Federal Reserve Chair Jerome Powell’s comments this week during his semi-annual testimony in front of Congress did not inspire much confidence with respect to the path for monetary policy. It seems like Fed officials’ are confused as to what they want to do next.

Case in point: last month, Powell said that the “disinflationary process has started.”

Since then, we’ve had a run of strong economic data, including January payrolls, retail sales, and inflation. And it looks like that was enough to spook the Fed. The shift was clear in Powell’s statements this week:

“Inflationary pressures are running higher than expected at the time of our previous Federal Open Market Committee (FOMC) meeting.”

And

“The ultimate level of interest rates is likely to be higher than previously anticipated.”

At the same time, he also said:

“If – and I stress that no decision has been made on this — if the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes.”

Markets were clearly taken aback by his comments, with equities falling 1.5% on Tuesday (March 7th) and rate hike expectations rising.

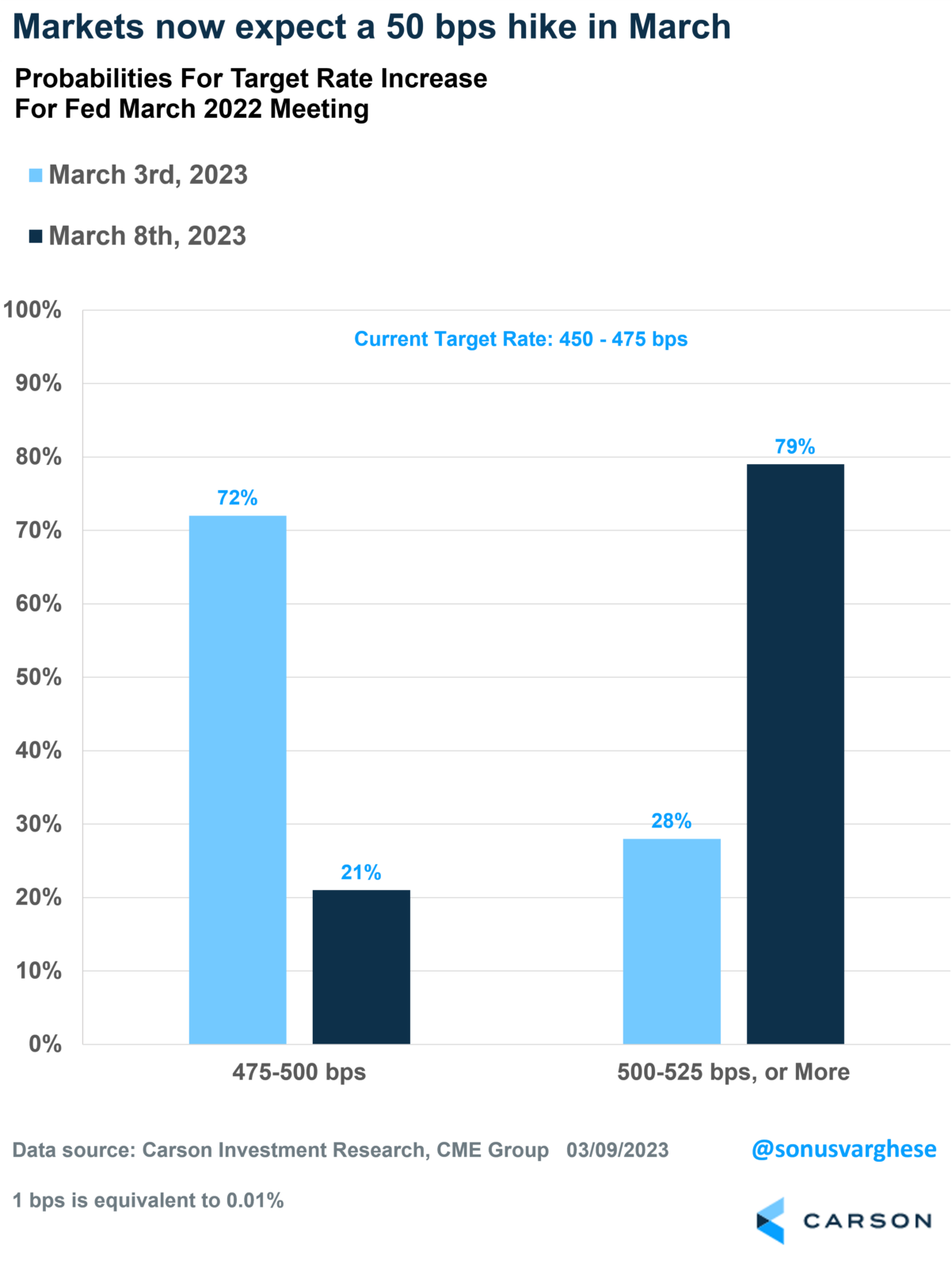

This becomes clear if you look at expectations for their March meeting. Last Friday, markets were expecting a 0.25% increase in the federal funds rate, pricing the probability of that at 72%.

