I traded options for more than a decade, and I learned that when everyone agrees on something, you better start to look at the other side of the trade. A quote I love from General Patton sums it up well: “If everyone is thinking alike, then somebody isn’t thinking.”

Markets are all about what is and what isn’t priced into things.

Here at Carson, we look at fundamentals, technicals, policy and more to form our overall investment and economic opinions. That includes sentiment, and although it isn’t always going to work, it can be extremely powerful at finding turning points.

What Happens to the Market When Sentiment is Lopsided

As we’ve noted, we think the June 16 lows on the S&P 500 could very well be the lows for the calendar year. That doesn’t mean it’ll be smooth sailing from here on out – the action following comments from Fed Chairman Jerome Powell at Jackson Hole confirms that.

One of the reasons we think mid-June could be the lows is overall market sentiment got extremely lopsided. As Patton would say, somebody wasn’t thinking.

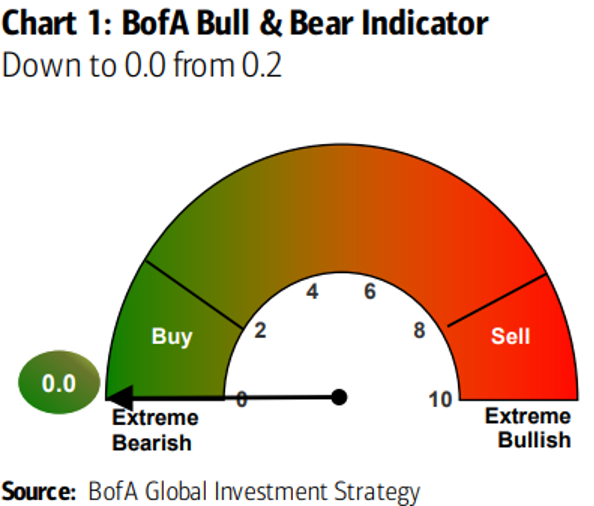

For instance, we saw historic levels of bears and a lack of bulls in various sentiment polls, consistent with major market lows. Incredibly, the Bank of America Bull & Bear Indicator moved to a rare 0.0 score, suggesting extreme bearishness.

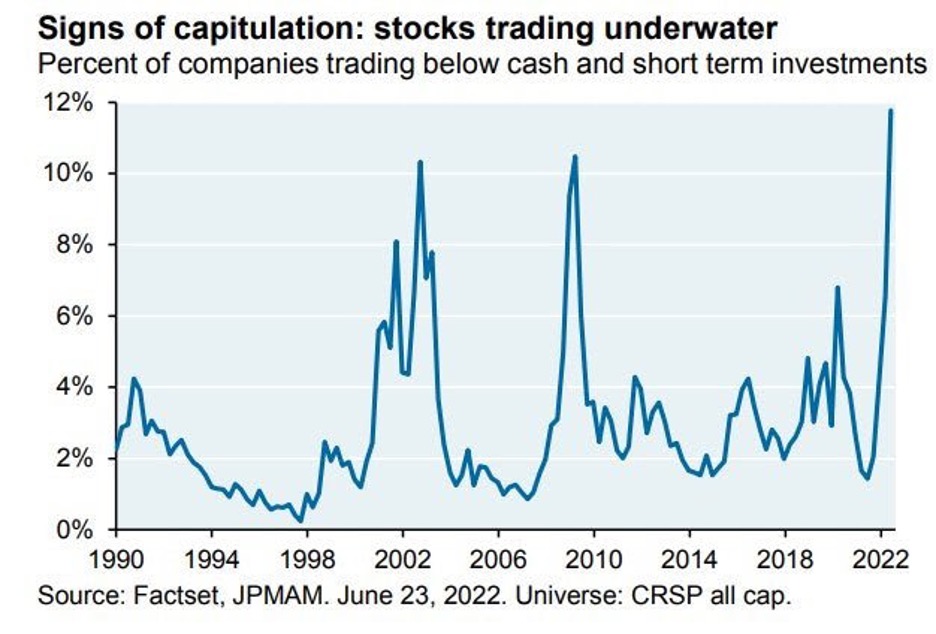

Factset data released in late June buoys that idea. It shows that a greater percentage of companies are trading less than their cash and short-term investments than during the tech bubble and financial crisis. That is the type of “throw the baby out with the bathwater” attitude that makes a major low.

