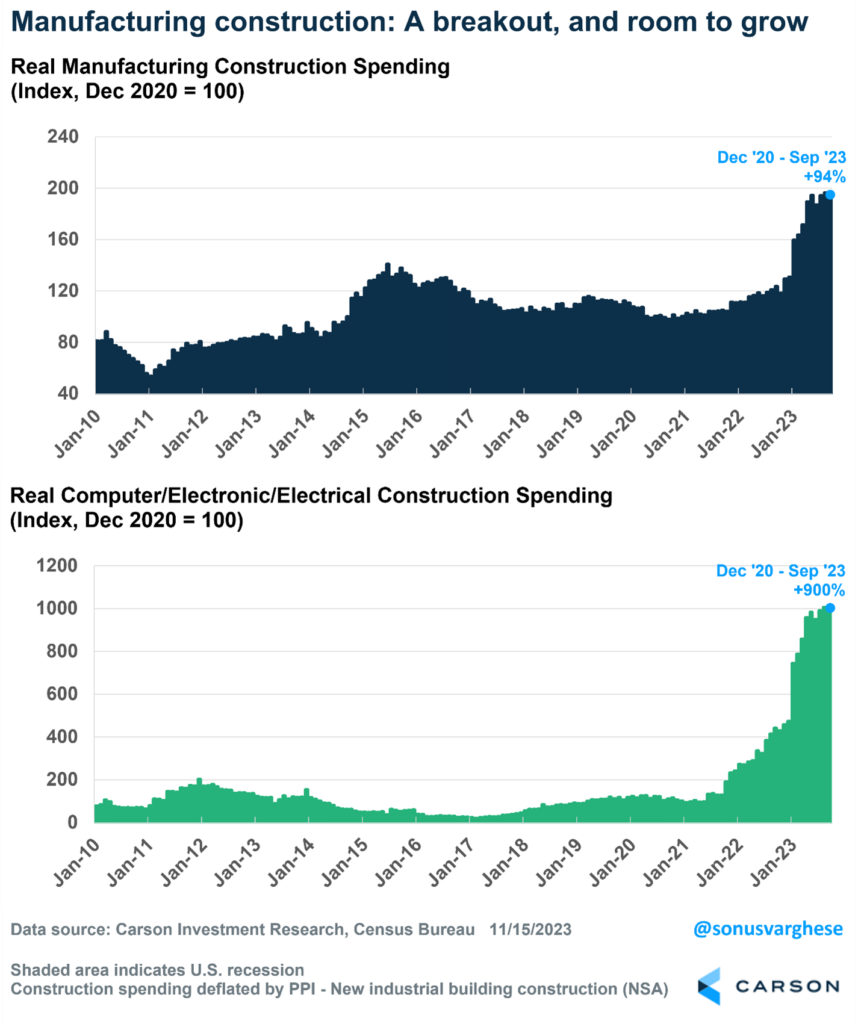

We saw a manufacturing recession last year, but this year the hard data has been much better than much of the soft survey data has been saying. The truth is historically manufacturing tends to lead the economy and it isn’t a coincidence we just saw three consecutive negative earnings quarters year-over-year with manufacturing lagging overall. The good news is we are seeing signs manufacturing is bottoming and should begin to grow nicely next year.

Here we show major surges in real manufacturing construction and high-tech construction spending. Yes, much of this is due to things like the CHIPS Act, which is incentivizing companies to bring semiconductors and other high-tech manufacturing back to the U.S. (called onshoring), but it is hard for us to consider this a negative event and likely it will lead to better productivity and economic growth down the road.

The Year End Rally Is Alive and Well

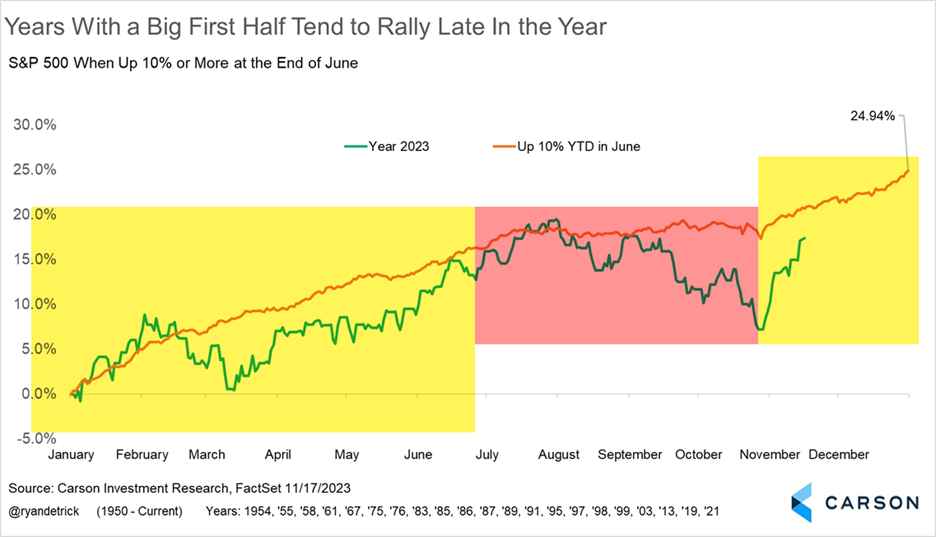

One of the amazing things about 2023 is how consistently it played out with history, from a strong first half, to a weak Q3, to a likely strong year-end rally. These are all what ‘the book’ said should happen. Well, we don’t officially know if we will have an end of year rally, but the S&P 500 is up more than 7% in November already and we are optimistic there could be more gains in store.

This chart of previous years up more than 10% at their midpoint does a great job showing how this year has played out, and why more strength is possible before the New Year’s ball drops.

Much to Be Thankful For

As we’ve been trying our best to lay out for more than a year now, the positives for markets and the economy have outweighed the negatives this year. Yes, there are many concerns and the headlines are quite scary sometime. But for investors, it has been a good year and we see many reasons to think 2024 should be strong as well.

We want to wish everyone a happy Thanksgiving week and hope you can get some rest, great food, and time with family and friends.

For more of Ryan’s thoughts click here.

01992366-1123-A