A lot has changed inside and outside the financial industry since 2005, when the first edition of “Tested in the Trenches” hit bookshelves. Technology, as an ever-changing entity, has been the catalyst for much of the innovation and change in the world. Not to mention, rapid changes in regulatory reform, industry consolidation and fee compression, all forcing advisors to shift the way they think about the value they provide to clients.

A fresh student on Harvard’s campus, Mark Zuckerburg created Facebook just a year before TNT’s first edition. And since then we’ve seen a slew of other social media sites, tech companies and innovations come and go or stay and grow. Amazon and Alexa. Uber and Lyft. Netflix and Hulu.

This technology boom is reflected in financial services, too. Firms are racing to stay current with the latest capabilities or risk frustrating and losing clients. We’ve all learned that technology is as much of a nuisance as it is an opportunity to enhance and simplify the client experience.

The past few years have taught us that to stay competitive in the current climate amid constant change, we must graduate from being “tested” in the trenches to being “proven.” Enter my new book, “Proven in the Trenches.”

While much has changed since 2005, the public’s perception of our industry hasn’t. A poll by the American Association of Individual Investors revealed 65% of Americans don’t trust the financial services industry. It’s still among the least trusted professions in the world today.

Critics say we emphasize sales over service, and that like any salesman, we have a hidden agenda driving our interactions. The advisors who are growing the fastest are those who have found a way to deliver tangible value in a compelling experience.

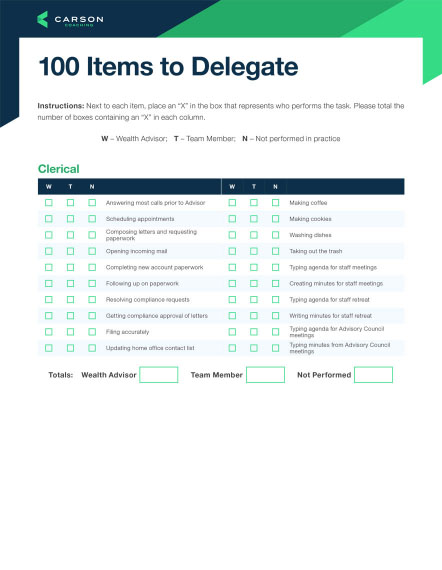

In the new book, I mention how we’ve had a unique lens into the industry over the last decade, and that unique perspective showed us there are 11 key principles for all advisors to adopt if they want to survive and thrive in the new era:

1. Understanding Investor Behavior

2. Blueprinting Your Life and Your Business

3. Attracting Talent by Growing Your Own

4. Putting Process Behind Your People

5. Building a Brand that Connects and Converts

6. Wealth Planning and What It Takes to Revive Advisor Value

7. Creating a Compelling Client Experience

8. Evaluating Partnerships

9. Attracting New Clients Through Organic and Inorganic Growth

10. Plotting Your Succession

11. Making the Shift from Advisor to CEO

By mastering all 11, you will possess the tools and wherewithal needed to navigate the evolving environment.

It’s crucial that we as advisors are proactive in preparing ourselves for what’s to come – the change that is knocking on our doors. If we don’t, our fate might be that of Blockbuster Video. A complacent behemoth that took for granted the pace of change.

Many advisors are blessed (and sometimes cursed) with an entrepreneurial spirit. We embrace new ideas and are passionate about innovating, but we struggle with processes and organization. Use it to your advantage and find new ways to provide value to clients and further cement your presence in their lives.

Technology isn’t the only factor influencing the industry. We don’t know exactly what the future of the profession will look like, but consolidation will continue, meaning fewer firms overall. Existing firms will grow larger and offer more services.

Stealth fee compression continues to move behind the scenes, shaping the way we run our businesses. The cost of servicing clients has increased, but many advisors haven’t updated their fee structure to match the increase. For now, the bull market has hidden the problematic outcome but that can only last for so long.

A 2019 Cerulli report found that firms with greater than or equal to $5 billion AUM are growing in value while firms with $10 million AUM decreased in value.

What gives? Bigger firms grew organically, adding new assets, while the smaller firms relied on market performance for growth. This works under a bull market but can be catastrophic when the market dips.

As you can see, multiple factors affect how the industry will change in the coming years. Ever-evolving technology, consolidation, fee compression, and the increasing average age of advisors – we have our work cut out for ourselves. The best thing we can do to stay afloat is to prepare ourselves for change. Mastering the 11 principles. Maximize the value we deliver. And, position ourselves for the future.

Want to dive deeper into each principle? Pre-order your copy of “Proven in the Trenches.”