That’s shifted significantly since Powell’s comments this week. Investors moved the probability of a 0.25% increase down to 28%, and the probability of a 0.50% increase rose to almost 80%.

This is a huge shift, especially this close to a meeting. Typically, the couple of weeks prior to the meeting is a “quiet period,” where Fed officials don’t give speeches or comments, i.e., anything that may lead to a shift in expectations. The last time this happened was in June 2022, when the Wall Street Journal reported that the Fed was considering raising rates by 0.75% instead of the 0.50% they guided markets toward.

There’s not much reason to panic

To be clear, the January data was hotter than expected. But this is just one month of data and is likely a rebound from the relatively soft December data (which, at the time, led to increased recession calls) and perhaps positive weather-related effects.

We’re yet to get February data, but it’s hard to believe the string of hot data continues into February and March.

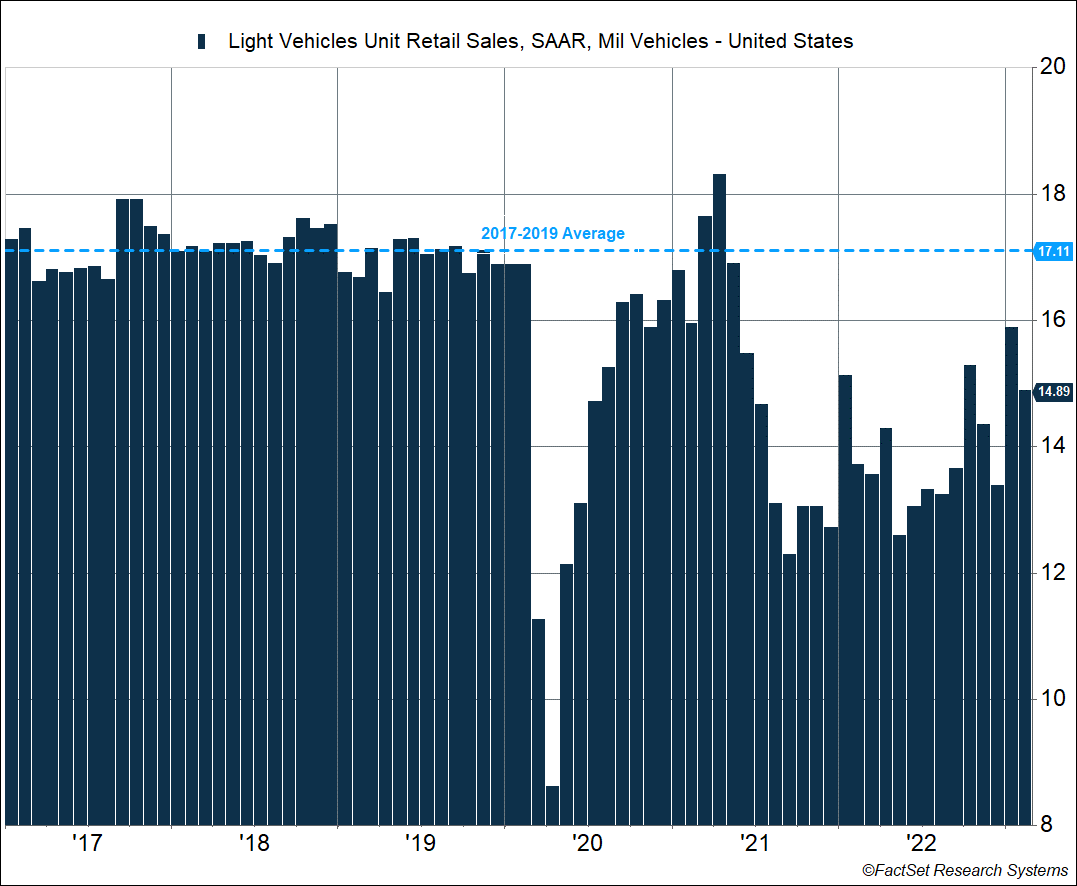

Take vehicle sales, for example. Sales surged 19% in January to a 15.9 million annualized pace, the highest since May 2021. But sales pulled back to 14.9 million in February. So the trend is still positive, but nothing suggests that the economy is overheating to the extent that the Fed has to up-end market expectations for upcoming policy.

