8 Principles of Equities:

#1 – Nothing Beats Long-run Equity Returns

Carson Investment Research recently published our 8 Principles of Equities. The first is the most important—In our opinion, nothing beats long-run equity returns. Not bonds. Not housing. Not gold, oil, or copper. Frankly, it’s not even close. Sure, there may have been periods of exception, but they haven’t lasted long. Yet, it can be easy to lose this perspective, especially during a downturn or heightened volatility and uncertainty. It is during these times that we get a parade of TV and radio ads that act like they have discovered some magical high-return/low-volatility asset, such as real estate, gold, commodities, etc. Certainly, these are useful for meeting retirement goals, especially with portfolio diversification and reducing volatility. However, when it comes to long-term returns, the stock market is arguably the undisputed champ among major asset classes.

We all know the famous long-term investing quotes. We won’t rehash them here. Carson’s Chief Market Strategist, Ryan Detrick, already wrote a great article about how the longer investors hold stocks, the greater the odds of positive returns. Here, we want to illustrate the extent of those returns over other major asset classes.

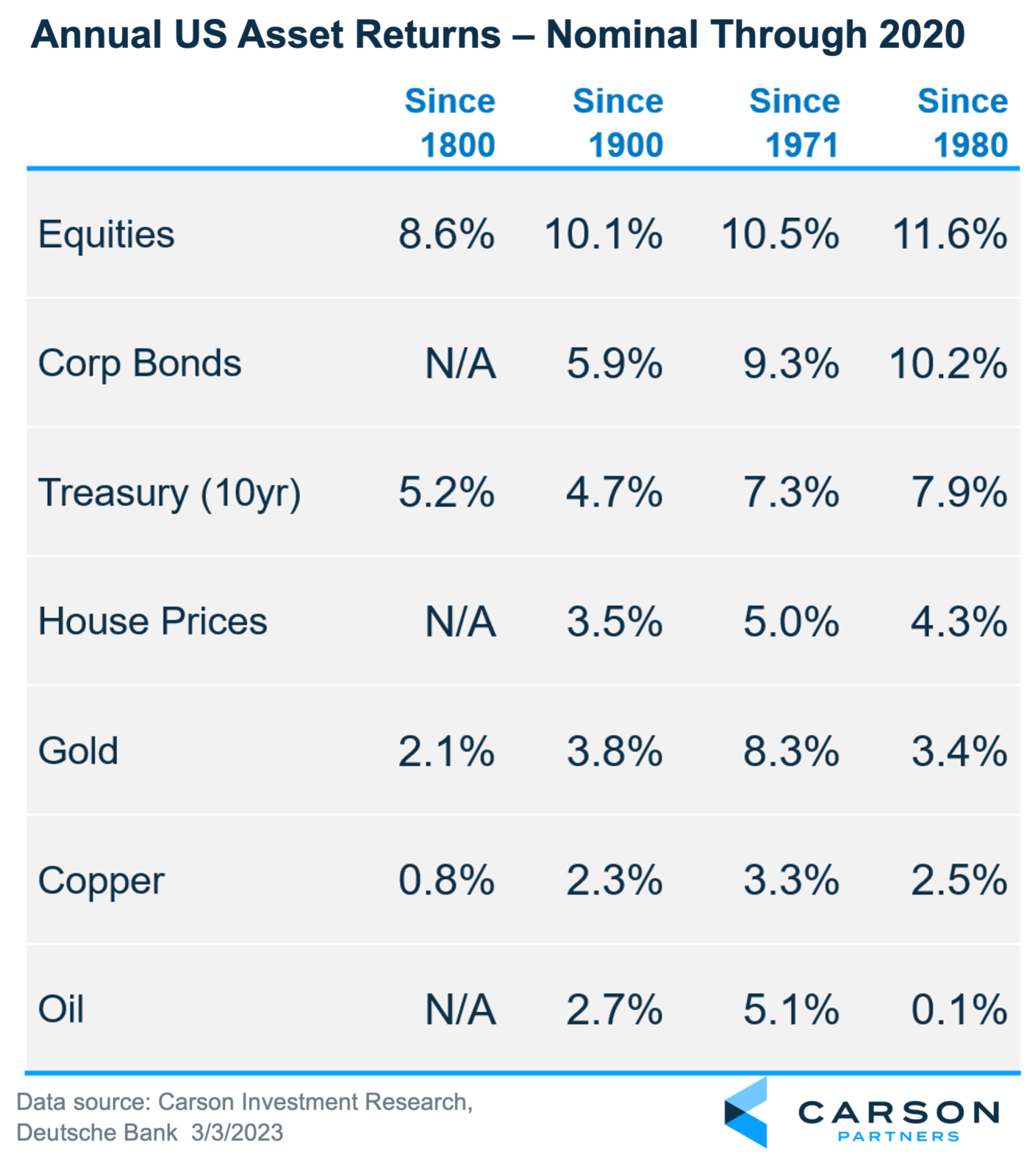

The chart above shows that stocks have fared quite well relative to other major asset classes. If we just look at 100-year data (1920-2020), equities have outperformed 10 and 30-year Treasury bonds by more than 4.5% per year, corporate bonds by 3.7%, gold by 5.6%, and oil by 8.4%.

What about inflation?

As my colleague, Sonu Varghese, recently wrote, stocks are real assets. The historical data bears this out. Stocks expand their lead over other asset classes in “real” terms, or after inflation. From 1920 to 2020, equities posted annualized real returns of 7.7%. Housing (ex-rents) were just 1.1% per year, and the overall commodity index was actually negative 1.1% per year! Only gold (2.0% per year) and copper (0.5% per year) were positive. The closest annual real return to equities over these 100 years is BBB bonds at 4.2% per year.

To be sure, there have been periods where equities have lost their crown, at least temporarily. However, they have been rare. Since 1800, there have only been 6 decades out of 22 where they weren’t the top performing asset class, or less than 1/3 of the time. Other than equities, only gold has ever been able to repeat as the champion –during the 1970s after the US abandoned the gold standard and the other in the 2000s during the bursting of the dot-com bubble and the global financial crisis.

Unquestionably, stocks are king. However, they are also volatile, so investors should be compensated with higher returns compared to most asset classes. This is why we continue to overweight stocks in our long-term Carson House View allocations. Our next three Principles cover the risk aspect of the stock market, which is the part that usually keeps investors from reaping all of its rewards.

We look forward to diving deeper into these soon.