Happy Star Wars Day, or if you’re fan like I am (or have a birthday today like I do), May the 4th be with you!

Of course, the title is a play on all this, but I find it apt since the Federal Reserve (Fed) looms so large as far as investors are concerned.

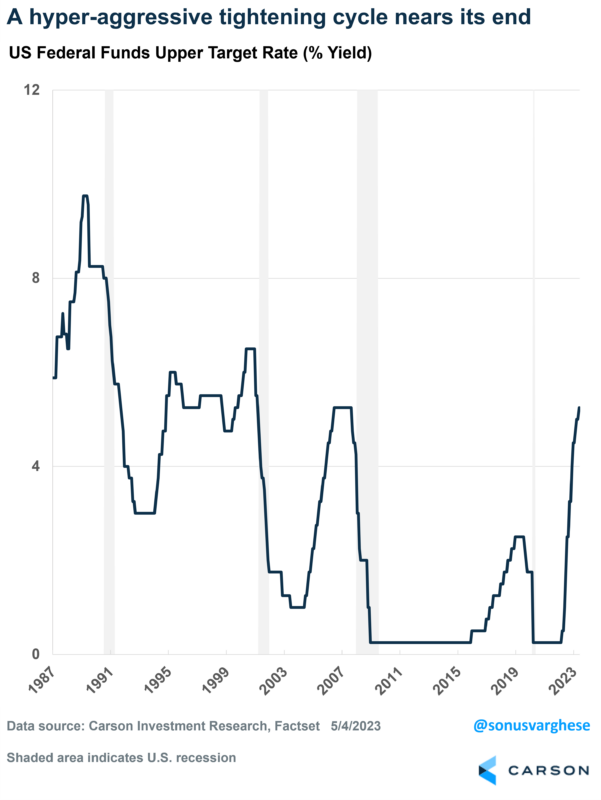

The good news is that their aggressive rate hike campaign to fight inflation appears close to the end. It saw them raising rates by 5%, including the latest 0.25%-point increase they just implemented. The federal funds rate is now in the 5-5.25% range, which is the highest it got to during the mid-2000s economic expansion.

The rate hike in May was expected, but what was more welcome was the fact that the Fed didn’t think that “additional policy firming may be appropriate”. While this is not an explicit signal that they are pausing, it did signal that they will be more data dependent. Fed Chair Powell explicitly referenced this when he talked about the future direction of policy, saying it will be assessed based on incoming data, including employment and inflation. Plus, they’ve done a lot – and they believe the economy is yet to reflect the full impact of that.

However, as we wrote in our 2023 outlook, the big question for policy this year wasn’t how high they’ll go. Instead, the question was how long they’ll stick with high interest rates, which they view as “sufficiently restrictive” to bring inflation down to their target of 2%.

Here we have a disconnect.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Markets vs the Fed

In his post-meeting press conference, Powell was fairly clear that they remain focused on getting inflation back down to target. Inflation has moderated but remains elevated. Their forecasts don’t suggest inflation will pull back in rapid fashion, which means rate cuts would NOT be appropriate.

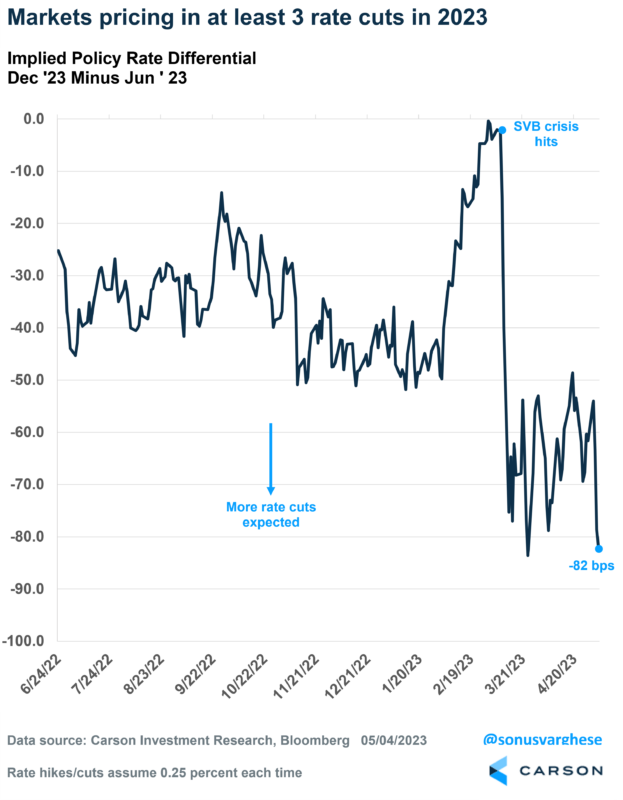

On the other hand, markets are well ahead of the Fed. Investors estimate that there are no more rate hikes coming, and even beyond that, they expect the Fed to cut rates a few times before the end of the year. The chart below shows the difference between expected federal funds rate in December 2023 and June 2023. The difference right now is more than 80 basis points (0.80%), indicating at least 3 rate cuts of 0.25%-points each in the second half of 2023.

We wrote about this disconnect after the Fed’s prior meeting in March, but it is surprising that it hasn’t resolved yet. In fact, rate cut expectations increased after Powell’s press conference.

You can also see how rate cut expectations surged after the SVB crisis hit, but we’ve also seen a lot of volatility in these expectations since then – as you can tell from how expectations moved after the SVB crisis hit.

Recession expectations

It appears that investors are expecting a recession in the second half of the year, which will force the Fed’s hand. However, it can be useful to look to history to put current expectations in context.

I looked at the last 3 rate cut cycles that came about amid recessions, and on average the Fed has cut rates by about 525 bps over 1.5-2 years. The table below shows the list. The 2020 recession was excluded because it was so short, both the recession and the rate cut cycle.

One thing you can see above is that the timing of the first rate cut is 0-3 months ahead of the start of a recession.

Markets are currently pricing the first rate cut in September 2023. Based on history, that would point to expectations for a recession starting between September and December 2023.

Meanwhile, investors expect the federal funds rate to be about 2.9% by the end of 2024, i.e. 19 months from now. That is about 220 basis points lower than the highest rate expected this cycle, of 5.1% (where the fed funds rate is currently).

Using a very simple calculation, and the fact that historically the Fed has cut by an average of 525 basis points, this would imply that the probability of a recession is just over 40% (220 divided by 525). In short, that is akin to rolling a 6-sided die and the odds of seeing a 5 or a 6 come up.

That is high. However, 42% is less than 50% and that means the base case is not a recession. Obviously, this is subject to a lot of noise, and crucially, these odds can change. Just two weeks ago, the expectation was for about 170 bps of cuts by the end of 2024. That translates to a recession probability of 32%.

The increased odds of a recession after the Fed’s latest meeting and Powell’s post-meeting comments suggests that markets think the Fed is biased toward overly restrictive policy in their quest to tame inflation. Which in turn will lead to a crisis and/or recession, forcing them to reverse course and make cuts.

My colleague, Ryan Detrick, and I just had Sam Stovall from CFRA as a guest on our podcast, Facts vs Feelings. He is a great market strategist, not to mention brilliantly funny, Amongst Sam’s 7 rules of Wall Street is “Don’t fight the Fed, at least, for too long”. Take a listen below.

Fighting the Fed appears to be what investors are doing right now, even as the Fed tries to hold firm. So, expect bit of a bumpy ride as their views converge. And circling back to the title, may the Fed be with us all!