This week, the Federal Reserve raised rates by 0.25%, taking the federal funds rate to the 4.50-4.75% range. This is the slowest pace of increase since last March and a welcome downshift after the aggressive pace we saw last year.

They also said that ongoing interest rate increases will be appropriate to return inflation to their 2 percent target over time. The language suggests that they’re not done with rate increases as yet. Though the extent of future increases will take the totality of what they’ve already done, incoming data indicate they are close to “peak rate.” Perhaps around 5%.

But all of this was kind of expected.

Not pushing back on the market anymore.

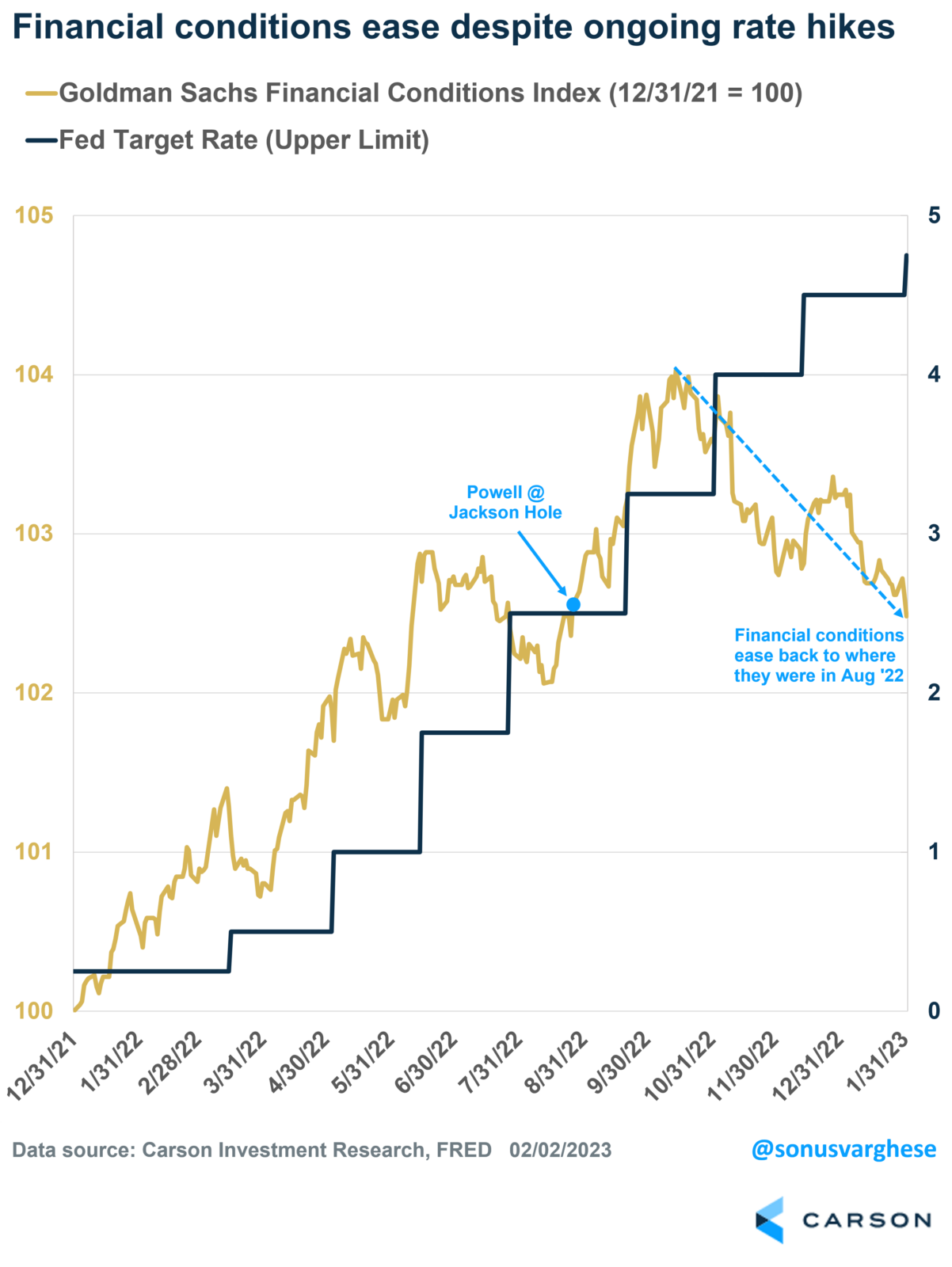

What was not expected was what Fed Chair Powell said in his press conference. There was a notable shift when asked whether they were concerned about easing financial conditions. He answered by saying that financial conditions should reflect tighter monetary policy.

But rather than focusing on the near term, he said that financial conditions have tightened over the past year. This is true. The most noticeable impact has been on the housing market, where activity crashed amid surging mortgage rates, directly resulting from their aggressive policy actions.

However, Powell ignored more real-time measures of financial conditions, which have eased significantly since October. These include financial measures like credit spreads and the stock market – we’ve seen a significant rally over the last three and half months.

All this is in sharp contrast to what happened last August in Jackson Hole, when Powell pushed back against markets. If you recall, the Fed had raised rates by 0.75% at their June and July meetings. But financial conditions eased, with the market rallying between late June and August.

Remember that the Fed has only one (blunt) tool to fight inflation, i.e., interest rates. And that must transmit to the economy via financial conditions. So if financial conditions ease, that would go against a tighter monetary policy stance.

This is why Powell pushed the market hard the other way in his Jackson Hole speech on August 26th. The immediate impact was the S&P 500 dropping 3.4% that day, and it broke through its prior June low a few weeks later. Minneapolis Fed Governor Neel Kaskari made the intention clear when he said

“I was actually happy how Chair Powell’s Jackson Hole speech was received”

My colleague Ryan Detrick and I talked about this on our very first Facts vs. Feelings podcast episode.

Well, that was then. They don’t feel the need to push back on easing financial conditions anymore.

Which is a big positive for markets!

Things have changed significantly since August. As I mentioned above, housing activity crashed as mortgage rates surged to about 7% (from under 5.5.% before Powell’s speech) – residential investment was a major drag on GDP growth in the second half of 2022, which was how aggressive monetary policy was reflected in the economy. The good news was that other areas of the economy continued to power the economy ahead.

