At long last, The Carson Investment Research team is proud to officially release our 2023 Market and Economic Outlook, aptly titled Outlook ’23: The Edge of Normal. You can download the whitepaper here:

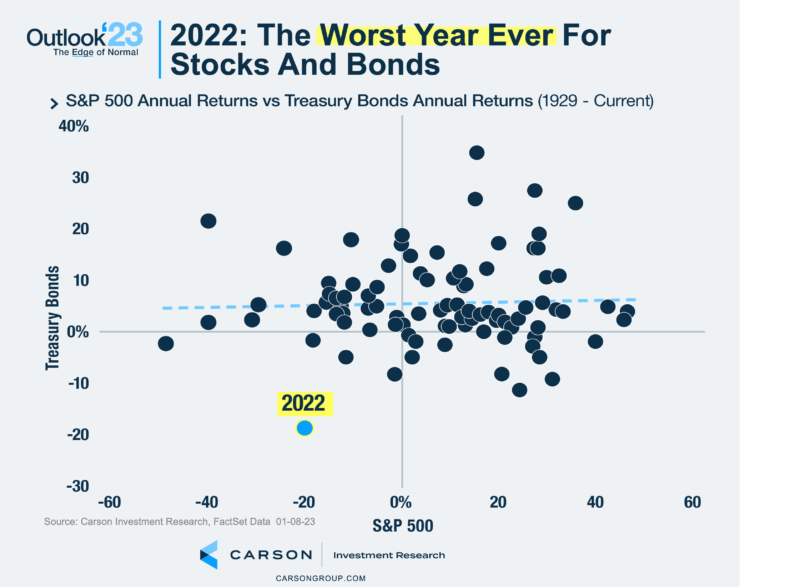

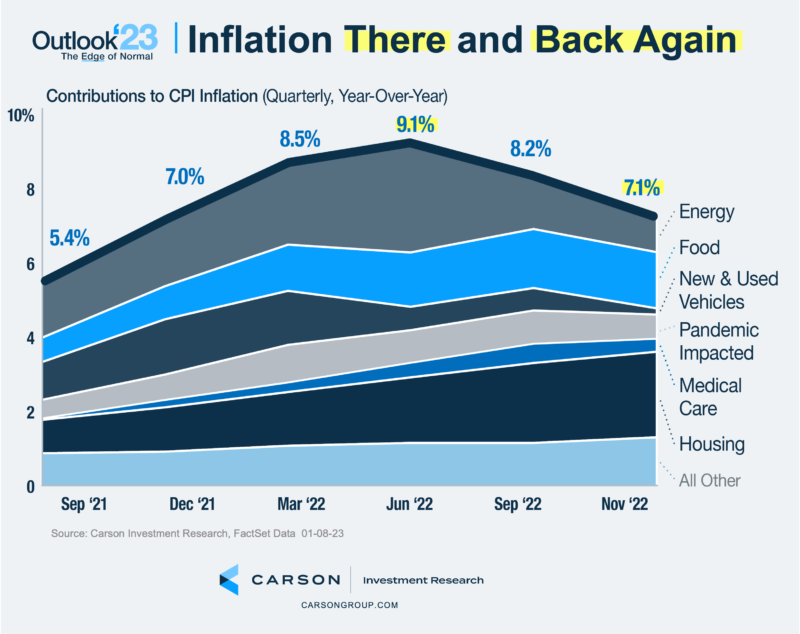

As you are all painfully aware, 2022 wasn’t pretty for investors – it was the first year to ever see both stocks and bonds down 10% or more. Higher-than-expected inflation was the theme of 2022, surging to the highest level since 1981. Add an aggressive Federal Reserve and an unfortunate war in Ukraine, and the result was a very poor year for investors and growing uncertainty for the U.S. and global economies. A bleak year, no doubt, but where do we go from here? We in the Carson Research team believe there are many potential reasons to be optimistic about the year ahead.

For example, Inflation already started to pull back in the second half of 2022, and 2023 may actually be disinflationary, with several factors that drove inflation higher last year reversing this year.

This could allow the Fed to slow down on the aggressive policy stance, and although it won’t be easy, we think there’s an above-average chance we can avoid a recession in 2023. Much like you don’t drive looking out of the rearview mirror, to look backwards to predict what could be next isn’t wise. Housing and manufacturing could be headed to recessions, but the consumer remains the most important and largest part of the economy, and they are still very healthy.

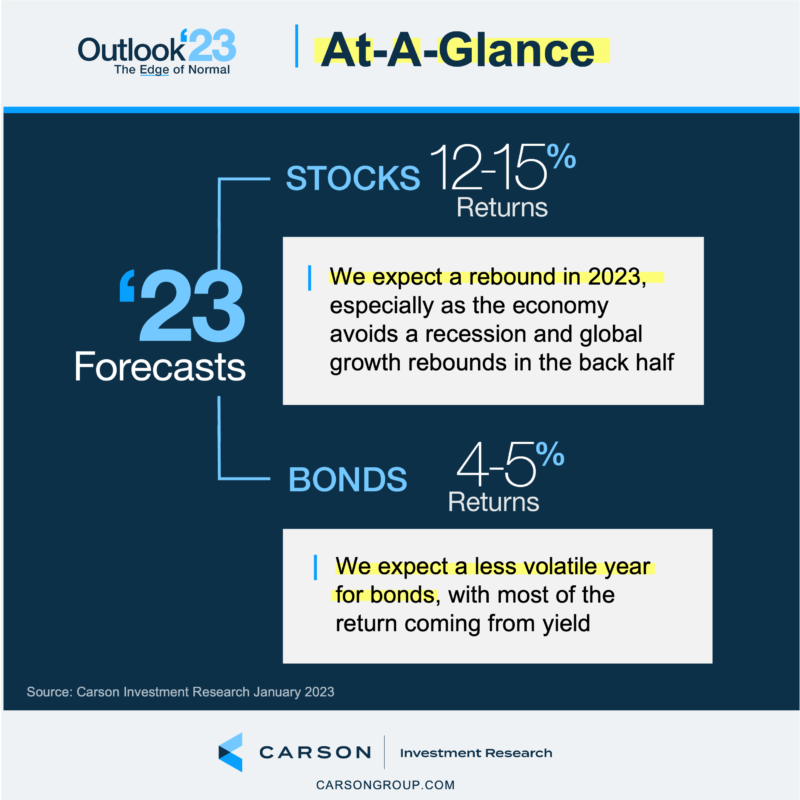

Just because 2022 was a poor year for stocks and bonds doesn’t mean the same will be true for 2023 (like our friends in compliance say, past performance isn’t indicative of future results). Stocks and bonds could bounce back nicely, with the potential for stocks to lead the way higher and for bonds to begin meaningfully contributing to investors’ portfolios again.

We expect stocks to produce a total return of between 12% to 15% in 2023. We also expect a more normal year for bonds, with most of the return coming from yield. Our expectation is that the Bloomberg US Aggregate Bond Index may produce a total return between 4% to 5% in 2023.

With our hype-free outlook, you’ll gain insights into how Carson Investment Research is positioning and preparing for the coming year. It’s an important tool for us as it solidifies and articulates our teams’ views and is the baseline for our portfolio management and advice recommendations.

You can read the full Outlook ’23: The Edge of Normal here. We hope you find it useful!