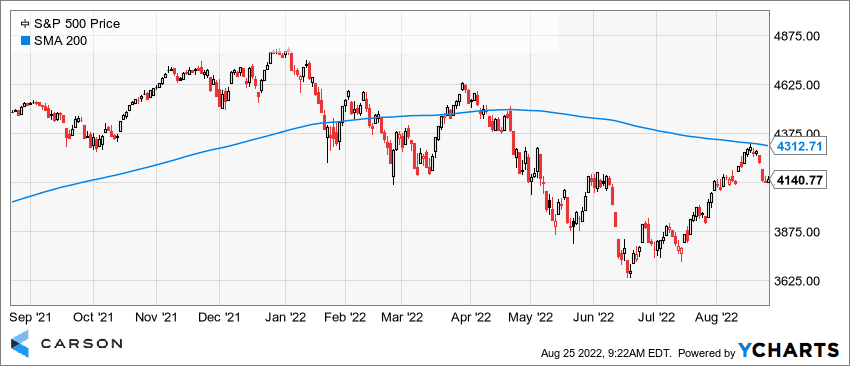

Are we having fun yet? The rollercoaster ride of 2022 continues, as the furious rally off the June 16 lows has taken a breather, with the S&P 500 Index finding resistance right at its 200-day moving average, a logical place for a break after a big bounce. Worries over a hawkish turn from the Fed at the Jackson Hole Symposium later this week, housing suggesting the economy is falling quicker than expected, the war in Eastern Europe, and stubborn inflation have all been listed as reasons for the recent weakness. But after a 17.4% rally off the lows, maybe it was just time for a break.

We aren’t surprised stocks have to take a breather after the bounce since mid-June, but we continue to think that stocks have likely made their low for the year, and higher prices before year-end are quite possible. In fact, we discussed two reasons we feel this way in Two Reasons the Bulls Should Be Smiling.

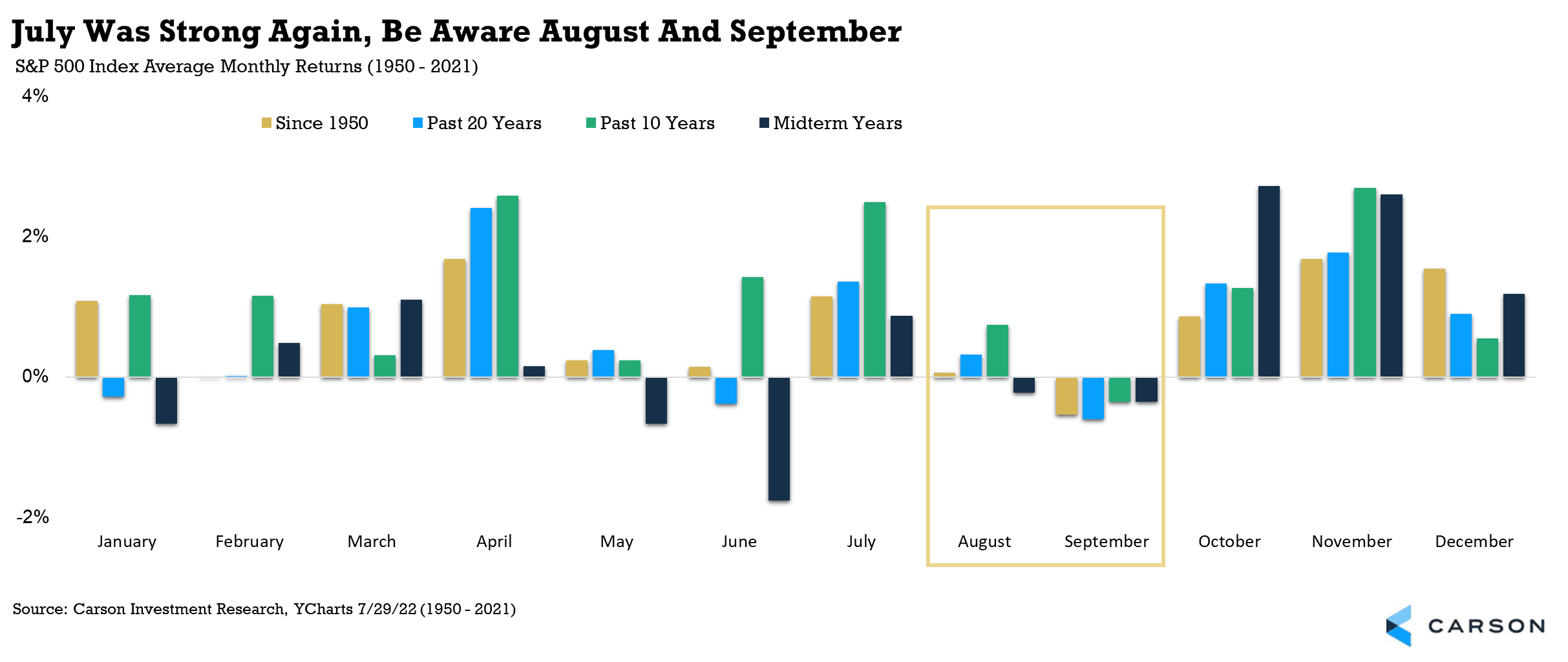

Will it be easy? Probably not (It never is). One of the bigger near-term worries is simply the calendar. Historically, August and September are two of the weakest months of the year. Buckle up, as we could see some usual seasonal volatility once again, but the good news is later in the year stocks tend to do well, something we anticipate to play out again.

