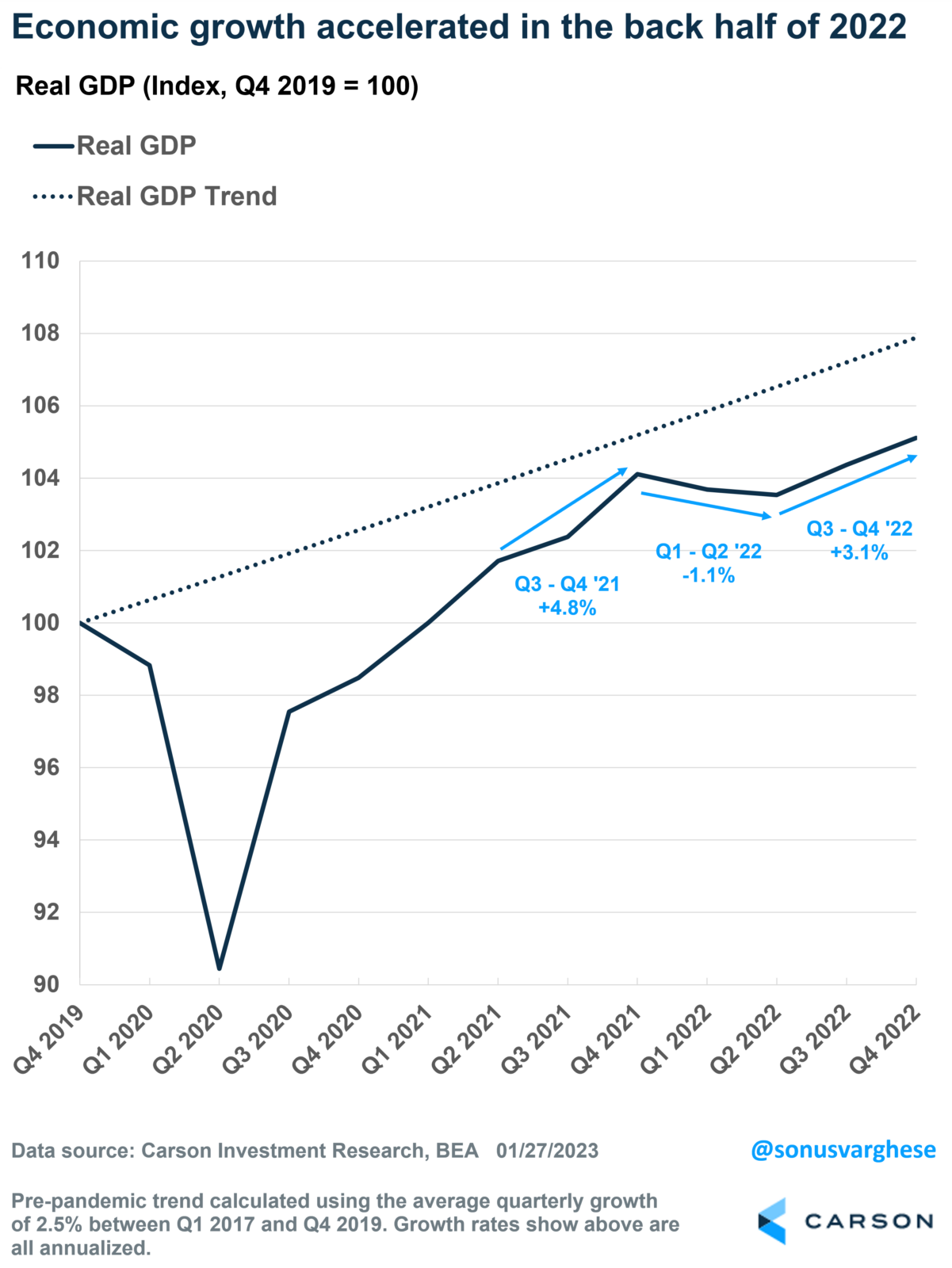

The latest GDP growth numbers for Q4 2022 came in at 2.9% quarter-over-quarter (annualized rate), which was higher than expectations for a 2.6% reading. This is only slightly below the Q3 growth rate of 3.2%.

Over the full year, GDP growth was up just 1% compared to the end of 2021. But this hides the fact that economic growth picked up in the second half of 2022. However, the first-half slowdown leaves the economy about 2.5% below its pre-pandemic trend.