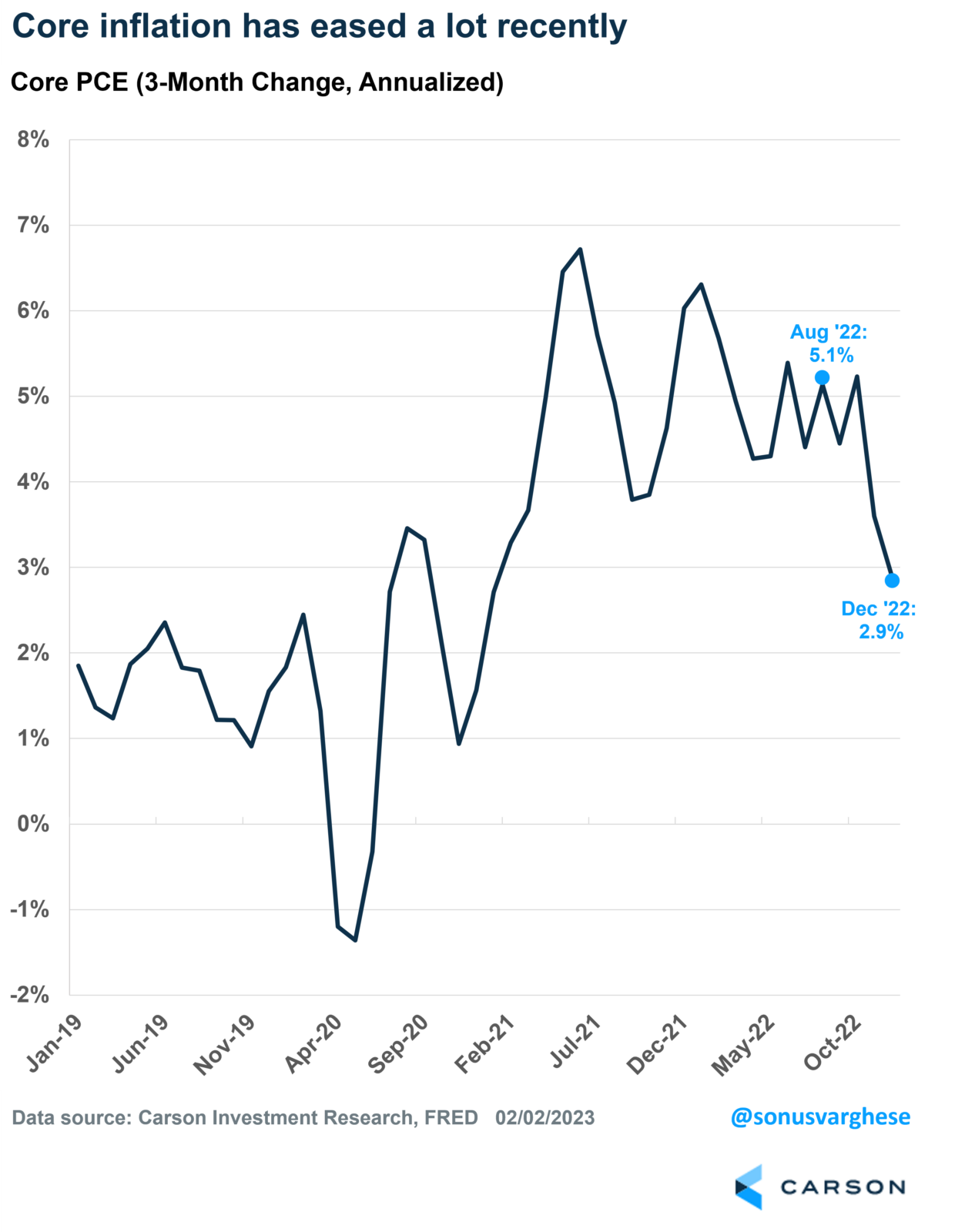

Most importantly, core inflation, as measured using the personal consumption expenditures index – the Fed’s preferred approach – is now running at a 2.9% annualized pace if you look at the last three months. Back in August, it measured around 5%. As Powell said, “disinflation is now underway.”

Another positive: They don’t seem interested in fighting market expectations for future policy either. Markets expect the Fed to cut rates at least a couple of times before the end of the year. Fed officials are clearly not there yet, projecting higher rates throughout. But Powell simply shrugged away this divergence. He said investors expect inflation to fall quickly, whereas Fed officials don’t. And that’s driving the divergence in expectations.

It does get to where they think they are in the battle against inflation.

“The job is not done.”

The Fed acknowledges that core inflation has softened, driven by disinflation in core goods, including items like used and new cars, apparel, and other household stuff. Also, housing disinflation is in the pipeline, especially if market rents continue to ease – which they are, except that it’ll take a while to show up in official inflation data.

