Inflation has been on everyone’s mind this year, whether it’s households, investors, and the Federal Reserve. Surging inflation has weighed on consumer sentiment, though arguably, this is primarily because of gas prices. And as gas prices fell after the summer, consumer confidence started moving higher once again (I wrote about this back in September).

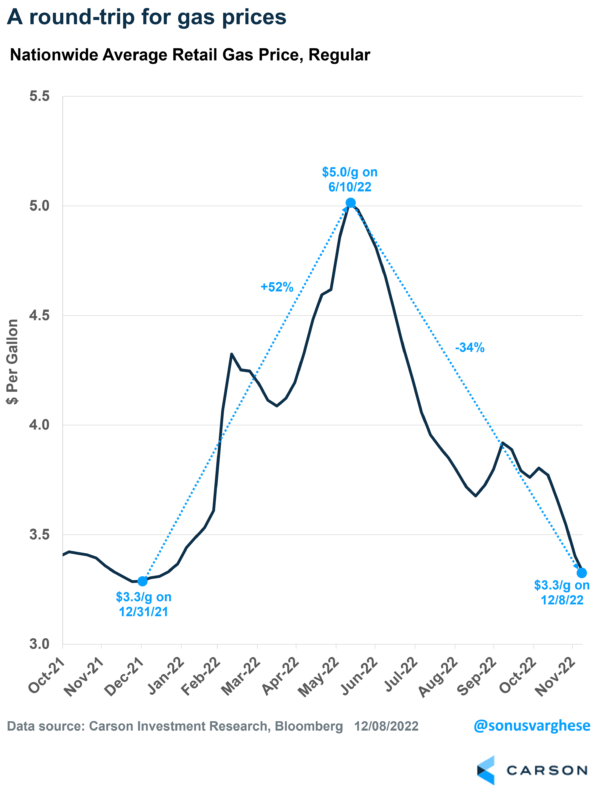

We saw gas prices tick up slightly in October, but the good news is that nationwide average gas prices have almost entirely erased the entire from earlier this year. Gas prices are back to where they started the year, at approximately $3.30 a gallon. As the chart below illustrates, gas prices rose 52% through June and then collapsed by 34%, returning to the same starting point.

This is great news for two reasons, which are connected:

- Inflation (duh!)

- Real incomes, i.e., incomes adjusted for prices

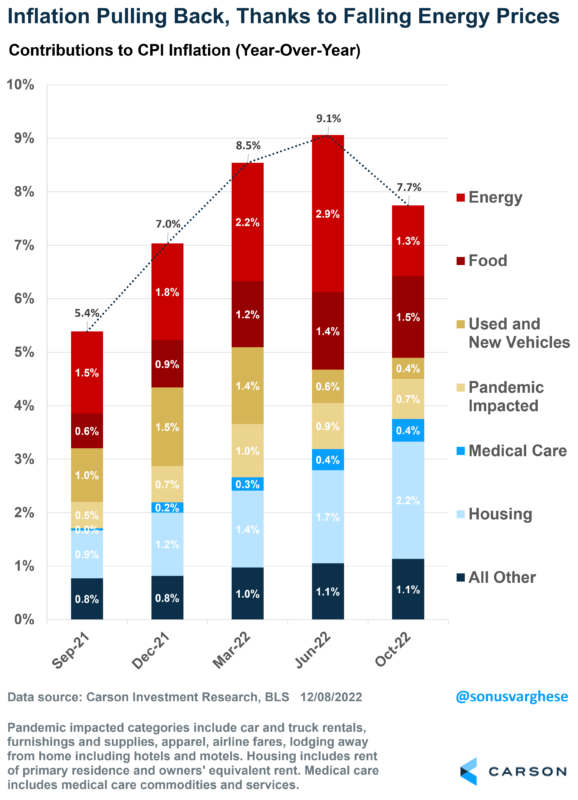

As you can see below, inflation surged in the first six months of 2022 on the back of rising energy prices. By June, the year-over-year increase in energy prices accounted for about a third of the 9% headline CPI inflation. However, energy prices (mostly gas prices) have pulled back since June, and that’s helped inflation to pull back. This is despite other factors that continue to put upward pressure on inflation, like housing.

The good news is that the above data is through October. Gas prices have fallen since then, so we should see energy prices pulling inflation even lower when we get the November and December inflation numbers.

If gas prices stay at the same place as they are now for another couple of months, the light red bar in the previous chart above (representing energy prices) should show up below the zero line. In other words, energy prices would be a deflationary force on inflation.

This matters for monetary policy. The Federal Reserve’s (Fed) ultimate inflation mandate is to keep headline inflation stable. They only focus on “core” inflation (which excludes food and energy) because it is less volatile and a better predictor of future inflation.

Falling gas prices will likely ease headline pressure over the next couple of months. As I wrote when the November CPI data was released, any pullback in inflation buys time: time for some core inflation components like goods prices and housing to start falling. My colleague Ryan Detrick just wrote a piece on this. Private data shows that rental prices are already falling quickly, but it will take at least 8-12 months to show up in official data. In the meantime, falling prices and even falling goods prices (like used car prices) should keep inflation on the low boil.

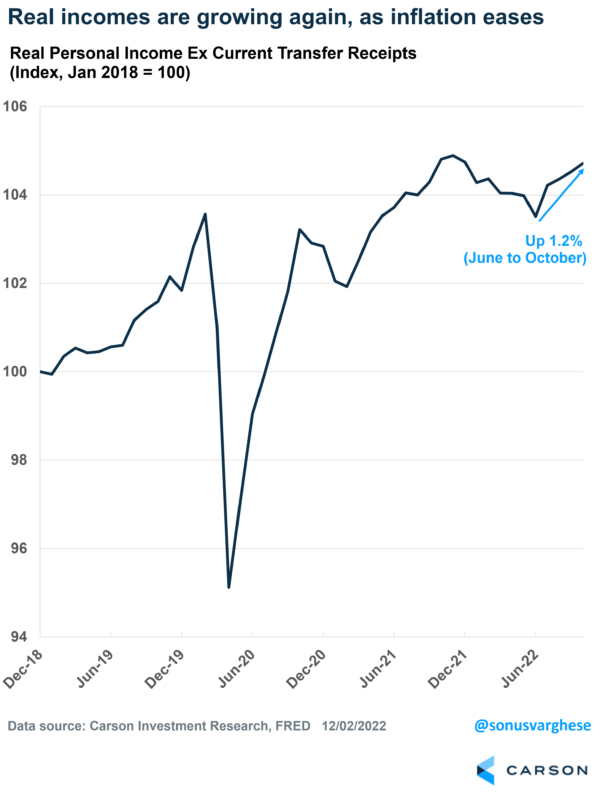

The other benefit of falling inflation, even if it’s on the back of energy prices, is that it boosts real incomes. Note that we don’t adjust incomes using core inflation data. Over the past few months, real incomes have started to rise again as inflation has eased. This is likely to continue as we head into 2023, which is a big positive for consumption, making up 70% of the economy.

Easing inflation, rising real incomes, and strong consumption are key reasons why our base case is for no recession in 2023. This is not to say there is no risk of a recession – there is, and it comes from the possibility of a policy error, i.e., the Fed raises interest rates too much. But the odds of this decline if inflation continues to ease.