Exxon, Salesforce and Zoom: Contrarian Market Signals

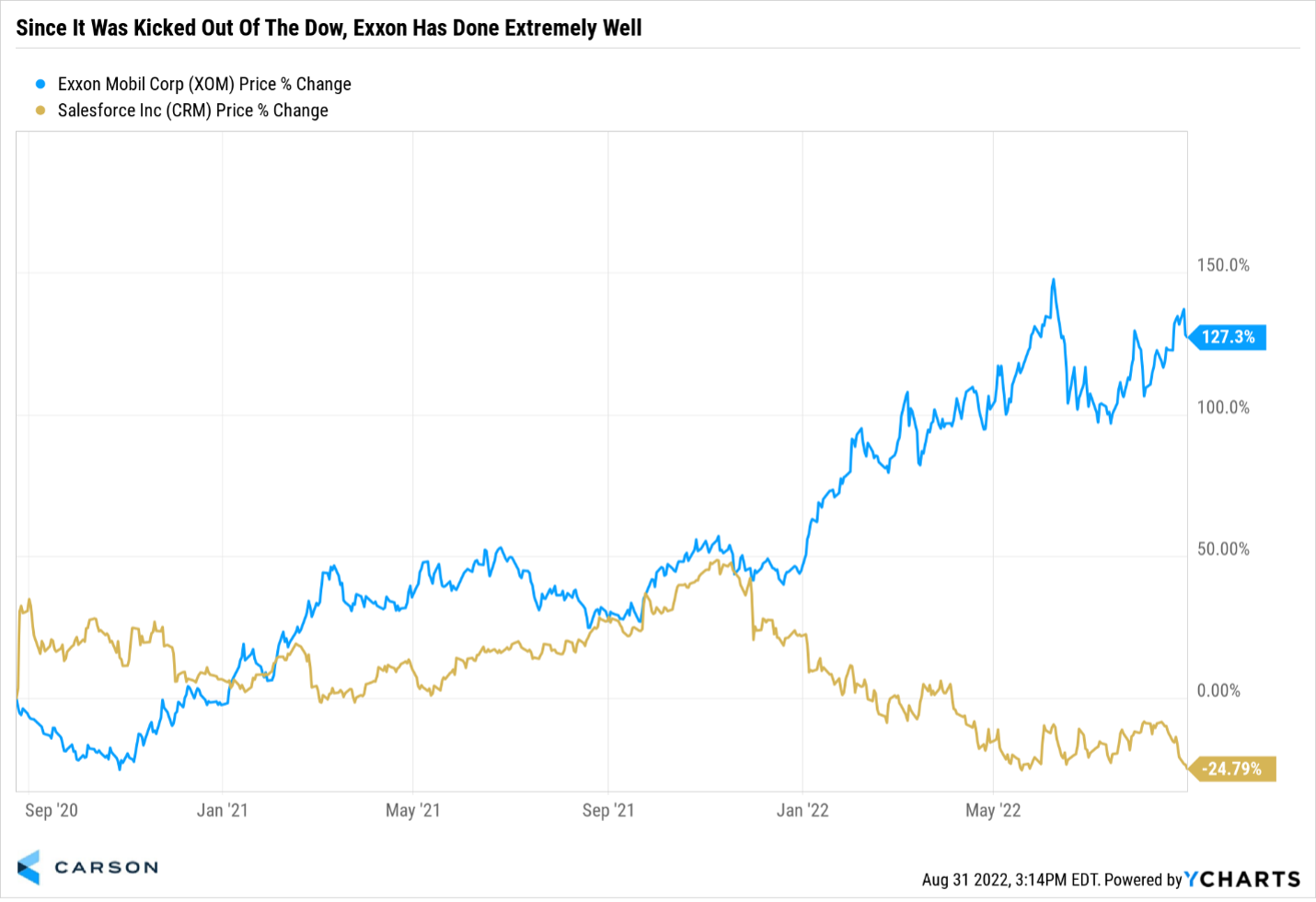

One of the potentially greatest contrarian signals ever flashed two years ago last week. On August 24, 2020, Exxon Mobil was removed from the Dow after 92 years. At the time, it made sense – oil had crashed, Exxon’s performance was poor, and everyone wanted to own green energy. In the last two years, energy has been far and away the top sector; the group no one wanted to own back then is making and breaking some portfolios.

When Exxon dropped out of the Dow, Salesforce joined. As seen in the chart, Exxon has outperformed Salesforce since the Dow shuffling, showing that buying low expectations and selling high expectations can play out well at the extremes.