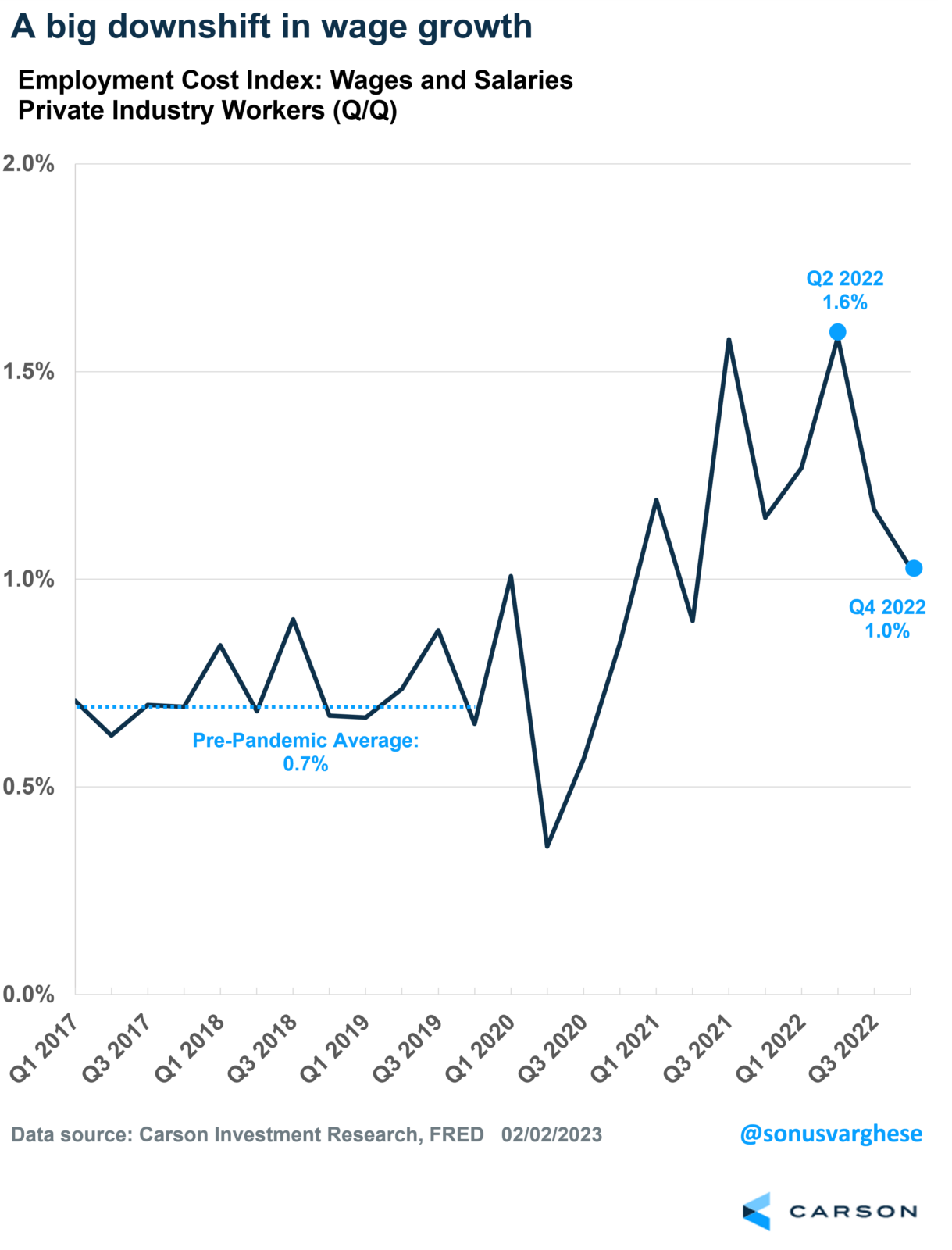

However, those categories comprise just under half of “core PCE inflation.” The remaining “core services ex housing” is what the Fed is focusing on now. And so far, it’s not showing signs of disinflation. Powell believes this category – which includes a grab bag of stuff like personal care services, airfares, car rentals, child care, physician services, etc. – is closely tied to the labor market and wage growth.

The textbook theory says we should see a deceleration in wage growth only if the unemployment rate goes up – as a softer labor market will put less pressure on employers to give their workers raises.

In the real world, we’re seeing wage growth decelerate even as the unemployment rate remains at 50-year lows. The employment cost index, perhaps the most stable measure of wage growth, showed a sharp deceleration in Q4, corroborating what we’ve already seen in other measures.

We’ll take reality over theory. And the good news is that Powell appears inclined to do as well. This is good news because they may not be wedded to a textbook model. They don’t need to be convinced that inflation is coming down and will remain low only if the unemployment rate surges. They just need to see the data, i.e., continued deceleration in wage growth and disinflation in core services, ex, housing.

We believe that will happen as wage growth decelerates amid labor market normalization. Quoting Powell, “this is not like other business cycles.” Always a dangerous thing to say when it comes to investing, but there’s good reason to believe that to be the case.