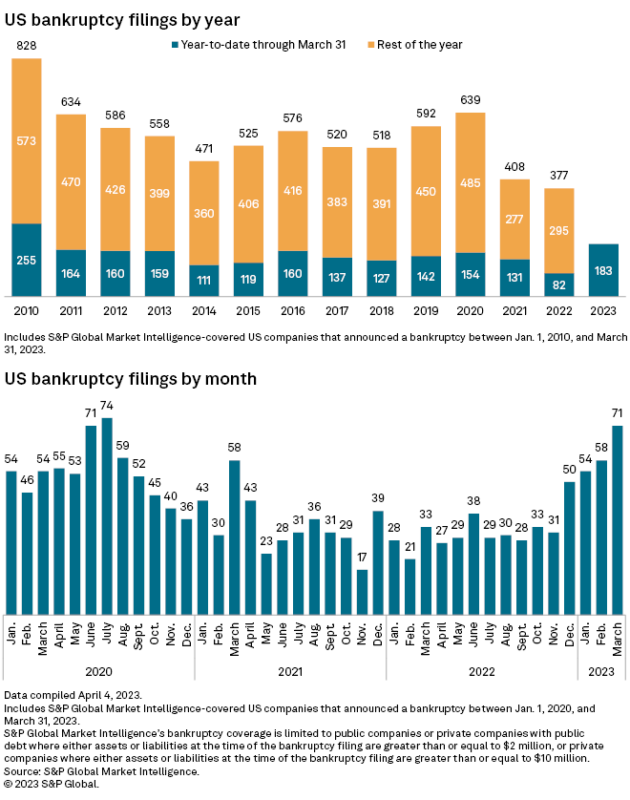

Corporate bankruptcies are rising in 2023, based on S&P data. The first 3 months saw 183 bankruptcy petitions, which was the highest for a first quarter since 2010.

March alone saw 71 corporate bankruptcy petitions, the fourth straight month of increase and the highest monthly total since July 2020. Obviously, the most noteworthy bankruptcy filing last month was SVB Financial Group. They filed for Chapter 11 on March 17th. Note that 2022 and 2021 were historically slow years.

S&P analysts expect an uptick in defaults for the lowest-rated borrowers in 2023, due to added stress from:

- Higher unemployment

- Contracting corporate earnings

- Tighter monetary policy

As we’ve written before, the labor market is showing signs of underlying strength despite the aggressive monetary policy.

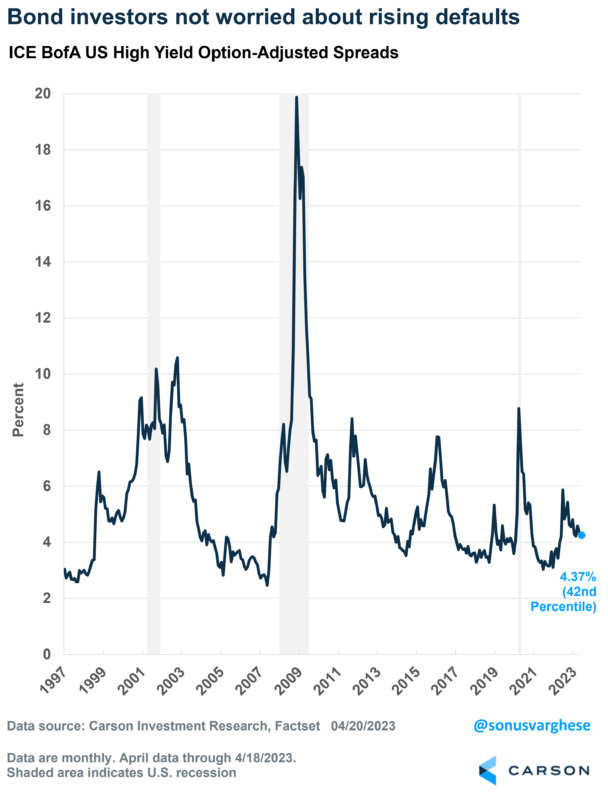

Bond investors not worried about rising bankruptcies

If bond investors were worried about rising bankruptcies, and associated loan defaults, we’d see that in the bond yields. Especially for junk-rated borrowers.

