The Federal Reserve (Fed) raised the federal funds rates by 0.25% at their July meeting, taking rates to the 5.25 – 5.0% range — the highest in 22 years.

This was widely expected. In fact, the Fed’s statement behind the decision was mostly unchanged relative to June, except for a subtle, but important change. Instead of saying the economy grew at a “modest” pace, they said it’s growing at a “moderate” pace.

We interpret that as Fedspeak for a strong economy. In fact, Fed staff are no longer forecasting a recession, which is a significant shift from the last few meetings.

Simply put, this wasn’t supposed to happen. Last year, when inflation hit 9%, the Fed (and a lot of other economists and market-watchers) was convinced that they would have to raise rates aggressively, reverse labor market gains, and send the economy into a recession.

They did raise rates, 11 times over the past 17 months (starting March 2022). This was the most aggressive rate hike cycle in 40 years. But the rest of the story didn’t quite pan out as expected:

- The economy created 5.2 million jobs since they started raising rates, and 1.7 million jobs just over the first six months of this year

- The unemployment rate was unchanged at 3.6% between March 2022 and June 2023

- The economy has grown 2.6% over the past 4 quarters, which is faster than the growth rate we experienced prior to the pandemic

- Meanwhile, headline inflation has pulled back from 9% to 3%

- Additionally, the S&P index is up 6.9% since the Fed started hiking rates in March 2022 (through July 26th, 2023)

In summary, there was no recession, despite an aggressive Fed. At the beginning of the year, we discussed in our 2023 Outlook why this was the likely scenario. Things have panned out as expected, and if anything, the economic environment looks even better now. (We wrote about this in our Mid-Year Outlook.)

In his post-meeting press conference, Fed Chair Jerome Powell acknowledged that inflation has moderated even as the economy remained resilient. More importantly, he said that is likely to continue.

Now, core inflation, excluding food and energy, remains elevated around 4.5%. But the Fed is now singing a bit of a different tune from last year. They’re saying that inflation can move lower without a significant breakdown in the labor market and a recession.

Which means they just need to see core inflation pull lower to end this rate hike cycle, as opposed to requiring the unemployment rate to move much higher.

And there’s good reason to believe that core inflation may move lower.

Core Inflation Could Surprise to the Downside

There are a couple of big categories that could send core inflation close to the Fed’s target of 2% over the next year.

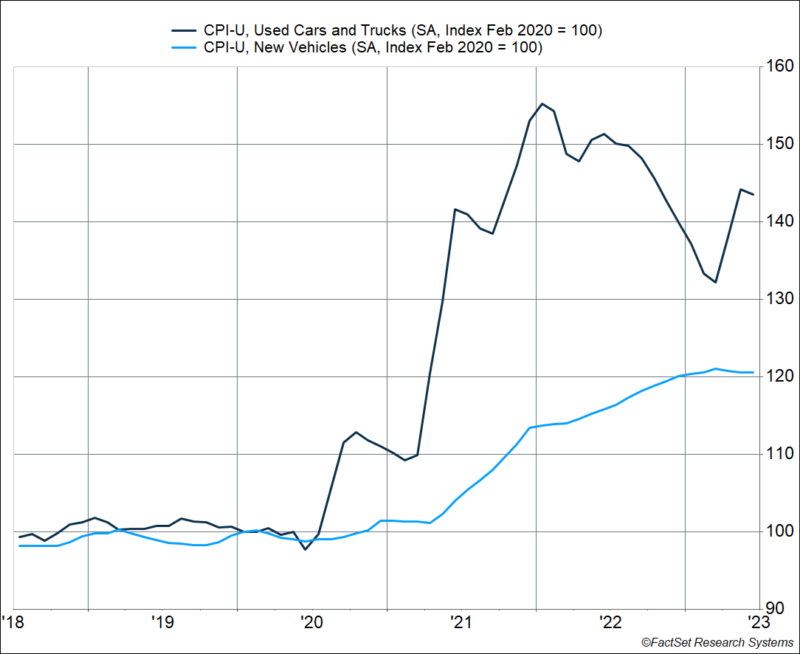

One, used and new vehicle inflation is likely to fall even more than it already has. Wholesale auction prices suggest that used car prices are falling quite significantly, and improved vehicle production should continue to ease new vehicle prices. There’s a good chance that prices move lower, i.e. we see outright deflation for a category that makes up 10% of core PCE inflation.

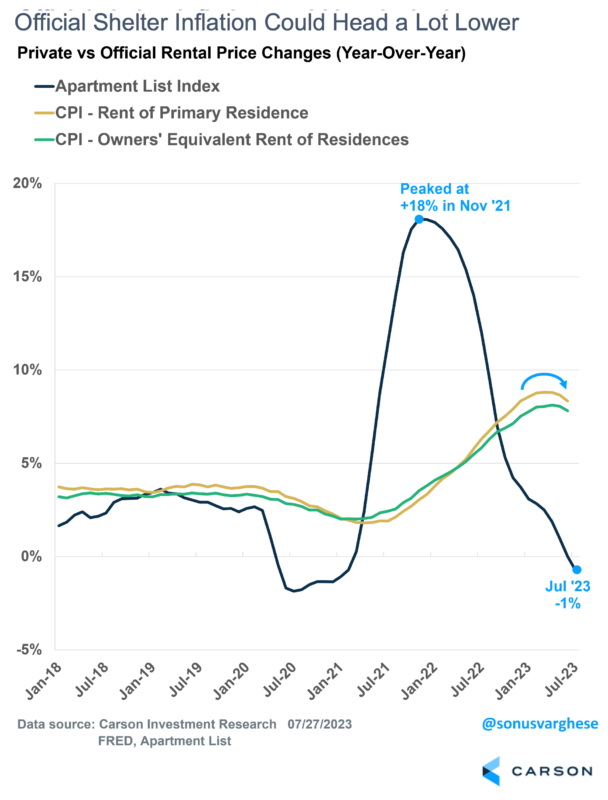

The second one is housing inflation, which makes up 40% of core CPI and 20% of core PCE inflation (the Fed’s preferred metric). Housing inflation is running at a 5-6% annualized pace right now. That’s down from 8-10% earlier this year, but still above the ~ 3-4% rate we experienced pre-pandemic.

However, private rental data indicate more deceleration is coming. In fact, the Apartment List data for July indicates rental prices fell 0.7% year-over-year. Add to this the fact that multi-family construction is at a record high. This means more rental units will come online as we near the end of 2023 and into 2024, putting more downward pressure on rents.

So, we could see housing inflation moving even lower than it was before the pandemic, perhaps close to 2%. That could easily pull core inflation close to the Fed’s target of 2%, if not even lower.

This is why we believe there is a high probability of inflation surprising to the downside over the next few months, and into next year, which means the July rate hike was likely the last one for this cycle.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Interestingly, Tom Lee of FundStat has a similar view on inflation. Ryan and I hosted him on our latest Facts vs Feelings podcast, and when we asked why he was bullish going forward, he answered a big reason was because he thought inflation could further surprise to the downside. The whole episode is great, and I highly recommend listening.