The big picture: the economy is more than 5% higher than it was at the end of 2019, which goes to show how strong the recovery has been despite the early slowdown in 2022. Obviously, the employment data corroborate this as well.

Details matter

GDP is measured as:

GDP = Consumption (68%) + Investment (18%) + Government spending (17%) + Net Exports (-3%)

Note that net exports are exports minus imports, and since the U.S. imports more than it exports, net exports tend to be a drag.

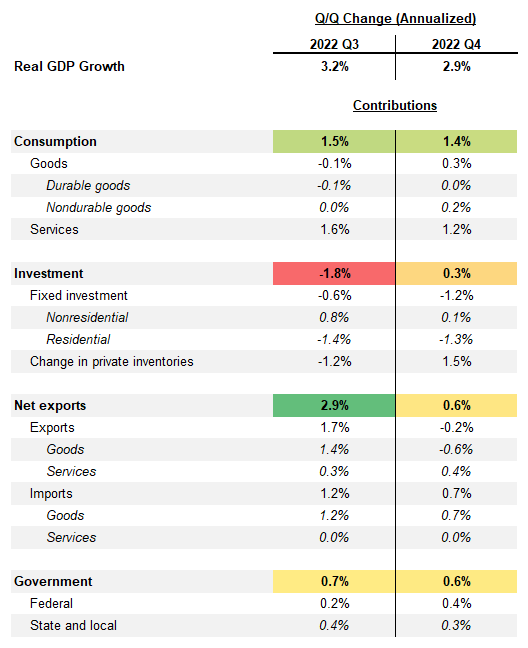

The table below shows how the various components contributed to GDP growth in Q3 and Q4. As you can see, consumption contributed close to the same amount in Q3 and Q4. But in Q3, the other big driver of GDP growth was Net Exports, whereas in Q4, it was “Change in private inventories.” Note that these are the two most volatile pieces of GDP, which is why it helps to look under the hood.

The details also help us to think about where things may go in 2023, and for that, let’s start with the most important category, i.e., consumption, which makes up just under 70% of the economy.

Consumption stays solid, even as services normalize

Consumption barely slowed from Q3, but there were important differences underneath. Services consumption eased, rising 2.6% in Q4 compared to 3.7% in Q3. But here’s the thing, that 2.6% pace is well above the average of 1.9% we saw between 2015-2019.