One way to monitor this is to look at spreads for junk-rated (or “high-yield”) borrowers. These spreads represent the interest rate premium that junk-rated companies have to pay over risk-free treasury interest rates.

Typically, if investors expect economic hardship, and a higher likelihood of default, they will charge these companies higher interest rates on loans. That would result in larger spreads against treasury rates.

The good news is that high-yield spreads are currently at 4.4%, which is just the 42nd percentile across the data going back to 1997. The average across the entire period is 5.4%. The current spread is also below what we saw last June, which is when the Federal Reserve signaled they were going to get a lot more aggressive. Notably, as you can see in the chart below, the current level remains well below what we’ve seen ahead of prior crises, including in 2000 and late 2007.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Bond investors typically sniff out hard economic times for companies well ahead of other investors. And right now, they don’t see any signs of that.

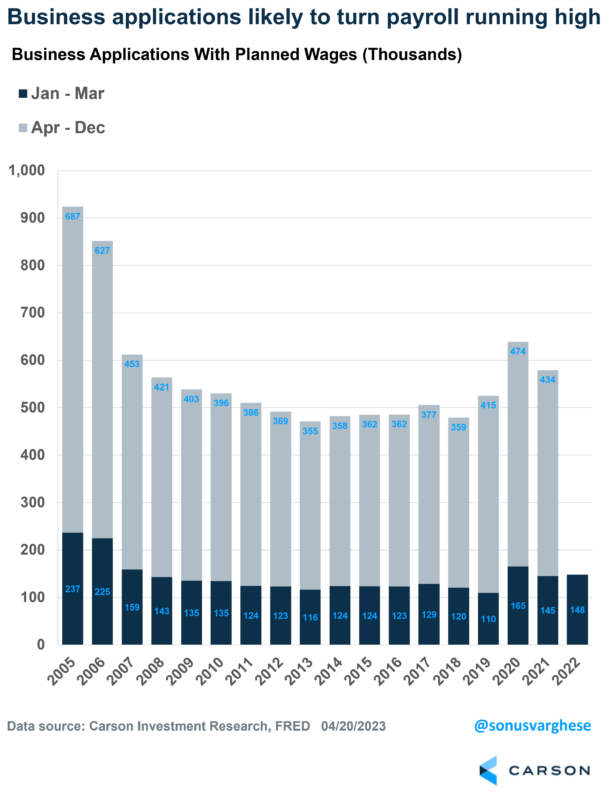

Meanwhile, entrepreneurship is also rising

The other side of business bankruptcy is entrepreneurship. Especially entrepreneurs who plan to turn payroll.

The Census Bureau tracks monthly business applications and especially useful is a category called business applications with “planned wages”. These are applications that include a first wages-paid date on the IRS form SS-4. Indicating a high likelihood of transitioning into a business with payroll.

There were more than 148,000 such business applications in Q1 2023, which is 2% higher than what we saw last year. It’s also 23% higher than what we saw in Q1 2019, the year prior to the pandemic.

One thing you may have noticed in the chart above is that businesses with planned wages are still running below what we saw prior to the Financial Crisis. In 2005 and 2006, business applications with planned wages averaged close to 680,000 per year. Unfortunately, after the 2008-2009 crisis, these sort of business applications fell well below that. The average between 2010 and 2019 was 373,000.

However, entrepreneurship kicked into overdrive after the pandemic, as people ended up with more money in their pockets – thanks to federal aid and money saved from limited spending during lockdowns.

Applications jumped in 2020 and 2021 to an average of 445,000 a year, which was a 19% increase from the average we saw in the previous decade. And the good news is that we didn’t see a huge falloff in 2022 despite aggressive rate hikes by the Fed.

It looks like applications are picking up again in 2023, as we saw from the Q1 data. Notch this against rising bankruptcy data, and hopefully puts things in perspective.