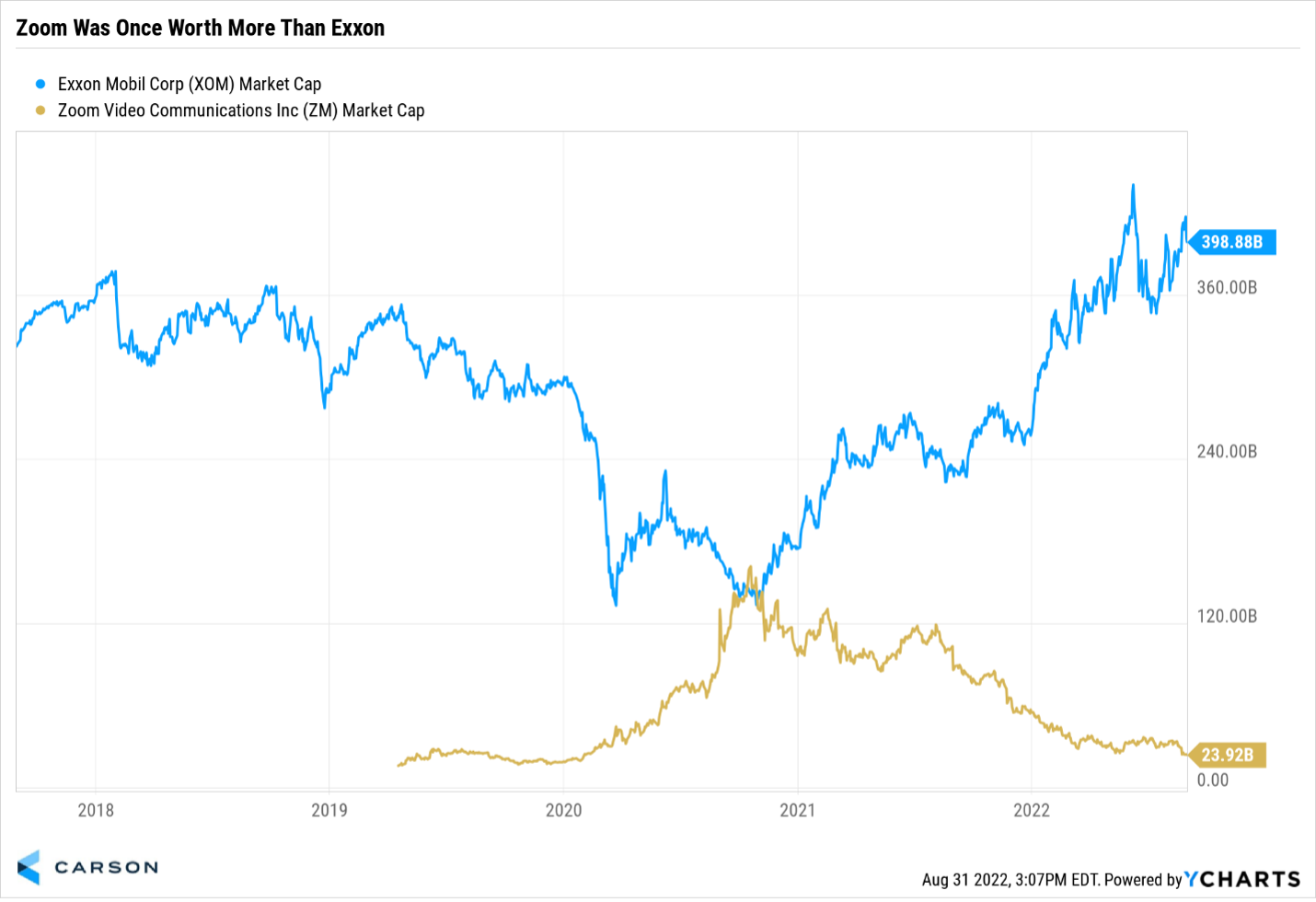

Right around this same time, Zoom had a market cap greater than Exxon Mobil. That was likely another contrarian indicator that signaled things had gone way too far. It didn’t last long. Today, Exxon is worth nearly $400 billion in market cap versus Zoom at $24 billion.

We see this play out in policy projections, too. When President Trump won, nearly everyone assumed that was good for banks and coal companies. The exact opposite happened, as both struggled, and while tech was expected to do poorly, it had a huge run. Similarly, many assumed that green energy would do great under President Biden, while energy companies that mined crude oil and coal would struggle. As we know, the opposite happened.

With midterm elections coming up, be aware that it’s never that simple. If everyone agrees, odds are the market has already priced it!

Want to know more about what’s driving the success of today’s fastest-growing advisors? Subscribe to Carson’s newsletter, The Trend Line.