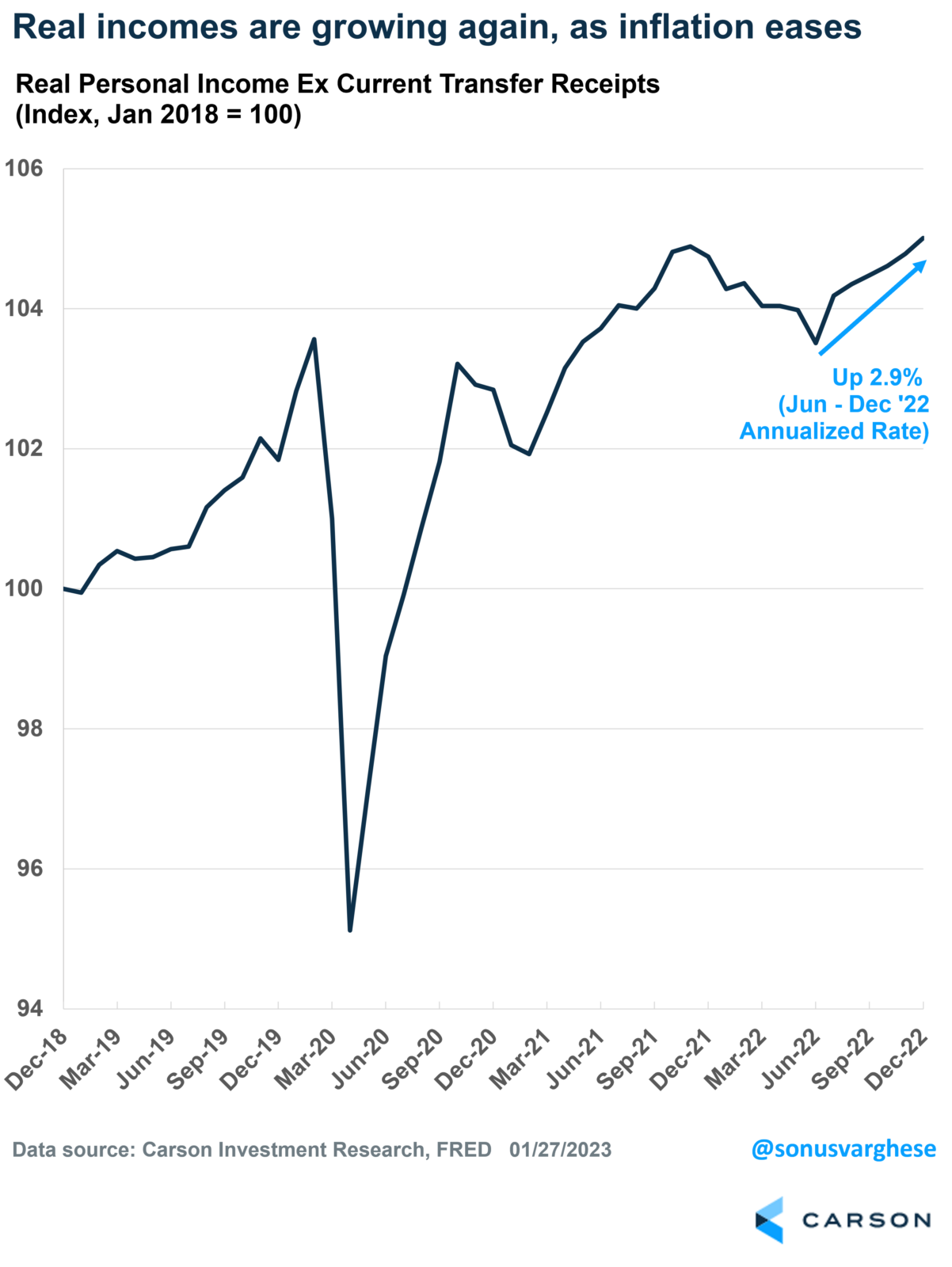

The good news is that goods spending picked up in Q4 and offset some of the services slowdowns. This was almost entirely due to increased auto sales, gas, and grocery purchases – the latter two thanks to lower prices. This is important because we believe this trend will continue into early 2023, especially with auto sales (and production) picking up. And further good news: consumers have more money in their pockets due to falling inflation, which could be a tailwind for consumption.