The Carson Investment Research team has been in the camp that the economy will avoid a recession this year. As we’ve discussed before, we believe consumers are in good shape, and real incomes are rising, which should keep consumption humming along.

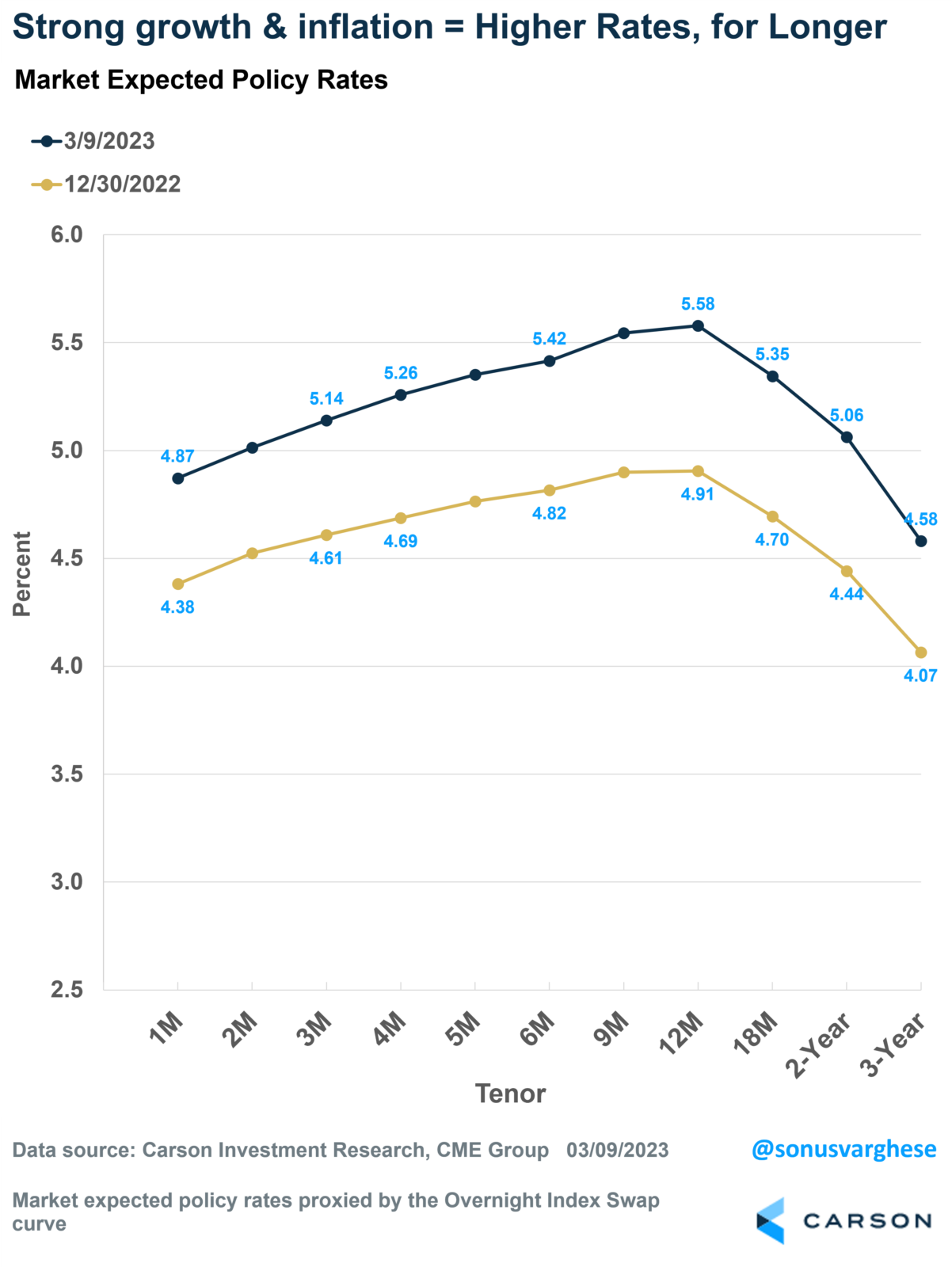

This gets to the point that we don’t see the Fed cutting rates any time soon. Expectations for the terminal rate, i.e., the highest rate the Fed will get to, also rose this week. At the beginning of the year, investors expected the terminal rate to end up around 4.9%. That’s now increased to about 5.6% on the back of strong economic data.

The good news is that, at the end of the day, positive economic data is positive. This perhaps explains why equities have remained resilient this year. The S&P 500 is up just under 4% year-to-date, despite rate expectations repricing higher.

That’s a big shift from last year and a positive one. And we believe equities have the potential to remain resilient, even as the economic data (and the Fed) swing back and forth.