Carson Investment Research recently published our 8 Principles of Equities. After a difficult year like 2022, the second principle is rather timely—the stock market is built to recover. It’s seen wars, recessions, depressions, pandemics, terrorist attacks, and speculative bubbles that crashed spectacularly. Not only did the stock market recover from the worst drawdowns in history, but it did so in dramatic fashion. Why? Human ingenuity and capitalism are powerful combinations that have stood the test of time. Permabears beware.

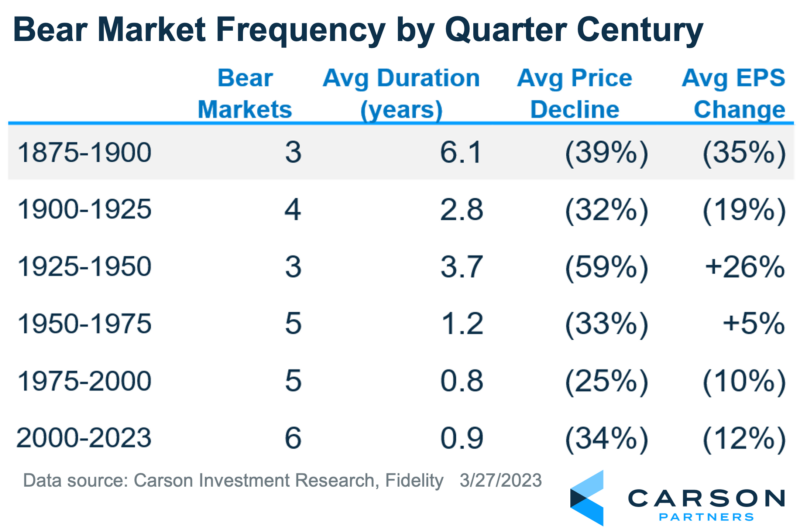

The traditional definition of a bear market is when stocks fall 20%. Since 1875, there have been 26 bear markets—one less than the total bull markets. They’re also becoming more frequent. Since 2000, the S&P 500 has seen six bear markets, the highest number yet in quarter-century periods.

There are a couple of other interesting observations from this table. First, while the frequency of 20%+ drawdowns has been increasing, the length of the modern bear market is dropping on average. This includes the severe downturns of the dot-com bubble (51% decline over 2.6 years) and the Global Financial Crisis (58% decline over 1.4 years). This has surely been helped by a highly supportive Federal Reserve. Secondly, the peak-to-trough EPS decline seen during bear markets rarely matches the market’s price decline. Often the two have not even been directionally aligned. Instead, much of the S&P 500’s drop was from multiple compression. This relates to our 7th Principle—Fundamentals lead, but price matters. We will dive deeper into that principle at a later date.

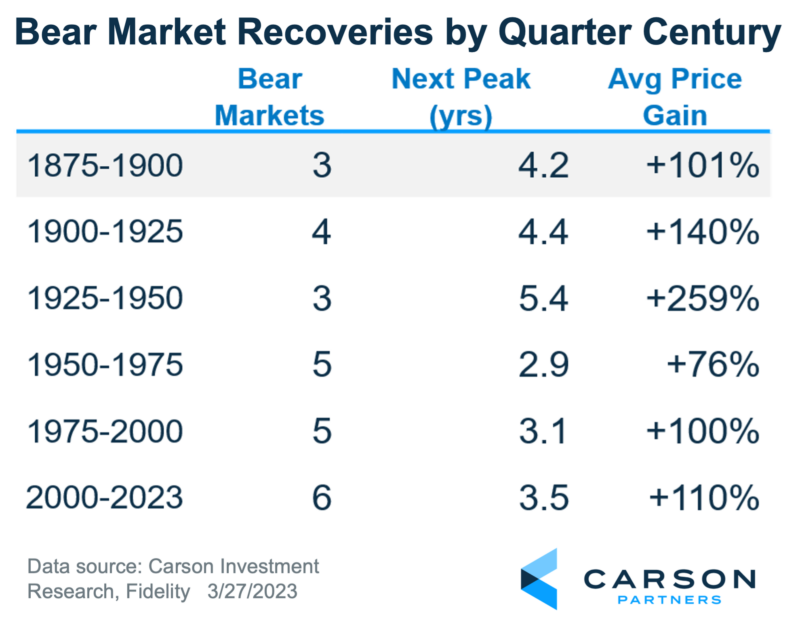

This table shows the subsequent recoveries after a bear market troughed. In other words, it shows the duration and magnitude of the following bull markets. The greater the fall, the larger the bounce. This is why bear markets are said to be great investing opportunities. It will take time and patience, but history shows that future returns resulting from bear markets are quite attractive.

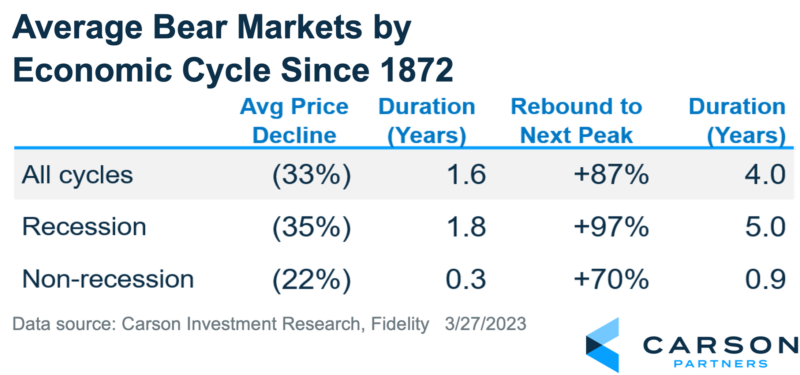

Usually, bear markets accompany an economic recession. Out of the 26 historical bear markets, only five were considered non-recessionary. This excludes the current bear market that started in January 2022 because it remains to be seen if a recession materializes. Without a recession, bear markets have been short-lived and shallower historically.

This table lists the top worst bear markets of all time in terms of drawdowns. Topping the list is the bear market that occurred during the Great Depression, which took stocks down 87%. However, the subsequent recovery was also one of the best as well, rising nearly 350% over just under five years.

We also find it interesting that two of the top 5 worst bear markets have occurred within the last 25 years. The bursting of the dot-com bubble ranks third all-time, and the bear market during the Global Financial Crisis comes in at fourth in terms of price decline In terms of length, the worst bear market of all time occurred between May 1887 and August 1896, when the stock market’s peak-to-trough took nearly 9.5 years. Now that’s a lost decade.

Bear markets are nasty. Pessimism abounds and seems never-ending. However, they are an inevitable part of market cycles and a much-needed cleansing of imbalances and excesses. It’s corporate Darwinism. However, bear markets present fantastic investing opportunities that have produced attractive returns with a little time, patience, and perspective. In the end, capitalism triumphs.