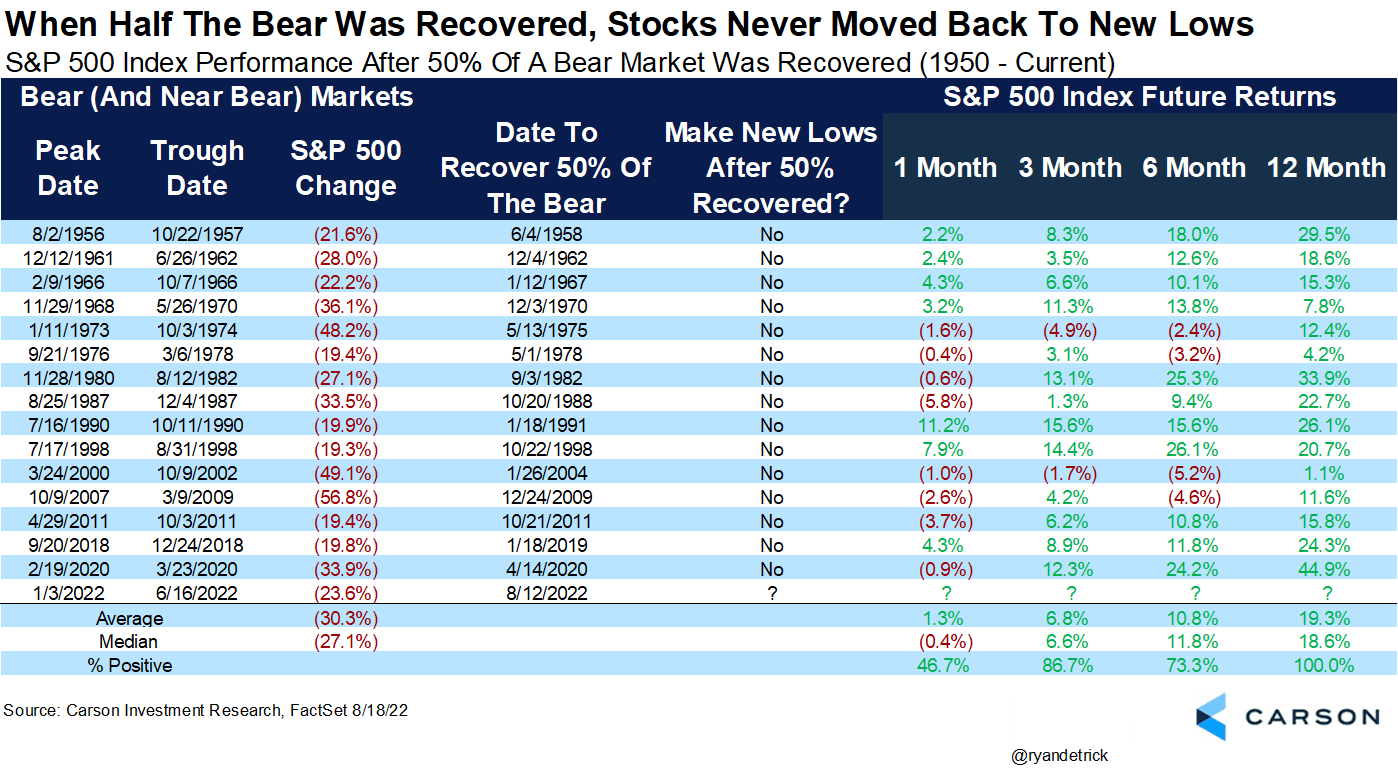

Now for some good news! The S&P 500 made up more than half of the bear market losses, something that indeed should have bulls smiling. As we show below, since 1950, stocks have never gone on to make new lows after this happened. Now, this doesn’t mean they will go straight up from here, but the past 15 bear markets never moved back to new lows once this feat took place. Even more incredible is the S&P 500 was never lower a year later either, up 19.3% on average.

So there you have it, yet another clue that June 16 was likely the lows, and stocks potentially could be a good deal higher this time next year. The Carson Investment Research team continues to overweight stocks here, anticipating continued strength.