Housing slowed, thanks to the Fed

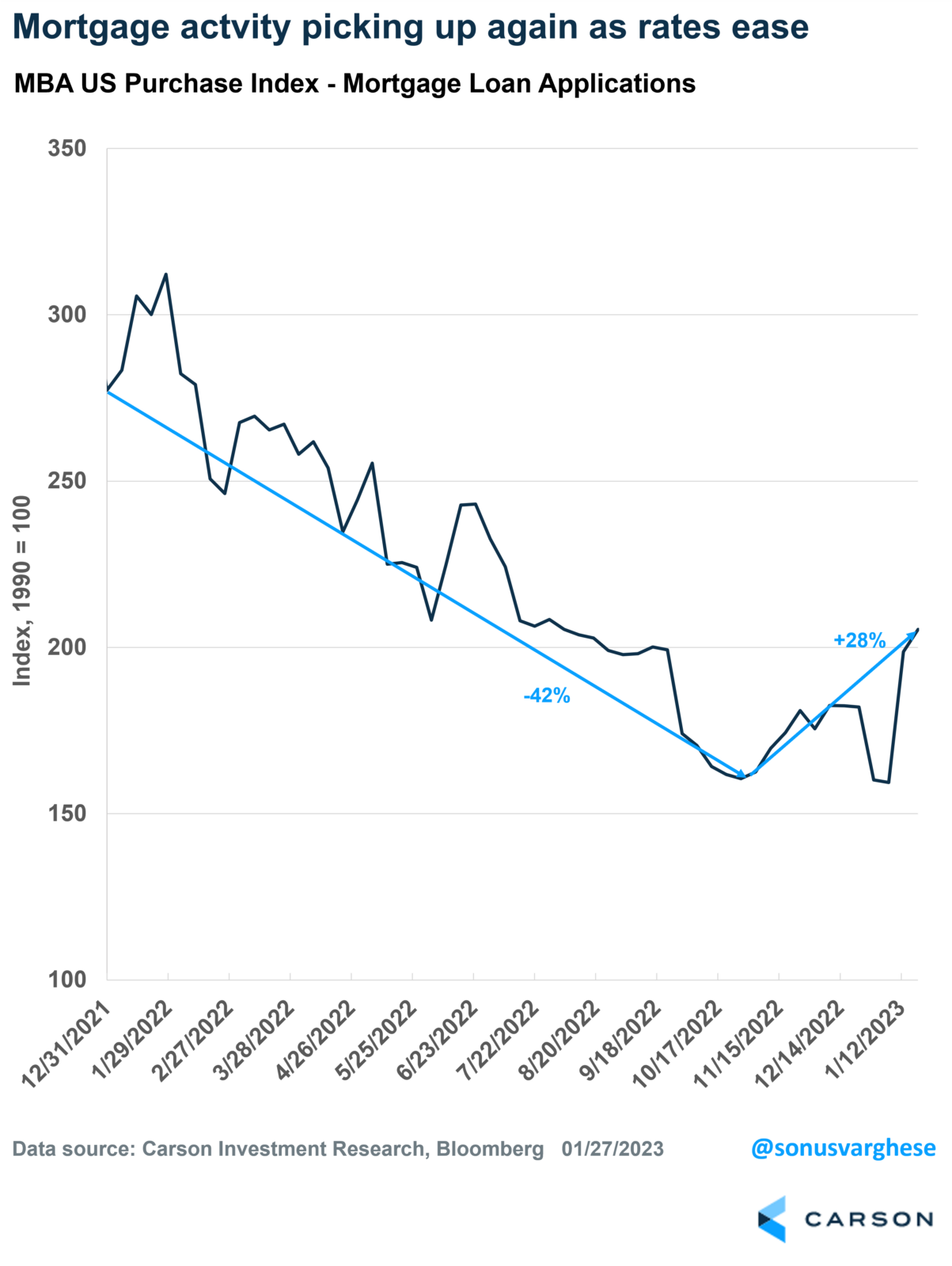

As you saw above, the Fed’s aggressive rate hikes had barely any impact on consumption last year. Where it did have an impact was on investment, and specifically residential investment, i.e., housing. Higher interest rates led to higher mortgage rates, and that led to a crash in housing activity. Housing pulled economic growth down by about 1.3-1.4 percent points in Q3 and Q4. Across 2022, residential investment fell 11%, which is the largest drop since 2009 (when it fell 22%).

The good news is that it looks like the housing data is looking less bad. In fact, mortgage activity has even picked up recently, with rates pulling back from peak levels. So, there is good reason to think housing will be less of a drag in 2023.

Nonresidential investment also slowed, which is concerning because that means businesses are investing less. However, it turns out the pullback in Q4 was due to businesses spending less on communication equipment – and that may simply be a reversal of all the spending they did soon after the pandemic hit when employees had to shift to their homes.

Government spending is no longer a drag

Investors forget that government spending is about 17% of the economy, and it matters. Over the last two quarters, government spending has picked up, reversing the drag from the prior five quarters. This has helped offset some of the pullbacks in private investment. It also is in sharp contrast to what happened after the 2008-2009 recession, when government spending was slashed and remained a drag on GDP growth all the way through 2014.

Government spending should continue to add to GDP growth in 2023. Congress passed some big spending bills over the past year and a half – the Infrastructure Bill, Inflation Reduction Act, and a $1.7 trillion government budget (which increased spending significantly) – all the money will really start to flow into the economy in 2023.

Still no sign of a recession

As we wrote in our recently released 2023 outlook, we don’t expect a recession in 2023, and the latest data corroborate that story.

Our story is simple: Inflation is slowing, and if employment and incomes hold up (as they seem to be doing), real incomes will rise. Add in the fact that goods consumption is likely to recover on the back of vehicle purchases, and we’re expecting consumption to remain solid. And consumption is ~ 70% of the economy.

Beyond that, housing should be less of a drag in 2023 (as noted above), especially as the Fed eases rate hikes, which looks increasingly likely to happen. So, the peak negative impact of aggressive rate hikes may be behind us.

Non-residential investment, especially on structures and equipment, may remain weak. However, recovering auto production, and even aircraft orders, should help U.S. manufacturing. More so as the global economy starts to strengthen later in 2023, which should also help exports.

Now, GDP growth data may be volatile due to volatile inventories and net exports (as we saw in 2022). But the underlying story is that there are still no significant signs of recession in 2023.